In theory, company executives use buybacks to prop up a company’s share price when they think the stocks are undervalued. This means that in theory, more buybacks should happen when valuations of stocks are low than when valuations are high. In practice, the relationship between stock valuation and share buybacks for US companies looks like this:

Share buybacks and company valuation

Source: Ko (2023)

Most of the share buybacks happen when a company’s stocks are already trading at high valuations and one has to wonder if corporate executives know what they are doing. And while it is easy to say that corporate executives are just greedy, trying to buy back shares when they are already expensive to boost the value of their stock options, Minsu Ko from Ohio State University proposes a more benign solution.

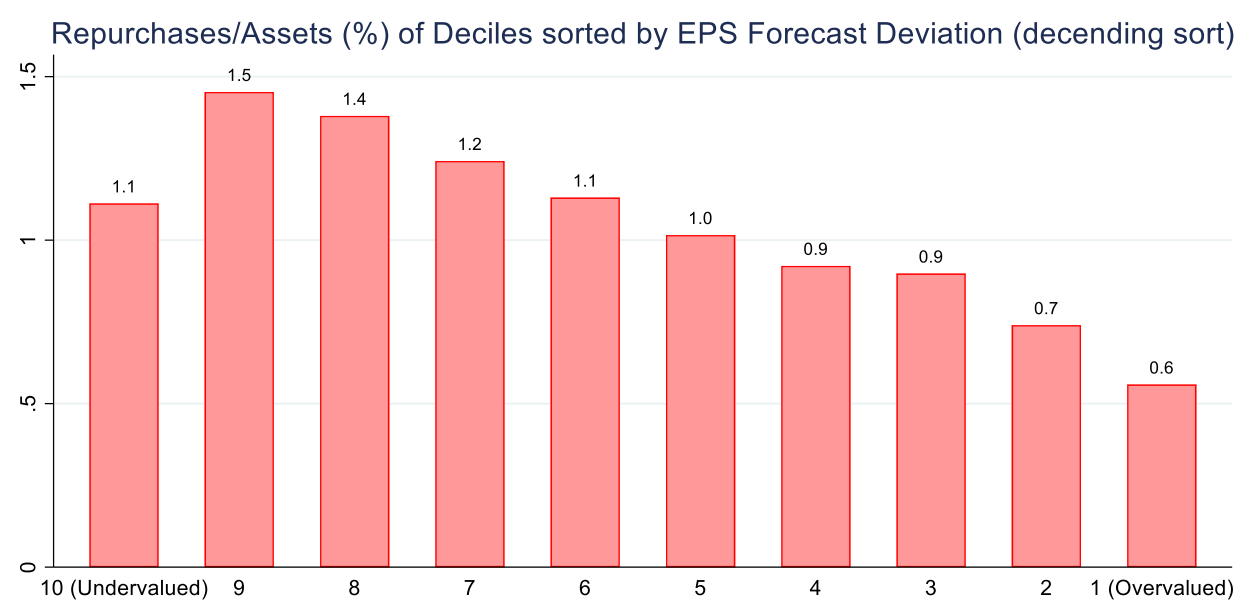

He argues that corporate executives do not focus on traditional valuation measures like book-to-market but instead focus on the earnings outlook of the company. If the executives think that earnings will grow much more than analysts expect, the company buys back more shares. If the executives think the earnings outlook is worse than analysts expect, they hold their fire. If we look at the relationship between expected earnings vs. analyst forecasts and share buybacks, it looks a lot like this is what happens.

Share buybacks and difference in earnings outlook

Source: Ko (2023)

My initial reaction to these results was that this is all fine and well, but executives may think their earnings are going to grow more than what analysts expect simply because they are overconfident in their ability to grow earnings. But it turns out that is not the case. Corporate executives tend to be slightly better at forecasting earnings of their own company than the analysts covering the stock.

And this small advantage in forecasting ability allows executives to time share buybacks. When executives think that earnings will grow more than analysts expect, they tend to accelerate share buybacks and push valuations higher. But on average that turns out to be good timing because on average earnings DO grow more after share buybacks have been accelerated. So at least when looked at through this lens, it seems as if corporate executives know what they are doing when they are buying back shares in their companies.

Takeaway: buybacks as leading indicator?

“ This means that in theory, more buybacks should happen when valuations of stocks are low than when valuations are high.”

Alternatively, companies can afford to buy back shares when they are doing well. When they’re doing well, they can afford to do buybacks.