The Fed and other central banks are adamant that keeping inflation expectations anchored at a low level is key to their success in managing inflation. This was at least part of the argument for why the Fed hiked interest rates so aggressively during the spring and summer of last year. There is an increasing amount of evidence that empirically, inflation expectations really don’t matter that much, as I have explained here, here, and here.

The fact that inflation expectations do not matter is probably because normal people on the street simply do not understand how inflation and interest rates work. President Erdogan of Turkey famously (or should I say infamously) believes that higher interest rates cause higher inflation, which is why he tries to keep the Turkish Central Bank from hiking interest rates to fight inflation. Most of us know the result of such policies, but for those who don’t, just take a look here.

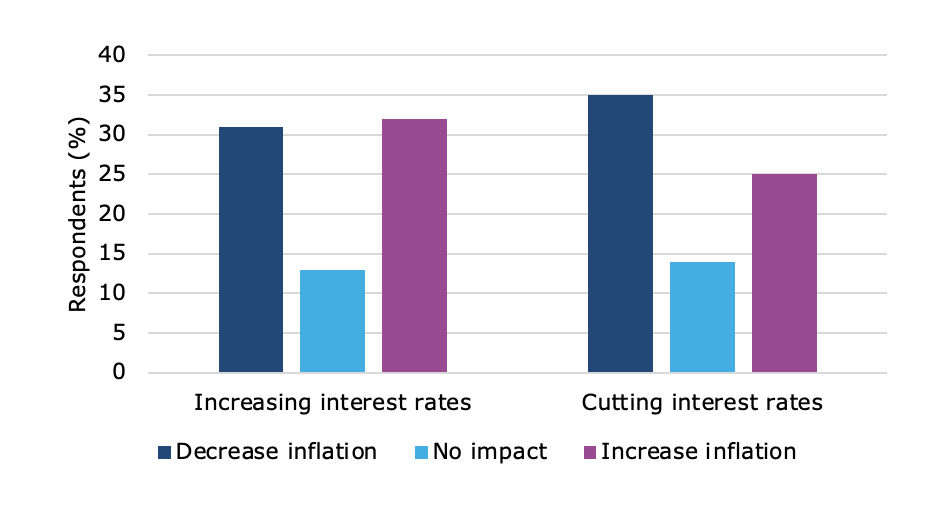

I am always tempted to laugh at such crackpot economics from authoritarian leaders who think they know everything, but in this case, Erdogan’s views are widely shared at least among the American public. Below are the answers given by Americans to a YouGov survey asking them to assess the impact of interest rate increases or cuts on inflation. And no, the labels in the chart are not wrong or mixed up. About the same share of people think that hiking interest rates leads to higher inflation as believe that it leads to lower inflation. When it comes to cutting interest rates, a plurality thinks that rate cuts lead to lower inflation.

Views of Americans on the impact of rate hikes and cuts on inflation

Source: YouGov

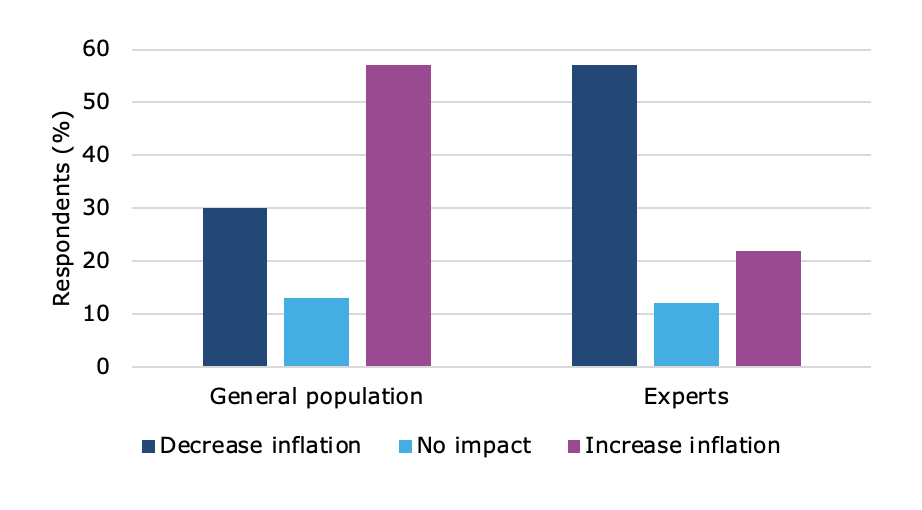

If you think that this is one of these surveys where people just didn’t take the time to answer it correctly, look at the survey done by Peter Andre and his colleagues among 2,200 US households and 1,500 professional economists. This survey was done for an academic paper and carefully corrected for sample biases, etc. The survey also asked about the impact of tax increases, oil price shocks, etc on inflation and unemployment, which are interesting in and of themselves, but I show only the expected impact of rate hikes on inflation below. Experts overwhelmingly believe that rate hikes lead to lower inflation, while the general public overwhelmingly believes that rate hikes lead to higher inflation. This makes you wonder once again if the Fed knows what it is doing and if it has the right view of how the world works.

Expert vs. public view of the impact of rate hikes on inflation

Source: Andre et al. (2022)

I wonder if one reason some of the public associates higher interest rates with higher inflation is because when high inflation is in the news discussion of rising interest rates is also in the news, so people make that association but end up getting the causal link backwards.

My view is that the rate hikes don't lead. I side with the public when it treats high costs from real economy shortages as no different from the high costs of borrowing. Maybe raising one cost doesn't lower another. It just doubles the pain.

The only way rate hikes can significantly lower prices is by crashing the economy and bleeding jobs.

We'd be better off letting inflation subside as supply repairs itself. The leeches aren't helping.