It’s a cultural thing, but Germans on average have a higher savings ratio and consume less than other Europeans. Another cultural quirk of Germans is that they are more reluctant than other European to adopt electronic and digital cash. Paper money is still in much wider use in Germany than in other countries and some places in the countryside to this day will not accept card payments.

The higher prevalence of cash vs. electronic payments is to some extent due to the fears of many Germans (especially older ones) about a lack of privacy of electronic cash. After all, Germany is a country that has lived through two autocratic regimes that severely undermined citizen privacy (the Third Reich and socialist East Germany). As a result, Germany has some of the strictest privacy laws in the world and the population overall relies more on anonymous forms of commercial transactions like using cash and hoarding gold.

Card transactions per person and year

Source: Smajlbegovic et al. (2025)

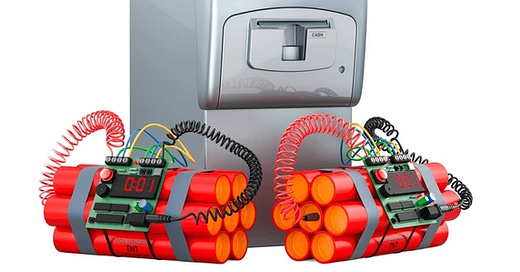

The problem with cash, however, is that it requires an ATM to get the cash from (at least if you need to get cash outside the limited opening hours of bank branches). A team of researchers from the Netherlands and the US now found an ingenious way to boost consumption in Germany and reduce the use of cash: Blow up ATMs.

OK, they didn’t go out and bomb ATMs across the country. They clearly wouldn’t be able to get that experimental design past the university’s ethics board (I know, health and safety gone mad). Instead, they analysed the wave of ATM bombings in the years before Covid across Germany. Organised gangs detonated ATMs across the country for years. Luckily, they did that in the middle of the night, and nobody was harmed in these attacks. The maps below show the ZIP code areas of the attacks and the adjacent control areas that weren’t affected by such attacks.

Geographical distribution of ATM attacks in Germany

Source: Smajlbegovic et al. (2025)

When people can’t get cash that easily anymore because their local ATM has been blown up, they must rely more on electronic payments. But we know that when people use electronic payments, they tend to overspend a little bit because they don’t ‘feel the money leaving their wallets’. That is exactly what happens in areas where ATMs are bombed. On average, consumption increases by about 2.3% for about three months before it settles down to levels only slightly above the destruction of the ATMs. I don’t know whether that is because the ATMs are being repaired and people revert to using cash or whether they are simply getting used to paying with cards.

Consumption around explosive attacks on ATMs

Source: Smajlbegovic et al. (2025)

But if the German government wants to boost consumption for a little while, here is a simply way to do it. Just shut down the ATMs. No need to blow them up – though replacing them with new ones would boost GDP growth even more…

Me: (holding stick of dynamite behind back)

Policeman: You are under arrest for plotting to cause an explosion

Me: No officer, I'm carrying out economic policy by boosting the aggregate demand level

In the US banks do this by sending out pre-authorised credit cards to people, like giving a bowl of cookies to a child. I know people who got themselves in massive credit card debt this way, but boy does it boost consumption! Amazon has done this with the 1-click function - how much useless crap has been bought at 12.30am due to that one little button god only knows...