What’s the job of a financial planner? While there is probably no consensus of the job of a financial planner in general, one part of the job, I think most people could agree on, is to help investors achieve their retirement goals.

Saving for retirement is one of the most important financial planning exercises we all have to do, and it gains in importance as government and corporate pension funds become increasingly thinly stretched. Even more so, we live in a world where employees of a company no longer have access to defined benefit plans but have to make do with defined contribution plans, which means that the employee bears the investment risk of the pension plan. Making the right decisions with your pension fund investments is crucial as is the effort to make the right decision in how much to save etc.

Unfortunately, I know too many financial advisers who define their job as helping people achieve their retirement goals and then translate this as helping them to pick outperforming funds or stocks. And that is not going well, as a study by researchers from the University of Missouri has shown. They looked at 2,000 pension plans in the United States and the performance of the funds and the plans overall between 2013 and 2015. Crucially, they split the plans between the c80% plans that provided advisory services to the investors and the 20% of plans that provided no such advisory assistance.

Their results show that when it comes to picking outperforming funds within a retirement plan, the advisors are no better than chance. While the average return of employees in plans with advisers was about the same as the return for employees in plans without advisers, the volatility and downside risks of the portfolios of employees in advisor-supported plans was somewhat higher. Thus, advisers moved investors into funds with higher risk but no compensation for that extra risk.

We could all chime into the usual song and dance how advisers are useless and unable to pick stocks or funds, but that’s not the point. The point is that achieving your retirement goals has nothing to do with picking stocks or funds. The true value add of an adviser lies in the actual planning process, not the selection of investments.

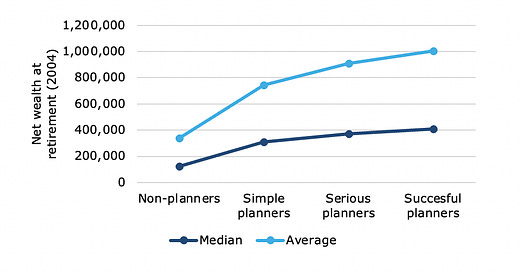

Already a decade ago, Annamaria Lusardi and Olivia Mitchel published what I consider to be one of the most important papers on financial planning of all time. They looked at the type of planning individuals engaged in and how that influenced their net worth at retirement. They distinguished between non-planners, simple planners (people who roughly knew how much of their income to save each month or each year), serious planners (people who have a proper financial plan) and successful planners (people who have a financial plan in place and managed to stick to it throughout their career, aka fairies, unicorns and otherwise unimaginably disciplined investors). The chart below shows that just moving from non-planners to a simple planning exercise increases net wealth at retirement by a factor of two to three. Engaging in serious planning then adds another 25% to 35% in extra wealth at retirement.

This is where the true value of financial planning lies and where advisers really add value: Making investors aware that they need to safe, how much they need to save and how best to manage their income and expenses to achieve their savings goals. Everything else is just noise and not worth your time.

Net wealth at retirement at retirement

Source: Lusardi and Mitchell (2011)

Another great article, as usual, Joachim! I love how you almost always manage to add a graph into your articles and that really helps put things in perspective.

The conclusion. Saving instead of spending is the most important part of planning for retirement. The earlier we start the more comfortable we are likely to be in later life. I think you missed a most important part of this story. - Young people have no sense of their mortality; this usually kicks in around our mid 30's. By then we are ten years behind with our savings potential and only 30 years away from drawing on the retirement fund. i.e. We missed 25% of the opportunity. We all do it because we are young and it appears that any amount of financial education will never be enough to outweigh the hubris of youth.