A one-factor model to explain asset returns

I recently came across a paper that claimed to explain asset returns with a single factor. “Here we go again”, I thought to myself. “Another group of people who want to modify the CAPM so that it ‘explains’ financial markets. What a waste of time.” But then my eye saw the magic words: “non-linear model” and the authors started talking about the Kolmogorov-Arnold representation theorem and the Weierstrass theorem and I thought to myself: “These guys seem to know what they are doing. I need to read that paper.” Note: If your head exploded just reading these last couple of sentences, you may want to skip today’s post…

The problem with most finance models and theories is that they have been developed by people trained in economics and finance, which is to say by people without a proper education in maths and statistics. Sorry, but not sorry to all the economists and finance guys out there who feel offended by this statement, but as a trained mathematician and physicist, I think it is true.

I was stunned and shocked in equal measure when I studied economics and finance and learned about the CAPM and similar linear models that were supposed to explain financial markets. I was equally stunned and shocked when I started working in the industry and found out that practitioners really use these models to manage trillions of assets.

Didn’t people realise that financial markets are complex dynamic stochastic systems and that trying to describe a complex dynamic system with a linear model is inevitably going to fail no matter how many parameters you use to ‘fit’ the model to reality?

Yet after the CAPM has been empirically refuted hundreds of times practitioners and academics alike still insist on modifying their linear factor models to create a better fit in the hope that this will solve their problems. Most importantly, practitioners and academics alike insist on using fundamental variables like valuation or profitability to explain market behaviour, which is obviously what we all aspire to do. Just fitting the data with any random function isn’t going to explain anything (which is true) and is not going to make you any money (which turns out not to be true).

Once when I was young and naïve, I wrote a paper that showed that you can use a Fourier filter to identify market cycles and that this simple nonlinear approximation of market behaviour is able to beat both passive and momentum-driven investment portfolios. I thought that was an incredibly simple model that performed extremely well, but I met a lot of resistance because the model did not rely on fundamentals, but instead used combinations of sine and cosine functions to identify cycles without ‘explaining’ what drives these cycles.

The new paper I came across does something similar. The researchers use polynomial functions with degrees as low as four to approximate the recent performance of a wide variety of asset classes. Then they test if this fitted fourth-order polynomial is better at explaining the cross-section of returns than existing finance models.

Let me quote from their paper to drive home how successful this approach is:

“Using 171 test assets across major asset classes across U.S. equity, U.S. and international bonds, commodities, and currencies, we show that this one factor model delivers superior cross-sectional empirical asset pricing performance […] Moreover, controlling for the HFL model, the majority of the established factors for the cross-section of asset returns becomes insignificant.”

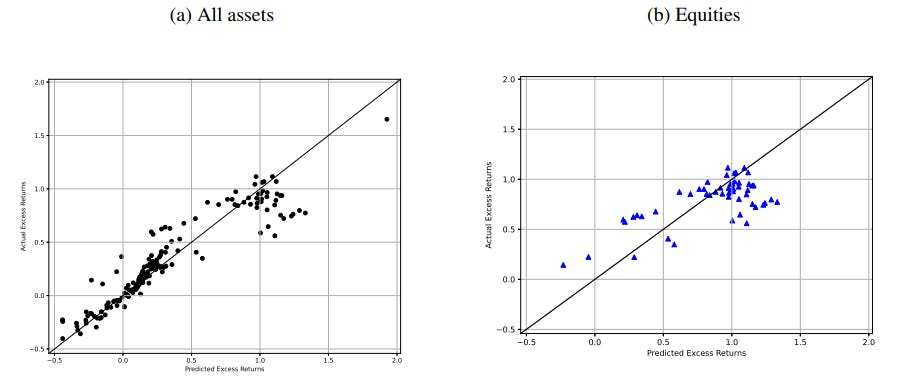

In short, this nonlinear model makes all known factor models redundant. But explaining past returns and forecasting future returns to make money are two different things. Yet, when they tested the forecasting performance of this nonlinear model, they found that it created sizeable outperformance and matched the actual returns of asset classes very well. The chart below shows the results for their hundreds of tests across all asset classes as well as their tests for equities. Again, their model outperformed existing factor models in almost all cases for forecast periods of 6 months.

Forecast performance of nonlinear single-factor model

Source: Borri et al. (2024)

But alas, I am not optimistic that this model will gain widespread adoption among practitioners or academics because once again, it doesn’t use fundamentals to explain share price returns. And that means to most practitioners and academics it has no meaning.

But you know who doesn’t care about ‘having meaning’ or using polynomials to understand and forecast asset returns? AI. The method used in this model is easily adopted in a machine-learning algorithm or many other forms of AI. And hedge funds and other quant-driven investors will be happy to use such AI approaches to make money. They don’t care whether their model uses fundamental variables to explain and forecast share prices or not. They just want to make money. This paper shows that by using nonlinear models, one can easily beat fundamentally driven factor models, no matter how complex they are.

As an average-at-best math student myself, I think some or the disconnect lies in the arcane language:

"The new paper I came across does something similar. The researchers use polynomial functions with degrees as low as four to approximate the recent performance of a wide variety of asset classes. Then they test if this fitted fourth-order polynomial is better at explaining the cross-section of returns than existing finance models."

What exactly does "explaining" mean in this context? It's appears to be a bit like "tracking error", which really isn't a "mistake" as much as an excursion, but the word never quite shakes its normal pejorative meaning. Perhaps it's the same for "explaining", which usually means "helping people understand the underlying fundamental drivers" but in a mathematical context appears to mean "account for" or "measure".

I think people with long careers in economics and finance have simply seen too many examples of mathematical attempts to "black box" financial markets which blow up spectacularly when exposed to real life. "Here's Dr. X and his staff of rocket scientist PhDs and their can't-miss quantitative trading model" ... which then systematically underperforms all those Oxbridge classics and music majors in Mayfair for eight straight years on the trot, and then fails completely when -35% market corrections such as the WFC and Covid occur. Lots of burnt fingers result in people inevitably reverting to more "fundamental" approaches, because even if they're wrong and underperform, at least they have the excuse that they tried hard by "working at it" ... rather than sitting around waiting for a set-and-forget quant strategy to work. And if the quants start tweaking their model on the fly, then the "fundamental" crowd squawks that that's really "active management" hiding behind a whiteboard full of Greek letters. Renaissance is then inevitably brought up https://en.wikipedia.org/wiki/Renaissance_Technologies , and the battle continues!

I genuinely hope you're onto something with this new approach, and can quit your day job ... but you just shared it with the world, so how soon berore the excess returns are arbitraged out? ;-)

OK. So what happened to the FFT model? I'm reading your paper now. Thanks for this article and the references. Best, j