A good memory makes you a better investor

Investing sometimes can feel like a game of chess. Things follow some basic rules, but the rules are so flexible as to allow an enormous amount of variation. Yet, if people play enough games, they tend to get better because they memorize past moves that proved successful. Yet, in the investment world, the rules constantly change, so how do chess players react when you change the rules, and what can we learn from that about investing?

In 1996, former chess grandmaster Bobby Fischer invented Chess960. It’s an intriguing concept to help chess players train their mental flexibility. The idea is that the rules of the game stay the same and pawns remain in their usual position at the start of a game. But behind them, the figures are shuffled randomly. The only two conditions that must be met are that bishops must be on opposite-colour squares and the king must be positioned between the rooks to enable castling. If that sounds complicated, refer to the screenshot below for an example of the starting board.

Example of a Chess960 starting board

Source: Salant et al. (2025)

As you can see, this presents a wonderful parallel to investing, as the basic rules are familiar, yet the concrete situation at hand is unfamiliar and new. Indeed, Chess960 is called that way because there are 960 different starting boards, far fewer than real-life variations in financial markets, but enough to run an experiment.

A team from Northwestern University asked approximately 147,000 chess players of different skill levels to play these games of Chess960 and measured the quality of their moves. In this study, they primarily examined the opening move because all chess players tend to memorise opening moves. The difference is just that more experienced and higher-ranked players have memorised more moves.

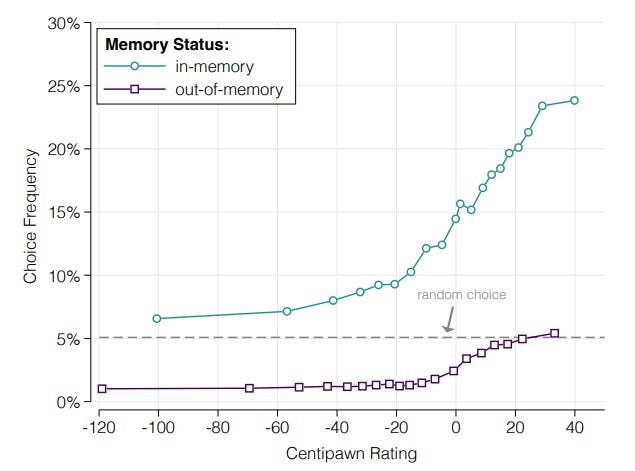

The chart below shows how often players chose a specific move as a function of the quality of the move (based on the centipawn scale, which measures the advantage a player gains by making the move).

Frequency of moves chosen

Source: Salant et al. (2025)

A couple of things stand out in the chart. First, better moves with a higher centipawn rating are chosen more often. However, moves that are part of the memorised set of opening moves a player has are chosen far more often than moves the player has not memorised. Second, moves that a player hasn’t memorised are selected less frequently than chance. And third, even the best possible move a player can make, but hasn’t memorised, is chosen less often than the worst possible move a player can make and remembers.

The latter is what the authors of the study refer to as a memory premium. The lower cost of retrieving a specific move from memory compared to analysing the unfamiliar situation fresh and without prejudice makes us choose suboptimal moves.

And as you might have guessed, I think that is what is happening in the investment world as well. People often default to heuristics, where they do what has worked in the past. As Richard Feynman liked to say, “Similar problems have similar solutions”.

That does work in the sciences where the laws of nature are immutable, but it doesn’t work in situations where the rules change. As we know from mountains of behavioural economics research, heuristics can lead us astray as investors.

But what this experiment shows to me is that there is a corollary: The better your memory of past events, the more options are readily available to you when you encounter an unfamiliar situation. And that allows you (at least in theory) to make better choices.

This rings true on so many levels. I forced myself to look at my client holdings with "fresh eyes." I imagined I was a competitor broker who was giving a 2nd opinion review. That allowed me to see the portfolio weakness that needed to be corrected. A broker friend of mine said "The first recession you go through you hurt your clients with bad advice, the second one not so much and by the third or fourth you are useful and add value to your clients' decisions." You are memorizing moves via the experience of having lived through a market downturn.

So what's the best opening move?