The French may not like it, but retirement ages have to increase across the developed world. As we live longer, our social security systems simply cannot be sustained when people draw a pension for 20 years or more. But at the same time, older people face a massive challenge finding a job in the private sector above the age of 55 or so because few companies want to hire them. And with the rise of automatization and AI this challenge seems to become only bigger.

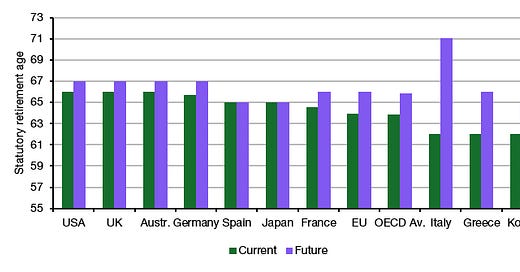

Today, the average statutory retirement age in OECD countries is 63.8 years rising to 65.8 years for the people currently in the workforce. But even so, most economists who look into the sustainability of public retirement and social security funds think that the retirement age needs to rise even more than that. I am not an expert, but I think Italy is on to something when it increases the retirement age to 71 in coming years.

Statutory retirement age in selected industrialised countries

Source: OECD.

Now, the automatization and AI revolution has gone into overdrive, and one has to wonder if there will be any jobs left for people at an advanced age who want to work. Automatization is likely to replace more and more low skilled workers in physically demanding jobs. That might not be too much of a problem, since in my view the best solution to the retirement crisis is to allow people who cannot work much longer than the official retirement age to retire at a lower age than white collar workers who have physically less demanding jobs. This has been advocated by Michael Falk in his book “Let’s all learn how to fish… to sustain long-term economic growth” and I am still convinced it is one of the best ways to create a fair retirement age for everyone.

I know that some readers don’t like this proposal of a differentiated retirement age based on how physically demanding a job is because they find it impossible to implement in practice. And I agree that in countries like the US where there is no proper record-keeping about its citizens that may be a problem. But across Europe, the government already knows from your tax forms where you are employed and in what function so they can easily assess your career to classify you into different groups with different retirement ages based on your career trajectory as well as your applications for disability insurance, etc. I can already hear the libertarians scream about the invasion of privacy, but let’s face it, the government in most countries already has that data and can use it whether we like it or not.

In any case, with the rise of AI, there is another problem because now automatization is not only going to increasingly replace physically demanding jobs, but also white collar jobs in call centres, accounting, and legal services. So, the people who could work longer suddenly face even more limited job opportunities than before.

What are we going to do about it?

I don’t know for sure, but I think as a society, we need to have a discussion how our lives are going to look like in the 21st century. And this discussion can no longer be limited to individual dimensions like the retirement age, or the number of hours worked per week. We need to make hard choices about the trade-offs between retirement age, retirement benefits, etc. and these choices impact other parts of the economy like the taxes we pay, or the unemployment and disability benefits offered. You change one variable, and many other variables will be impacted. If we don’t provide holistic solutions, we are only going to make things worse.

Which brings me back to our attitude toward older employees. It cannot be that companies are reluctant to hire people over the age of 55. Having employees in their 60s as a substantial part of their work force has to become normal in a world where the retirement age closes in on 70. And no voluntary scheme by private businesses is going to make a significant change to this awful habit of businesses to not employ older people.

Obviously, we can’t force companies to hire older people just to give them a job. But we can enforce transparency on the diversity of their workforce. Regulators are already enforcing public disclosure on gender and ethnic diversity. This helps investors put pressure on companies to improve this dimension of diversity and inclusion.

But what about ageism? Shouldn’t we enforce more transparency on the age distribution of a company’s workforce? Isn’t the current practice of indirect age discrimination just as bad to a company’s bottom line as the discrimination against women or ethnic minorities? After all, older employees may not be as fast in adopting new technologies, but their experience and their institutional memory allows them to avoid many mistakes younger people make. I don’t know of any study that looks at the impact of age diversity on corporate performance, but I wouldn’t be surprised to see a better performance of companies with a more equal age distribution in their workforce than of companies with predominantly young or predominantly older workforces.

Retirement Age: The ideal is flexibility. A heavy manual worker may need to retire at age 60yo. At present the incentive is for her to ‘go on the Sick’. Conversely a 70 yo brain worker has valuable experience; and my be content to work on at lower pay. Pension schemes could offer ‘£x if you retire at 60 yo, £y at 65yo, etc. For all there must be compulsion / encouragement to save more at a younger age. The UK regulatory insistence on holding Fixed Income should be changed.

AI: I suspect we shall see this as a nonentity in 2026 and transformative in 2033.

The retirement system in Italy is based on two criteria: seniority and old age. To retire by seniority, one needs 41 years of contributions; to retire by old age, one needs to be 67 years old. I am 45 years old now and I will only meet the old age criterion when I am 71. The job market is becoming more and more competitive. The well-off white-collar workers of the past are now unemployable at any age, while the blue collars are the same as always, same status and above all same salary. So I ask myself: who will sustain the cash flows of our economic and welfare system? The luxury market that the German car makers are targeting? Henry Ford would be rolling in his grave.