And the winner was…

As we prepare for the possibility of another Trump presidency in the US, it’s probably a good idea to look back at his trade war with China. After all, it seems highly likely that if Trump gets back into office, he will once again ratchet up tariff barriers for Chinese imports and China will retaliate with tariffs on its shores. So, who won last time?

First, let’s be clear about one fact. On average, there are only losers in a trade war. Back in 2019, I discussed how increased uncertainty about future trade led to less investment and lower GDP growth. Back then I cited a study that indicated that in 2018 alone, US GDP growth was dragged lower by 0.4% in 2018 due to all the talk about a trade war. In emerging markets, the impact on GDP was probably even bigger at 0.6%.

But while overall, there are only losers, some people ended up winners from the trade war. And Donald Trump may not like to hear that (and hence he will simply ignore it if somebody ever tells him) but clear winners of the US-China trade war under Donald Trump were Mexicans.

Hale Utar, Luis Bernardo Torres Ruiz, and Alfonso Cebreros Zurita got hold of confidential firm-level customs data from Mexico which allowed them to reconstruct how global supply chains were rerouted in response to the US tariffs on Chinese imports and Chinese tariffs on US goods.

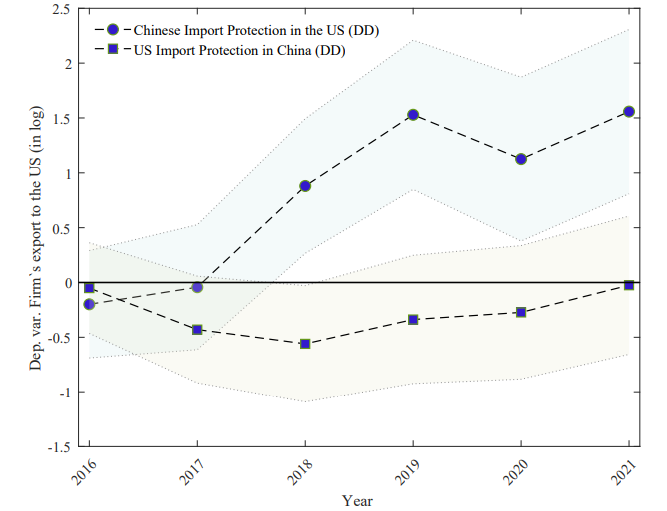

Today’s first chart shows how exports from Mexican companies to the US increased significantly in 2018 and 2019 as the trade war unfolded while Chinese retaliatory tariffs led to a less significant decline in Mexican exports to the US.

Impact of US and Chinese tariffs on Mexican exports to the US

Source: Utar et al. (2023)

Effectively, what happened was that US companies exported less which meant that their demand for semifinished goods and raw materials from Mexico declined. But other companies in the US that mostly imported goods from China were looking to near-shore their supplies. And because producing stuff in the US is still very expensive, there was no benefit to bringing production back to the US. Instead, they bought semifinished goods and raw materials from suppliers in Mexico which, thanks to the USMCA trade deal negotiated also by Donald Trump had no tariff hurdles to overcome. And the result was more exports from Mexico to the US for suppliers of these goods.

Looking at different parts of the Mexican manufacturing industry, we can see that the impact of US tariffs on Chinese goods was on average slightly negative for Mexican producers of food, textiles, and clothing and slightly positive for producers of chemicals, rubber and plastics. But it was clearly positive for Mexican manufacturers of machinery and automotive parts. These were the sectors in the US that were hardest hit by the US tariffs on steel and that re-routed their global supply chains most aggressively – much to the benefit of Mexican suppliers.

Impact of US tariffs on Mexican manufacturing exports to the US

Source: Utar et al. (2023)