Do fund managers believe in ESG?

I never tire in my Monday missives to emphasise that I think ESG investing is a great risk management tool. But when meet people along the “money management value chain”, I get the feeling that there is a wedge in terms of conviction.

If I talk to asset owners, be they individual investors, family offices or pension funds, ESG investing is a major topic and most of the people I talk to think that it is a useful and necessary development that ESG criteria are included in the decision-making process.

When I talk to fund managers, I get the feeling that there is more reluctance to integrate ESG into their decision-making process. Here in Europe, most fund managers are committed to integrating ESG into their investment process and see that it adds to the quality of investment decisions. But there remains a sizeable minority of fund managers that think this is all a fad. When I go to the US, the situation is worse and I think most fund managers don’t really care about ESG investing, though the group of fund managers that are committed to the concept is getting larger over time. Yet, even with the fund managers committed to integrating ESG into their investment process I sometimes get the feeling that they do it mostly because their clients want them to do it and because it is easier to attract new assets if they do it.

And then we enter the realm of the sell side. Here the buy-in to ESG investing reminds me of the most common approach to prove a mathematical theorem I learned at university: “Let epsilon be larger than zero, then as epsilon approaches zero, we see that…”

Of course, most brokers have dedicated ESG research teams but once you talk to strategists and equity analysts or investment bankers about how ESG considerations feed into their work, most of them will give you either a blank stare or tell you that straight up that they don’t care about that stuff at all.

But these are just my opinions based on my personal experiences and they may be way off the mark.

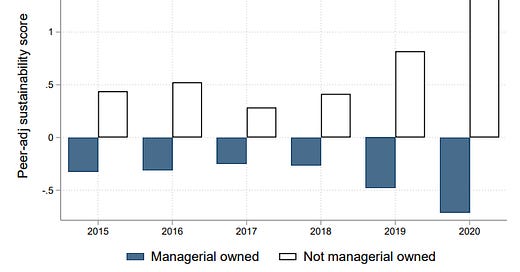

But when it comes to my views about fund managers, a group of Swiss researchers have found that my views may not be too far off the mark. Vitaly Orlov and his colleagues looked at the ESG performance of some 22,000 fund portfolios in the US. The trick they used to identify if fund managers ‘care’ about ESG investing is to check if there are material differences in the ESG performance of funds where the fund manager has his or her own money invested vs. funds where the fund manager is not invested. Similarly, if the fund manager has more money invested in a fund, does the ESG performance of that fund change?

The results are straightforward and unfortunately not good. The more of his or her own money a fund manager has invested in a fund, the lower the ESG performance of the fund. Even more, if a fund manager invests more money in a fund and thus owns a larger share of the fund, the lower ESG performance of the fund gets over time.

This strongly indicates that fund managers in the US on average implement ESG factors in their portfolios because their clients demand it or to attract additional assets. However, I would be reluctant to extrapolate these results to Europe or the UK. As I have said above, I think the buy-in of fund managers in Europe is much larger and European fund managers on average are much more convinced about the benefits of ESG investing than their US peers.

Sustainability score of fund managers

Source: Orlov et al. (2022)