Another look at commodities

If you want to see two financial analysts get into a fistfight, all you need to do is find one who likes commodities and one who doesn’t. There is hardly an asset class that is as divisive as commodities. Traditionalists say that commodities don’t have any cash flows, thus there is no way to value them properly and as a result, all you can do is speculate that you find someone who will pay more for them tomorrow than you did today. And then there are the more eclectic people who say that just because commodities don’t provide cash flows doesn’t mean they cannot be useful in a portfolio.

I am clearly on the eclectic side and in the early 2000s, when I was much younger and hot-blooded, I once almost lost my job over a dispute whether commodities should be part of the strategic asset allocation of portfolios. Thankfully, as I gained more experience, I got more relaxed about the topic.

I think the problem with commodities is that it is incredibly hard to invest in them even if you are a long-term investor. The returns are extremely lumpy, something that has been shown again by a new study by Geetesh Bhardwaj, Rajkumar Janardanan and Geert Rouwenhorst. They went through the hard labour of finding prices for 230 commodity futures contracts going back to 1871. Unlike previous studies, which mostly relied on data since the 1960s, this is about the most comprehensive analysis of commodity returns ever. The chart below, for example, shows the average risk premium (excess return above the spot return) of commodities per decade since 1871 together with the real price return of stocks (I know this is comparing apples with oranges, but I only show the stock returns as a comparison to the lumpiness of commodity returns, not as a comparison in size).

Average risk premium of commodities per decade and real stock returns

Source: Bhardwaj et al. (2019), R. Shiller.

While the average risk premium per year was about 5.3%, the chart shows that commodities can underperform both this long-term average and stocks for decades at a time, just to massively outperform in other decades. The swings are even more pronounced than for equities.

What makes the research so interesting is that thanks to the long history of their dataset, the researchers could check whether the experience of the last sixty years since the 1960s is similar to the experience of the first half of the 20th century. And the good news is that, yes, the last sixty years were no different from the 90 years before that. All the technological changes we experienced in moving from an industrial to a service economy, all the advancements of technology, the rise in emerging markets, none of that changed the return patterns of commodities. And if you look at the paper of Bhardwaj and his colleagues, you can see that this is not only the case for commodities overall, but also for commodity subgroups like industrial and precious metals.

This is an important finding because one of the arguments of commodity skeptics is that industrial metals are becoming less and less important as inputs in our economy and thus the demand should systematically decline over time, creating a negative long-term trend for excess returns. None of the commodity subgroups in their study show such a declining trend.

Furthermore, commodity returns are today still driven by the same factors as in the first half of the 20th century. Excess returns are higher in an economic expansion than in a recession (when commodity excess returns become highly negative), they are higher when inflation is high or rising and lower when inflation is low or falling. And of course, commodity excess returns are concentrated in those times when the futures curve is in backwardation, which is historically about 40% of the time.

If there is any difference visible in the performance of commodities after 1960 compared to earlier times, then it seems to be that the amount of time commodity futures spend in backwardation has declined. This may well be the result of the rise of commodity index investing where simple commodity indices buy the futures with the shortest maturity and roll them to the next future before expiration. These simple indices have been popular in the first wave of commodity investing in the early 2000s but have increasingly been replaced by more sophisticated approaches that do not suffer from the weaknesses of these simple indices.

Commodity excess returns in different market phases

Source: Bhardwaj et al. (2019).

But while this new study confirms that commodity returns today aren’t qualitatively different from commodity return a hundred years ago, it also confirms that investing in commodities today is just as hard as it was a hundred years ago. Every investor knows that a strategy or an asset class can underperform for a long time. Sophisticated investors are prepared for that and can hold on to an investment even if it underperforms for several years. But when it comes to commodities, they can underperform stocks for 10, 20 and sometimes more than 30 years. And even the most disciplined investors I know don’t have that kind of patience – at least not if they have to justify their investment to other stakeholders. And that’s the problem. Markets can stay irrational longer than you can stay solvent and commodities can underperform longer than you can stay alive.

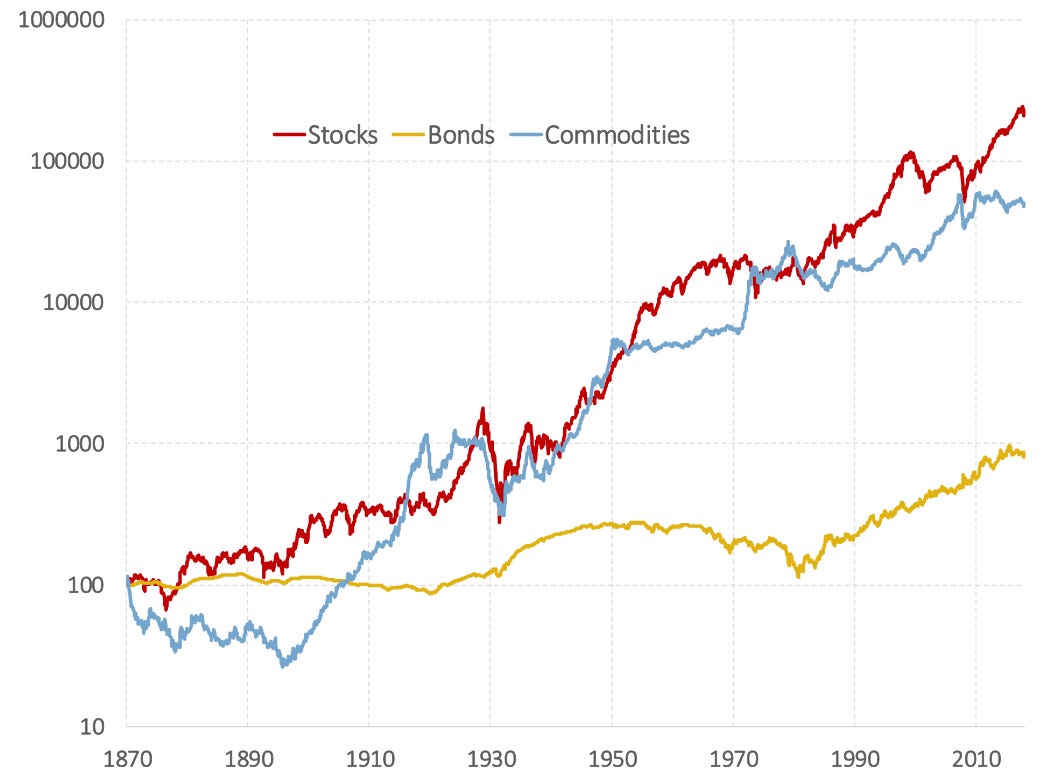

Performance of stocks, bonds and commodities since 1871

Source: Bhardwaj (2019).