One of the best things about working in finance is that the world changes all the time and our understanding of what works and what doesn’t evolves as well. And from time to time somebody throws down the gauntlet on some of the most dearly held tenets of investment wisdom. The monetarists did that to the Keynesians in the 1960s, the behavioural psychologists to the neoclassical economists in the 1980s, and on a smaller scale the advocates of equal-weighted portfolios to the proponents of modern portfolio theory in the 2000s. And now Aizhan Anarkulova and her colleagues are challenging current investment practice in retirement savings portfolios.

The conventional wisdom for retirement savings portfolios is that investors should hold a portfolio diversified across stocks and bonds and possibly other asset classes and reduce the allocation to risky assets like stocks as they grow older. One simple formula is that the allocation to equities should be 120 minus the age of the investor and the allocation to bonds the age of the investor minus 20. Hence, at age 50 you should invest 70% in stocks and 30% in bonds. At age 80, you should invest 40% in stocks and 60% in bonds, etc.

However, in their research, Anarkulova and her colleagues show that simply investing in a portfolio of 50% US stocks and 50% international and holding that ratio constant is superior to any other retirement portfolio in every respect. Whether one looks at wealth generated at retirement, income generated from the portfolio during retirement, or the probability of running out of money during your lifetime, a pure equity portfolio beats them all.

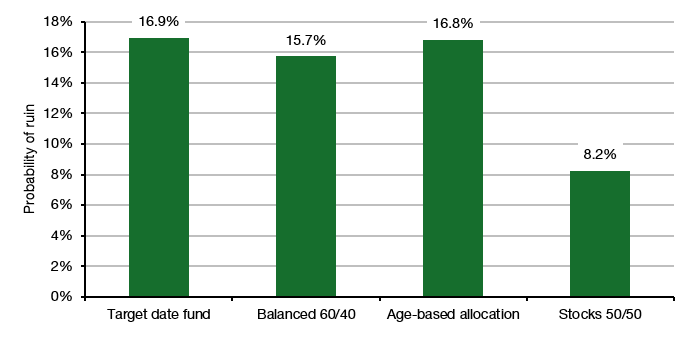

The chart below provides an idea of the probability of running out of money during your lifetime for different retirement savings portfolios. These probabilities are based on sophisticated simulations of income paths during the career of an investor, the possible paths of different asset classes, and the statistical distribution of the moment of death. Hence, none of these results depend on the recent strong performance of US stocks or the weak performance of bonds. They are averages over all kinds of periods, both strong and weak for stocks and bonds alike.

Probability of ruin for different retirement portfolios

Source: Anarkulova et al. (2023)

The gap isn’t small. The probability of running out of money during a lifetime is about half for investors sticking with a portfolio of 50% US stocks and 50% international stocks compared to market-typical target date funds or the classic 60/40 stock/bond portfolio. That is not small. If you look at the size of the US retirement savings market, one can estimate that US investors could earn trillions more in retirement savings if they simply switched to a portfolio of 50% US and 50% international stocks. And I you have time off in the coming weeks, I suggest you ponder this result and think what that means for your retirement savings portfolio.

I penned a similar article a week or so ago, perhaps more aggressive than what you are suggesting but agreeing fully that too conservative of a balance towards bonds really isn't enshrined in history as the ideal investment strategy once you retire. Here's my two cents: https://www.emorningcoffee.com/post/spending-your-retirement-savings

Thanks, Joachim.

I am halfway through Victor Haghani‘s and James White‘s book on the same topic: „The Missing Billionaires“. Those who liked this post of yours will enjoy the book, too.