Are people going to hold more cash in the future?

After a year of rate hikes, money market funds and bank deposits are starting to pay decent interest again. But as some statistics about historical cash holdings show, this might not trigger a persistent increase in cash holdings.

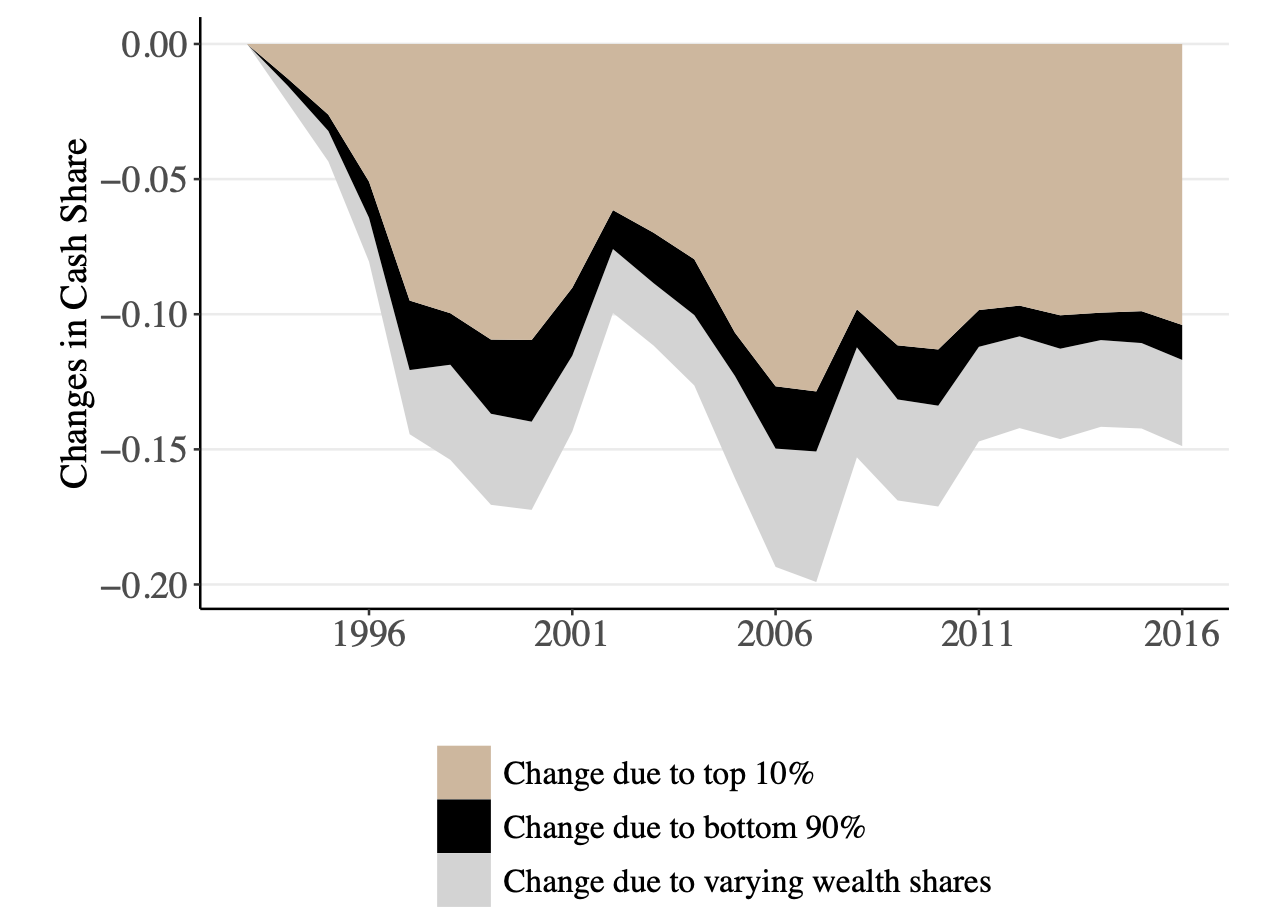

Sebastien Betermier and his colleagues looked at the cash holdings of households and companies in Norway, the Netherlands and the United States over time to examine what determines cash holdings. One of the less surprising things they find is that the 10% richest households account for almost half of all cash holdings, and their decisions move markets. The poorest families have to hold cash because they need it for emergencies, so they don’t hold cash for investment or savings. The result is that as deposit rates declined over the last 20 years, the poorest households hardly changed their cash holdings. Similarly, companies hold cash predominantly for payments and thus try to minimise their cash holdings independent of the level of interest rates. Thus, nothing much has changed in the cash holdings of companies either.

But what about the wealthiest 10% of households that hold cash at least partially as an investment? Well, they significantly reduced their cash holdings in the late 1990s when interest rates in the US and Europe declined to low levels for the first time. During the 2001/2002 recession, they increased cash holdings again, but then quickly depleted them again once times got better and house prices rose strongly. Higher interest rates after 2006 did not incentivise people to hold more cash and near-zero interest rates after 2008 did not create a significant drop in cash holdings either.

Basically, since the early 2000s, cash holdings have been at a minimum no matter whether interest rates were high or low. What determined cash holdings were the state of the economy. People hold more cash in a recession and deploy that cash in a recovery when they see more opportunities in equity markets and other risky assets.

The fact that even in the 2006 to 2008 period cash holdings did not rise despite interest rates rising well above 4% in that period tells me that the equity boom is not over. Once the recession is over, investors will likely put their money at work again in equities and other risky assets. And money market fund managers will again be looking for new jobs and ways to attract funds with risky investments disguised as safe assets, just like they did over the last 20 years.

Movement in cash holdings in private households

Source: Betermier et al. (2022)