Every fund manager lives and dies by her performance. However, hedge fund managers are even more reliant on good performance because of the performance fee they charge on top of a flat fee. And this creates all kinds of weird incentives for excessive risk taking.

One effect that is widely known is that hedge fund managers with poor performance have a strong incentive to take on more risks in their portfolios. Usually, performance fees are capped to the downside at zero but have unlimited upside. So if you are already under water, why not increase the risk dramatically? If the risks pay off you get some performance fees and if the additional risks lead to even more losses, you don’t suffer any downside because all the losses accumulate with investors.

A study by the Office for Financial Research of the US Department of the Treasury showed exactly this effect among US hedge funds. Managers that were among the biggest underperformers in the first half of the year significantly increased portfolio risk in the second half of the year in the hope of making up for lost performance.

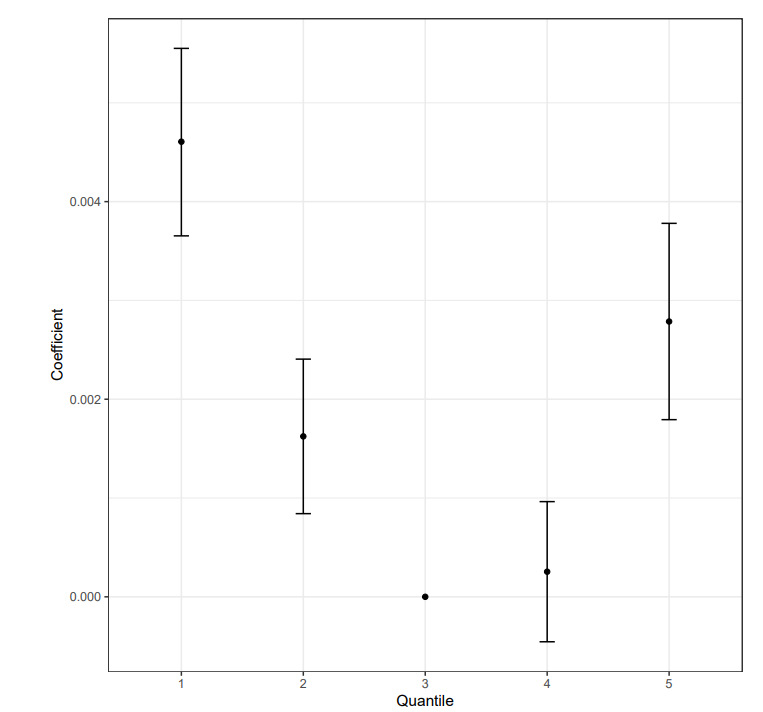

But if you look at the chart below you see that hedge fund managers who are in the top quintile of all hedge funds by performance (quintile 5 in the chart below) also materially increased the risk in their portfolios.

Hedge fund risk shifting from the first to the second half of the year

Source: Andrews and Gadgil (2024)

What is going on there is probably a combination of several effects. The research shows that top-performing funds increase risks by taking on more contrarian bets in their portfolios. This could reflect overconfidence that sets in after a string of good results. The fund managers become cocky and think they are invincible, so they tend to take on riskier contrarian bets.

But there is also another effect at play. If you are outperforming your peers, your prospects of attracting additional investor capital increase significantly. And the larger the outperformance the more money you will attract which will increase your base fee and potentially your performance fee next year. So why not increase the portfolio risk somewhat to capture more of these investor flows thanks to a blowout year with extremely good returns?

As we all know, incentives matter and hedge fund fees just like the government tax breaks discussed yesterday are just poorly designed incentive structures that work against the investors and businesses.

Your post reminded me of the following quote from Charlie Munger:

"Show me the incentive, and I'll show you the outcome."