Are stock markets global or local – or both?

From time to time I get asked if it is better to look at global equities as a selection of different countries or as a selection of different sectors. The underlying question is usually if it is better to think of markets as local (in which case stocks within a country should be more correlated than stocks of the same sector globally) or global in nature (in which case stocks of the same sector should be more correlated with each other than stocks in a country).

I have looked at this several times in my career and always came up with the same in-conclusion: Sometimes it’s better to look at sectors and other times it is better to look at countries.

And this is simply because stock markets react to the underlying economy and the economy in each country is subject to its own local swings and at the same time linked to the global economy and its swings. The local economic swings are typically driven by two major forces: the housing market and local lending standards by banks. If the housing market enters a bubble or banks lend too freely (be it for houses or other purposes), we typically end up with a local bubble like the one in Japan at the end of the 1980s or the housing market bubble in Scandinavia and Canada in the early 1990s.

The global economy is typically driven by global capital flows that can create asset price bubbles in different countries or create a collapse in financial markets in weaker economies. Just think of the Tequila crisis in 1994 or the Asian crisis 1997. These were crises that were triggered by a sudden withdrawal of investments from emerging markets. Another example of a global crisis is the tech bubble of the late 1990s that was fuelled by excess savings in oil-exporting countries (Petrodollars) and relatively low-interest rates (compared to previous levels). Add to that the magic ingredient of a promising new technology that could change future growth and productivity globally and you get the perfect stew for a global asset price bubble.

And then there is the Silverback Gorilla in the room that is the United States (joined by the new kid in the jungle China). If these countries suffer from a local crisis, the global economy might suffer as well. The financial crisis of 2008 is a case in point.

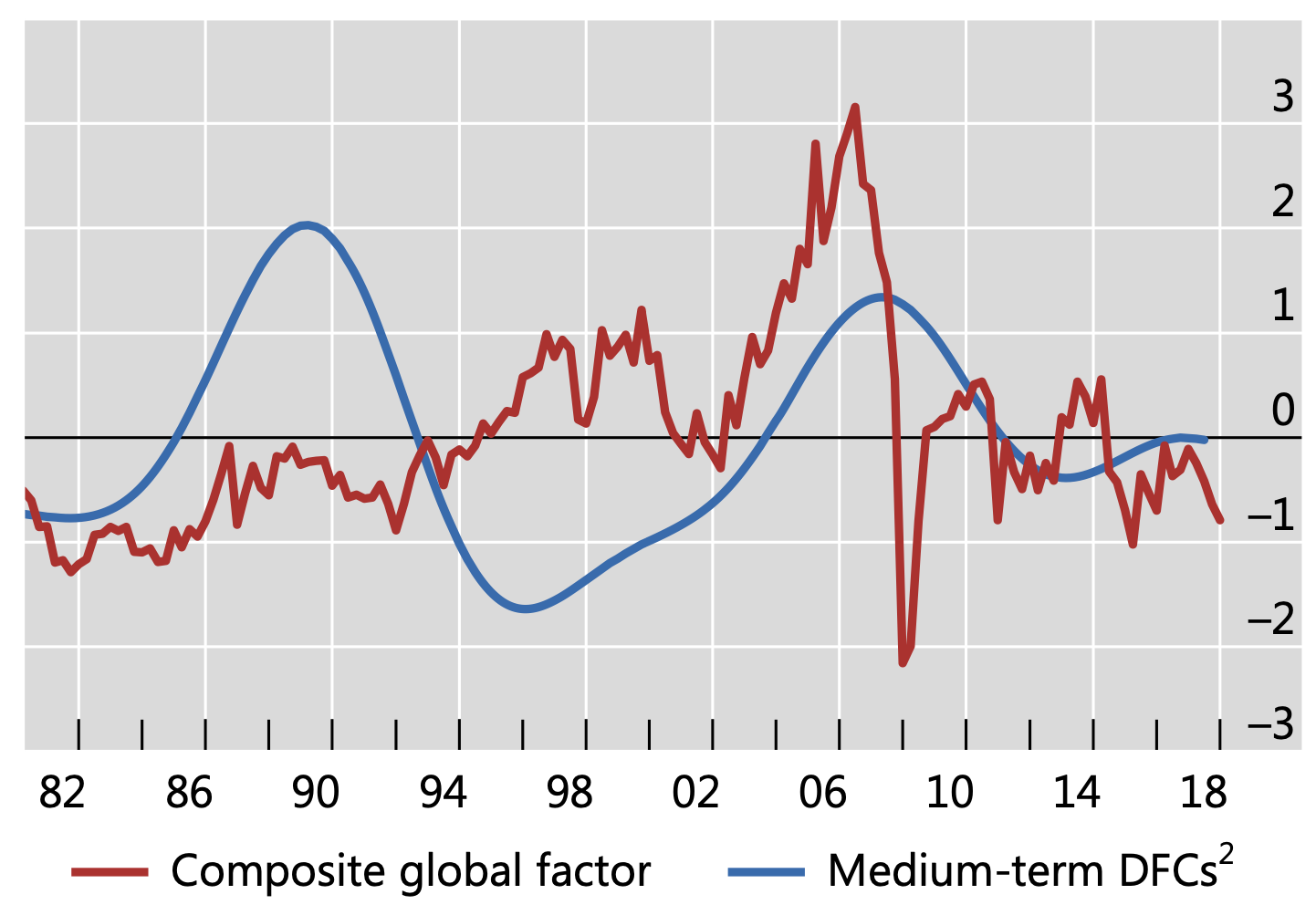

The good thing is that the correlation between local and global cycles is pretty close to zero as this analysis of the two cycles shows. Domestic cycles tend to be longer than global cycles, simply because lending standards and house prices don’t change as fast as global investment flows do. And luckily, until the year 2000, the average domestic cycle and the global cycle tended to have peaks and troughs at different times, thus canceling each other out from time to time.

Global and local financial cycles

Source: BIS. Note: DFC = Domestic Financial Cycle

But the chart above already shows that since 2000, domestic cycles and the global cycle have become increasingly synchronised. This may just be a coincidence because the shape of domestic cycles hasn’t changed much, and the global cycle has always been somewhat irregular. But it also could be that this synchronisation in domestic and global cycles is a result of globalisation and global supply chains where a crisis in one country can spread more easily around the globe. So far, we don’t why the domestic and global cycles have become more synchronised.

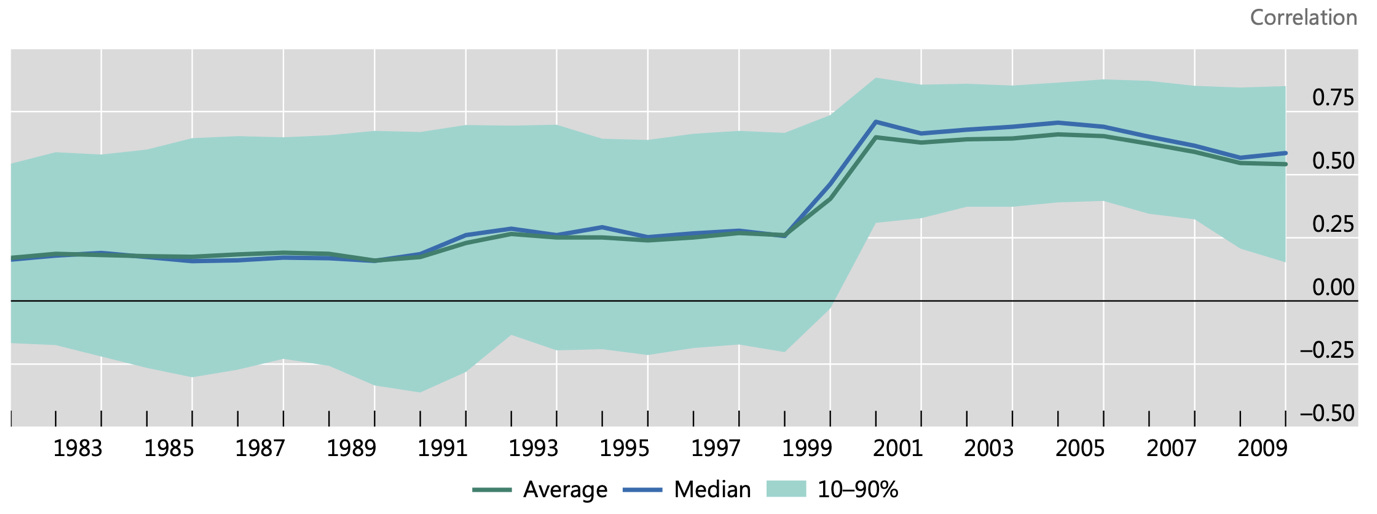

Yet, the impact on the correlation between GDP growth of different countries is material. In the 1980s and 1990s the correlation between two countries was somewhere between 0 and 0.5. Now, it is typically between 0.25 and 0.75. Thus, monitoring the global cycle has become more important in the 21st century and thus companies within the same sector are likely to be more correlated with their global peers than with other companies in their home country.

Average correlation between GDP growth in developed countries

Source: BIS