ESG scores or ESG ratings are pretty useless, which is why most serious ESG investors in Europe are abandoning them in favour of more targeted approaches. One of the key reasons why ESG scores are so useless in practice is because they are trying to summarise in one number many different risk factors most of which have nothing to do with each other. Investors who try to optimise portfolios along these dozens of ESG components simultaneously can end up with a portfolio that is in some ways worse than doing nothing at all.

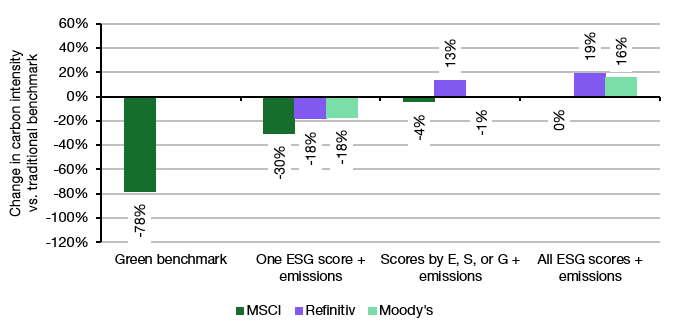

The always great Noel Amenc, Felix Goltz, and Antoine Naly from Scientific Beta have gone through a massive data exercise where they looked at the ability of ESG portfolios to reduce the carbon intensity of the investment. To do this, they started with a simple market cap weighted global traditional benchmark and compared the carbon emissions per $1 million of sales with that of a green benchmark that invests only in companies with the lowest carbon intensity. This simulates an investor whose primary goal is to reduce the greenhouse gas emissions of the investment portfolio. As the chart below shows, by focusing exclusively on this narrow target, greenhouse gas emissions can be reduced by about 78%.

Of course, this is an unnatural process because most of the time, by focusing only on reducing carbon emissions, one would create a large tracking error and the potential for very large performance gaps with a traditional benchmark, which many investors don’t want. But for the sake of showing how ESG criteria mess with each other irrespective of the performance impact, let’s just continue down this track.

Once the green benchmark was established, the researchers added additional ESG components from Moody’s, MSCI, or Refinitiv to the selection criteria. In essence, they were trying to construct portfolios that tried to not only reduce carbon emissions by as much as possible but also improve other environmental, social, or governance dimensions. The second set of bars in the chart below shows that if only one ESG subcomponent of the ESG scores is added to the mix, the average reduction in carbon intensity of the portfolio is reduced to 18-30% instead of 78%. By adding another ESG goal to the mix, about two thirds of the benefits of focusing on emissions reductions are lost. Then they kept on adding additional ESG criteria, either in each of the E, S, and G pillars or, as in the set of bars furthest to the right, the whole set of ESG scores.

This is essentially what happens in many ESG thematic funds that simply use ESG scores to construct their portfolios. As you can see, the more ESG goals one adds to the mix, the worse the outcome for the original goal of carbon emissions reductions. In fact, portfolios that try to optimise all ESG dimensions at the same time as trying to reduce carbon emissions end up doing nothing of the sort. On average these portfolios have higher carbon emissions than the original, non-ESG benchmark. By trying to be a Jack of all trades, the portfolios ended up being masters of none. And if you ask me, that is worse than not having any ESG scores at all. Time to abolish ESG scores altogether if you ask me.

Carbon emissions reduction based on different ESG goals

Source: Amenc et al. (2023)

I do not know if I fully agree with you. This results can be interpreted also as the ESG scoring is a way to minimize the risk, not to maximise the impact.

Moreover it is another proof that sustainability goals may be in conflict with each other. In this case the targeted approach would depend on the goal of the single investor

Agree. Its all a ploy to get you to eat bugs you don't own and like it, as they build a neo-feudal paradise for elites.