Assessing the oil shock

Saudi Arabia announced today that it would ramp up oil production significantly, sending oil prices down by more than 20% - the biggest daily drop since 1991. This move comes after Russia decided not to participate in the OPEC production cuts to stabilise prices after the significant decline in recent weeks.

The motivation for Russia to not follow the OPEC decisions was likely driven by its desire to hurt the US shale business. Shale oil production needs oil prices of $50 to $60 per barrel to be profitable. The average production cost of a barrel of crude oil in Russia in 2017 was estimated at $17.20/bbl. but obviously, the marginal costs of production are much higher, and Russia likely needs oil prices in the range of $40/bbl. to $45/bbl. to produce oil profitably. The marginal cost of production of a barrel of crude oil for Saudi Arabia, on the other hand, is likely at or below $30 per barrel.

I have been writing a book on the impact of geopolitics on the economy and financial markets, which will be published later this year. In what follows, I will draw heavily on the contents of this forthcoming book to help investors put these events into a historical context and assess the short-term and long-term consequences of this move.

Historical context:

This move by Saudi Arabia is not unprecedented. From February 1982 to October 1985, OPEC tried to control supply to ensure oil prices stayed high during the Iran-Iraq War (see the grey shaded area in the chart below). However, for years, several OPEC members secretly pumped more oil than their quota would allow until Saudi Arabia in October 1985 decided to teach them a lesson and started to expand supply dramatically, thus sending oil prices in a heavy tailspin. Since Saudi Arabia and Iran have the lowest production prices in the world, they could survive the low oil prices much longer than other OPEC members, thus eventually enforcing a discipline amongst OPEC members that has held up to this day. It took several years of low oil prices to enforce this discipline but since Saudi would always be the last man standing, it was just a matter of time until other countries would fall in line.

It seems to me that Saudi Arabia is following the same playbook this time around. The announcement today sends oil prices to a level much below the level Russian producers need to be profitable. Russia is extremely dependent on oil and gas exports given the economic sanctions imposed by the West, so it may have seemed plausible by the Russian government to defect from the OPEC agreement to sustain its income and at the same time hurt US shale producers. With today’s actions by Saudi Arabia the calculation has changed dramatically, and it is only a matter of time until Russia will have to backtrack. How long that will take, however, is anyone’s guess. It may happen in a matter of days or weeks; it may take years.

Real price of crude oil

Source: Kilian (2009).

Impact on the economy

Lower oil prices tend to be good for the economy since prices for petrol and other consumer goods drop. However, we need to be aware that not all oil price shocks are created equal. To quote from my upcoming book:

Kilian differentiates between three different types of oil price shocks, a classification system that has become standard and is important to remember for investors:

Supply shocks are driven by unanticipated changes in the production of oil. Supply shocks can be negative, such as when Saudi Arabia had to shut down its Abqaiq oil processing plant after a drone attack in 2019, leading to a decline of global output by 5% overnight. As Kilian (2009) shows, such supply disruptions generally are short-term in nature and while they do lead to a spike in oil prices, they tend not to have a lasting impact on the economy or financial markets.

However, the fear of lasting supply disruptions can lead to oil-specific demand shocks if oil importers start to stockpile crude oil in anticipation of a longer outage. For example, if the Abqaiq outage had led to a general concern that Saudi outages could not be recovered quickly, oil consumers may have started to stockpile oil and drastically increase the global demand for this commodity. Similarly, the expectation of a prolonged war in an oil-exporting country or an open-ended restriction of production (e.g. the OPEC embargoes of the 1970s) can trigger such a demand shock. These oil-specific demand shocks are the biggest danger for the global economy because study after study has shown that they lead to spikes in oil prices, drops in stock markets and a decline in economic growth. And what is worse, such oil-specific demand shocks can last a long time and thus cause significant damage to the global economy and financial markets.

Finally, Kilian (2009) shows that the most common shocks are aggregate demand shocks which are triggered by a general increase or decline in demand for crude oil. These aggregate demand shocks are essentially a reflection of the global business cycle and will thus not be discussed in detail in this chapter. Suffice it to say, that aggregate demand shocks are the best kind of shocks since they lead to higher oil prices but also to rising stock markets as investors understand that the higher oil prices are a reflection of strong economic growth.

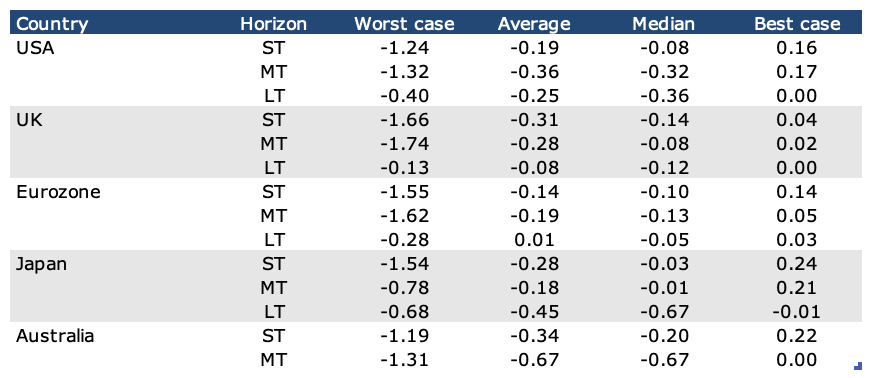

This is clearly a supply shock and thus we should not expect it to have lasting implications. Nevertheless, if Russia remains stubborn, the current supply shock could last for six to twelve months and depress oil prices for a prolonged time. In this case, studies on the economic impact of oil price shocks on GDP growth become relevant. The table below is taken from a metastudy of 149 studies performed since the year 2000 that examined the GDP impact of oil price shocks. The table is normalised to a 10% increase in oil prices, so to assess the likely impact on GDP of a 20% drop you need to change the sign and multiply the numbers by 2.

If we take the short-term projections as the most likely outcome of the current oil price shock, we can expect a boost in GDP growth of 0.2% to 0.4% for the United States, 0.3% to 0.6% for the UK and 0.2% to 0.3% for the Eurozone. However, we need to take into account that the current Covid-19 epidemic provides a background of negative GDP impulses, especially in the Eurozone where the lockdown in Italy will hurt this economy more than already anticipated. Add to that the weakness in the German economy due to its dependence on exports to China and it seems likely that the economic boost from lower oil prices may be overpowered by the economic slowdown from the epidemic. Similarly, for the UK and the United States, it seems to me that the boost from lower oil prices will be largely counteracted by the negative effects of the Covid-19 epidemic.

Estimated impact of a 10% oil price shock on GDP growth

Source: Oladosu et al. (2018). Note: ST = up to one year, MT = one to three years, LT = more than three years.

Impact on financial markets

Normally, oil price declines tend to be positive for stock markets if it is a supply shock because supply shocks typically happen in times of stable demand. However, with the current Covid-19 epidemic as a backdrop, we are witnessing both a potential decline in demand and an increase in supply. Nevertheless, the increase in supply seems to be much larger than the potential decline in demand, so that the supply shock should dominate the market reaction. In general, this should support stock markets (other than the energy sector). In recent years, however, much emphasis has been paid to the nonlinear reaction of stock markets to oil price shocks. To quote once more from my forthcoming book:

The nonlinear reaction of stock markets to oil price shocks has been at the centre of interest in recent years. Reboredo and Ugolini (2016) use a copula approach to investigate spill-overs from oil markets to stock markets and they find that more extreme oil price shocks lead to outsized stock market reactions. The figure below shows the value at risk for the weekly returns of stock markets in developed countries. The dark bars show both the unconditional upside and downside risks of these stock markets and the light bars the upside and downside risks given an oil price shock that is in the top 5% or bottom 5% of the historical distribution.

The figure shows that stock markets react much more sensitively to bad news than to good news. For example, the Value at Risk (VaR) for the US stock market over one week with a 95% probability is -4.1% on average. But in times of an adverse oil price shock the VaR more than doubles to -8.3%. In reaction to positive oil price shocks, the VaR only increases from 3.6% to 4.6%.

Stock market reaction to oil price shocks

Source: Reboredo and Ugolini (2016).

Summary

Given the backdrop of the Covid-19 epidemic and the fear this has induced in financial markets at the moment, it is very difficult to assess the short-term implications for markets. However, if we look beyond these short-term jitters, a supply shock like the one we witness at the moment should only be short-lived in nature. Russia will eventually have to fall in line with OPEC quotas at which point, oil prices should rise to the levels we saw last week. In the meantime, the lower oil prices will provide a small benefit to economic growth in developed countries that helps alleviate some of the negative consequences of the Covid-19 epidemic.

For stock markets, any setbacks due to the oil price shock should be short-lived in nature except for energy stocks which may remain depressed until Russia and Saudi Arabia decide to cut production again. The producers most at risk from this oil shock are clearly shale oil producers – especially those that are highly leveraged. The main beneficiaries of this oil shock should be consumer stocks – especially producers of energy-consuming consumer goods from cars to airlines.