Advisers eat their own cooking - unfortunately

One common assumption about advice in retail banking and wealth management is that conflicts of interest lead to recommendations of expensive or suboptimal products to clients that ultimately cost performance. A recent paper by Juhani Linnainmaa, Brian Melzer, and Alessandro Previtero has investigated this claim amongst 3,276 Canadian advisers working at two different firms.

Here is the good news: the researchers could not find a significant difference between the recommendations of advisers to their clients and what advisers did in their own portfolios. This means that even in the absence of a fiduciary duty, advisers do not give in to potential conflicts of interest.

The bad news is that advisers are crap at their job. The researchers found that client portfolios had miserable performance, because advisers recommended too concentrated and underdiversified portfolios, traded too frequently and favoured expensive funds with high past returns. And they did exactly the same in their own portfolios.

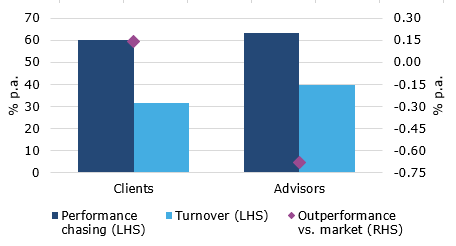

As has been documented in other research, client portfolios generally differed substantially, depending on which adviser the client had. Good advisers can create significant added value to a client while bad advisers destroy performance. This new research shows what makes advisers so bad. Take for instance return chasing behaviour, something we know is not conducive to strong future performance. The funds recommended to clients were on average in the 60% rank of past 12-month performance, i.e. only 40% of funds in the eligible universe had better 12-month trailing performance. The funds that advisers used in their personal accounts on average were in the 63% rank. Average annual turnover in client accounts was 31.5% while advisers had an average annual turnover of 40% in their personal accounts.

The result is that client portfolios had an average outperformance vs. the Canadian stock market of 0.14% per year, and -0.69% per year when style biases like value or size are accounted for. In comparison the personal portfolios of advisers had an average annual alpha of -0.68% vs. the Canadian stock market and -1.25% when style biases were accounted for. Cynics might say that advisers add value for clients because the client portfolios perform better than their own personal portfolios, but it is more likely that clients just are more hesitant to invest in some ideas presented to them and thus have lower turnover and better performance than advisers.

Adviser and client portfolio characteristics

Source: Linnainmaa et al. (2018), Fidante Capital.