Central banks killed currency trading

It is almost ironic that factor investing became popular in equity markets just when currency investors learned the hard way that factors can stop working altogether.

The most popular anomalies (aka factors) that are traded in the currency markets are the carry trade (buying currencies with high interest rates and selling currencies with low interest rates), momentum trades, and the valuation trade (based on purchasing power parity). All of these factors have been described in the literature and shown to make substantial profits in backtests. And just like equity market factors, many of them become less effective after they have been published and lose a large chunk if not all of their profitability.

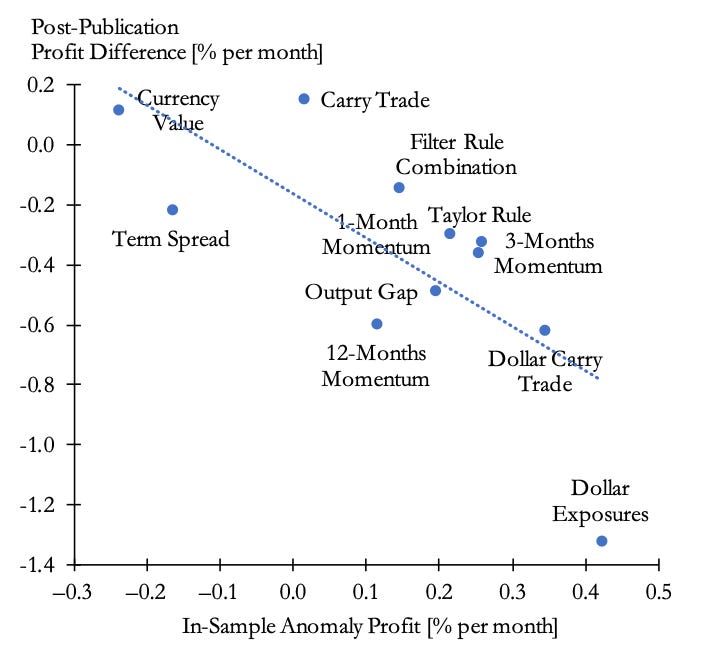

Take a look at the chart below which shows the monthly profit of 11 currency anomalies in sample (i.e. reported in the academic literature) on the horizontal axis and the change in profitability after publication on the vertical axis (positive numbers indicate an increase in profitability after publication, negative numbers a decline in profitability). All numbers are calculated with transaction costs taken into account.

Profitability of currency factors before and after publication

Source: Bartram et al. (2020).

Momentum strategies based on 1-month and 3-month momentum had a monthly profit of 0.2% to 0.3% in the literature, but after publication that dropped by 0.4% to an average monthly loss per month. In other words, these factors not only stopped working but became outright loss-makers. Value strategies were losing money in sample (i.e. you should have bet against them according to the academic research), but once that fact was known, so many people started betting against value that the strategy started to work better after publication. Unfortunately, the net profits per month after publication are still pretty much zero anyway, so you can’t make money with that factor either. The only factor that kept working was the carry trade, but there only if you avoided the US Dollar. So, you had to invest in the carry trade between emerging market currencies for example to make money. As soon as you used the US Dollar as one of the pairs in your carry trade – well you can see what happened to the Dollar carry trade in the chart…

The performance of all the different factors combined over time is something to behold. Net of transaction costs factor investing in currencies did make money – until about 2008. Since then, factors have completely lost their efficacy. Nothing is working in currency markets anymore for more than a decade now.

Net profits of all currency factor trades

Source: Bartram et al. (2020).

And what changed right around 2008? Correct, monetary policy changed and central banks lowered interest rates close to zero almost everywhere in the developed world. The new policy regime after the financial crisis has made it impossible to make money in currencies in any systematic way. Which makes me wonder if this regime change after the financial crisis also contributed to the decline of factor performance in equity markets over the last decade.