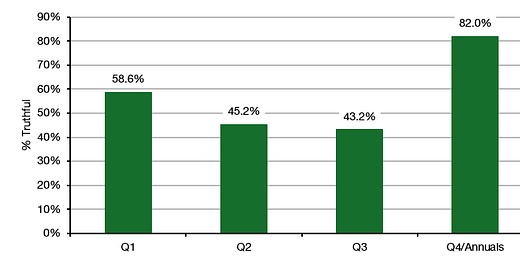

We are approaching the end of the second quarter and soon, companies will start reporting their results for the previous three months. Unfortunately, as research from D.A.T.A. shows, the results for Q2 and Q3 tend to be the least truthful results in the year, so I decided to use today’s post as a PSA for analysts and investors.

Truthfulness of quarterly results in the US

Source: D.A.T.A.

One reason why truthfulness in Q2 and Q3 results is lower is that annual results are scrutinised by investors and regulators more closely, so more work goes into them. Meanwhile, Q1 results often re-iterate what has been said three months earlier. With the results presented in the middle of a year, things start to get dicey. Businesses may realise that they won’t be able to make their full-year targets and may try to shift the goalposts. This creates a mild form of deception where businesses are dangling a new shiny object in front of investors to divert their attention from deteriorating performance in an established business.

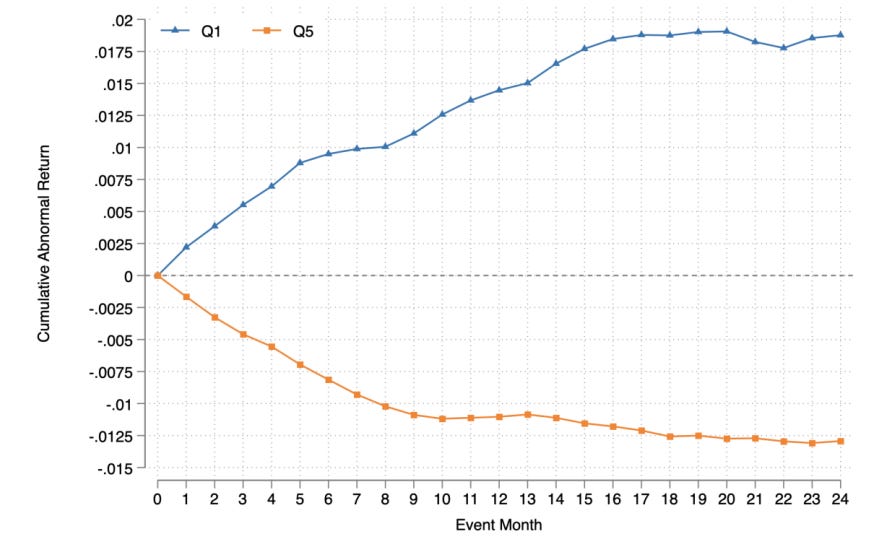

Lauren Cohen and Quoc Nguyen analysed the earnings call transcripts of US companies from 2006 to 2020 and used natural language processing to identify the goals companies talked about and how much they talked about these goals. One of the key insights they gained was that managers emphasise the good news in the results and focus investor attention on the goals related to these successes. But when a specific metric deteriorates, they tend to not just mention it less, they try to establish new targets.

For example, if a company has strong sales performance for many quarters, the management will emphasise its targets for sales growth. But when sales disappoint, management is tempted to shift attention to another target like capex to distract investors from the deteriorating sales growth. This is not to blame company executives. They are just doing their job and I certainly would do the same if I were in their position. None of this is too surprising.

But still, investors seem to fall for it. They move their attention to the new targets and then are (negatively) surprised when the company presents worse results than expected in the subsequent 12 months. This negative surprise for companies that have moved the goalposts translates into an underperformance vs. companies that kept their targets unchanged. The chart below shows how these two groups of companies diverge in their share price performance after targets have been changed.

Performance of companies that changed targets the most (Q5) vs. companies that changed targets the least (Q1)

Source: Cohen and Nguyen (2024)

As the research documents, investors often fall for this kind of target shifting. But they can wise up to it. A simple thing to do is to prepare for an earnings call by checking what targets a company sets and what metrics the executives have focused on in recent earnings calls. Then, listen to the earnings call and see where the company management stays silent. Are there any topics they used to talk about a lot but don’t mention this time? If there are, ask company executives directly about this issue or focus your analysis on it. It could be that management wants to distract you from deteriorating business performance.

I have undoubtedly fallen for these shifting targets tactics numerous times 🙈

So important to look out for!

Thanks for sharing.