I keep banging the drum about how useful it is for investors to monitor employee turnover in a company. It is simply the best single metric to measure employee morale and it gives important insights into a firm’s culture. High voluntary employee turnover is often a sign of a bad firm culture and in the worst case a sign of an IBGYBG mindset of the people who work there.

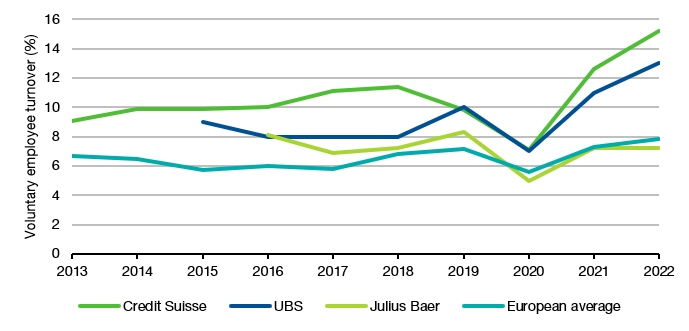

As a case study, look at the chart below that shows the voluntary turnover of three large listed Swiss banks (UBS, Credit Suisse, and Julius Baer) together with the average of the banks in the Stoxx Europe Bank index. As you can see, Julius Baer has voluntary employee turnover rates very much in line with industry averages, hovering around 6-8% of the workforce. Meanwhile, UBS has a systematically higher voluntary turnover rate and Credit Suisse was even worse. In fact, over the last five years, Credit Suisse had the second-highest voluntary turnover rate of any bank in Europe, just 1% below Standard Chartered which takes the top spot in this rather unflattering statistic. And this is voluntary turnover, i.e. excluding layoffs from cost-cutting or restructuring measures. Note also how Credit Suisse’s voluntary turnover rate exploded after the pandemic. People who worked there were voting with their feet long before the company went under.

Voluntary turnover in Swiss banks

Source: Liberum, Bloomberg

Vladimir Mukharlyamov from Georgetown University has now shown that employee turnover in banks is not only a sign of poor culture but can also give an indication of how at risk a bank is when a crisis hits. He looked at the career backgrounds of more than 250,000 employees in 224 banks worldwide before and during the financial crisis of 2008. His hypothesis was that banks that have more of a short-term mentality and a hiring and firing culture will take on more risks and will fare worse in a crisis.

To test this hypothesis, he measured four things: (i) the share of MBAs working in a bank, (ii) the share of employees from the top 50 schools in the US, (iii) the average job tenure of the employees in a bank, i.e. how long on average employees stay at a firm, and (iv) the percentage of employees with a high propensity to switch jobs in the past.

I have already discussed the significance of employee turnover rates, which is the inverse of the job tenure statistic used in this research. An even better statistic to use would be the ability to measure the share of employees who have a history of job switching in the past, but this data is typically not easily available. If you think about it, people who switch jobs frequently either are not committed to their work or their employer and jump at every opportunity they get (thus having left the moment some of their past decisions turn sour) or they are below-average employees who can’t hold on to a job. And as a company, you don’t want to employ either of these people, really.

But why look at the share of MBAs or the share of graduates from elite universities as a measure of risk? Well, this paper has found that executives with an MBA tend to take on more financial risk in the companies they lead and follow more aggressive strategies, while this study has shown that people with a degree from top schools form a network of like-minded executives that tend to be subject to groupthink within their peer group and thus may underestimate the risks of their actions.

Interestingly, the results are remarkably strong. A one standard deviation increase in each of the four measures lead to a significantly higher drop in share price during the financial crisis of 2008 simply because banks run by more MBAs or full of people with short job tenure and/or a history of job switching took on more risk in the runup to the financial crisis and then had to pay the price when the market collapsed. A one standard increase in each of these variables coincidentally is close to 8%, so having 8% more MBAs in your bank meant that the share of the bank lost 3.8% more during the crisis than banks with an average share of MBAs. Similarly, having an 8% higher employee turnover on average meant that the share price of the bank dropped 13.2% more in 2008 than the share price of a bank with average employee turnover.

Share price reaction in 2008 to an 8% increase in “company culture metrics”

Source: Mukharlyamov (2023)

In essence, these banks had more of an IBGYBG culture than banks where employee turnover was low and where the share of high-powered MBAs and graduates from elite universities was lower. This was true not only in 2008 but also during the Asian financial crisis in 1997 which was used as an independent case study to verify the results.

And while the study did not look at the 2023 banking turmoil, my guess is it would have been accurate there as well.

Thanks for this. I guess I'll have to read the paper to find out whether the increased risk is compensated by better stock performance when times are good.