The tensions between the United States and China are heating up again and lo and behold, some market pundits start to bring out old arguments about the nuclear option available to China to sink the global economy.

The argument goes somewhat like this: China owns $1tn of US government debt. If they want to sink the economy, all they have to do is sell all their Treasury holdings and send US Treasury yields through the roof. The result would be massive losses in the bond holdings of banks and other investors and the likely onset of a global financial crisis.

This argument is so oblivious of crucial details like facts and data that it pains me to see people getting airtime with this kind of scaremongering. So, let’s set the record straight:

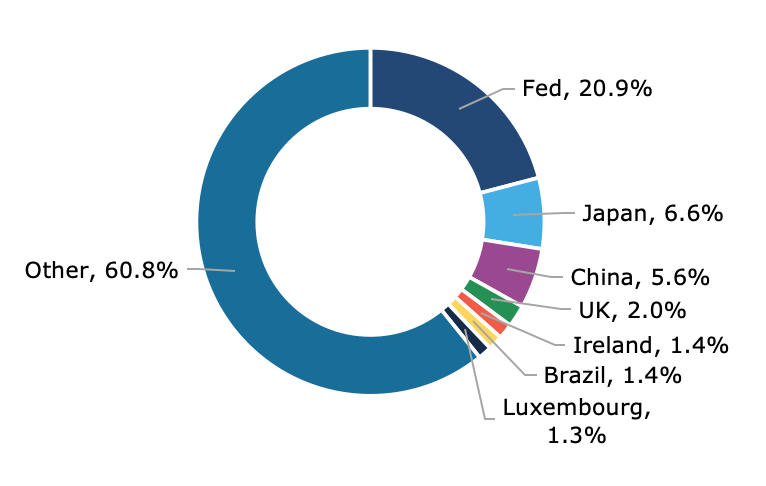

Yes, China holds c. $1tn in US Treasuries. But as of April 2020, the Fed alone owned about four times as much in Treasuries than China did. If China wants to sink the Treasury market, it needs to overcome the buying power of the Fed. Alone, it is by no means large enough to do that. Unfortunately, the other major holders of Treasuries are all countries that have a big incentive to help stabilise the Treasury market should China decide to sell. The chart below shows the biggest individual holders of Treasuries as of April 2020.

Biggest holders of US Treasuries

Source: US Treasury.

Potential adversaries of the United States like Russia no longer hold substantial Treasuries and I find it pretty unlikely that Luxembourg will dump its Treasuries to sink the US economy. In fact, between March and May 2018, Russia sold almost all its $100bn in Treasury holdings. Does anyone remember that? Did anyone even notice?

The second data point one needs to consider is that in March 2020, the Federal Reserve bought about $1tn in Treasuries in the open market. By the same argument as a Chinese dump, this should have driven Treasury yields into extremely negative territory, particularly since markets were in extreme flight to safety mode back then. Yet, Treasury yields remain stubbornly positive.

And finally, if you still aren’t convinced about the inability of China to influence the Treasury yield curve you may want to read a new paper by Erin Wolcott. In it, she calculated the impact of a central bank buying or selling Treasuries on the yield curve across different maturities. The chart below from her paper shows what would happen to different Treasury yields if a foreign central bank would buy 0.3% of all outstanding Treasuries. The lines show the reaction of one-year Treasuries (which would react the strongest) to six-year Treasuries (which would react the least).

Reaction of Treasury yields to foreign bond-buying (in bps)

Source: Wolcott (2020).

Note that this simulation assumes that neither the Fed nor anyone else will stand ready to compensate for the change in demand. Hence, if China would dump 0.3% of all outstanding Treasuries (about 5% of its current holdings) 2-year Treasury yields would increase by about 4bps. If China would dump all of its Treasuries overnight, the expected change in 2-year Treasury yields would be 80bps.

In comparison, in the first two weeks of the Covid-19 crisis between 20 February and 9 March, the 2-year Treasury yield dropped 100bps.

In other words, if China chose to sell all its Treasuries in the open market, we would just go back to the levels we had at the end of February. We would hardly notice.

So, please, stop listening to fearmongers who claim that China is going to destroy the world if it wants to. It could literally be the stupidest argument peddled in markets today.

aaah finally!

Great insights Joachim. Can you please explain why Russia sold so much during the time you mentioned?