The year 2022 should have put any of the bogus claims that cryptocurrencies provide diversification benefits or a hedge against inflation to rest. Yet somehow, crypto aficionados still think that the performance of the first half of 2022 was the exception that proves the rule. But there is a fundamental reason why diversification benefits broke down and are likely to break down again and again when markets are declining.

You can think of the cryptocurrency ecosphere as consisting of risky and safe assets just like the traditional capital markets can be split into safe and risky assets. In traditional markets, safe assets are short-term fixed income assets like Treasury Bills and Commercial Papers issued by high quality corporate issuers. The risky assets, meanwhile, are equities (let’s ignore the plethora of other assets for a moment).

When investors become scared, they sell equities and switch to safe assets, which reduces the interest rate on these safe assets. This decline in interest rates then feeds back into the equity market as a signal to other investors that the market is panicking and looking for safety, thus triggering more investors to switch from risky assets to safe assets. It is George Soros’ concept of reflexivity at work.

Now, let’s look at the cryptocurrency space where you have risky assets like Bitcoin and Ether. But you also have safe assets like Tether and USD Coin that are linked to the US Dollar. By now, the market cap of all stablecoins is some $150bn with Tether accounting for some 44% of the market and the four largest stablecoins together for some 95% of the market.

The size of the stablecoin market

Source: Coinmarketcap

When investors become more risk averse, they may not sell Bitcoin and move into Treasury Bills or other traditional safe assets, but instead into stablecoins. If that is the case, the market for cryptocurrencies is separate from the market for stocks and other traditional assets and it is possible that the correlation between cryptocurrencies and traditional assets is low or even negative.

Unfortunately, there is a significant link between cryptocurrency markets and traditional asset markets even if all the money invested in cryptocurrencies stays within that market. The reason for this link is the existence of stablecoins.

Stablecoins are “stable” because the coins are backed by physical dollars, Treasury Bills, Commercial Paper, and other conventional safe assets. Yes, there are discussions about the actual backing of Tether and other stablecoins by truly safe assets but let’s put that aside for now and assume that all stablecoins are fully backed by US Dollar (or other currency) safe assets.

What happens if additional stablecoins are issued is that the issuer needs to buy these traditional safe assets. Sang Rae Kim has calculated that for every $300m increase in the issuance of stablecoins, the demand for Commercial Paper increases by 10.7%, leading to a 20bps decline in Commercial Paper yields and a 15bps decline in Treasury yields. This is a lot. The bigger the stablecoin market becomes, the bigger the new issuance of stablecoins will be, and the larger the impact on interest rates will become as well.

What is more, Sang Rae Kim also finds that a one standard deviation increase in the market cap of the three largest cryptocurrencies (Bitcoin, Ethereum, and Binance Coin) leads to a 20bps increase in Commercial Paper yield and an 18bps increase in Treasury yields.

Cambria Trinity ETF (TRTY) is a global allocation ETF that targets 50% in traditional assets such as stocks and bonds, but also targets 50% in non-traditional assets such as commodities, currencies, and alternative investments. Learn how TRTY can help your portfolio. Distributed by ALPS Distributors Inc. View Prospectus here.

What happens is that if investors become more optimistic about cryptocurrencies, they switch from stablecoins to Bitcoin & co., and if they become more pessimistic about cryptocurrencies, they switch to stablecoins. But if more investors switch into stablecoins, the issuance of additional stablecoins picks up, increasing the demand for Commercial Paper and Treasury Bills and pushing down interest rates. This decline in interest rates is interpreted as a sign that investors are becoming more worried and triggers other investors (most of which will not hold any cryptocurrencies at all) to sell risky assets like stocks.

The transmission from the crypto world to traditional assets like equities is not a reflection of margin calls for crypto investors as has been speculated throughout May and June this year by major investment banks. No, it’s the demand for stablecoins that gives markets a false signal of panic and triggers a major sell-off in equities.

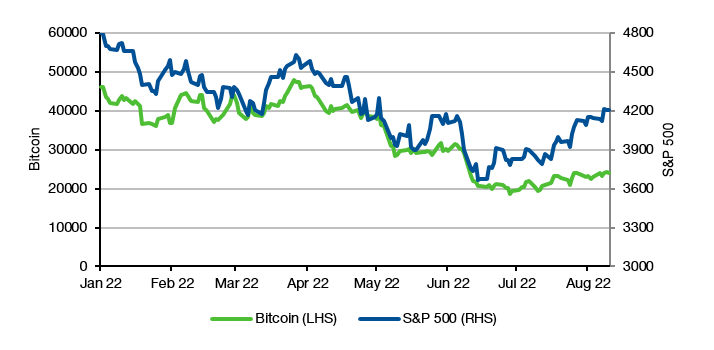

And because the link between cryptocurrency markets and traditional capital markets directly influences some of the most-watched interest rates, I have no hope that cryptocurrencies will ever be uncorrelated to equities. They may be uncorrelated in a bull market, but in a bear market, when you need the diversification benefits, they are not diversifying risk but amplifying risk. And the bigger the market for stablecoins gets, the larger the stronger the link to traditional capital markets will get and the lower the diversification benefits will become. Crypto aficionados may think that the high correlation between cryptocurrency prices and equity markets in the first half of 2022 is a bug. I think it is a feature.

Bitcoin and US equities in the first half of 2022

Source: Bloomberg

I find a lot of great insights in this newsletter, but I'll give this one a miss.

a) There is no evidence that in a bear market crypto assets are moving to bitcoin & co to stablecoins

b) Even if that was the case, the size of those stablecoins relative to US CP and treasuries is not meaningful, so it wouldn't impact the rates