Note: This is a reprint of a post that was originally published on the CFA Institute Enterprising Investor blog.

Over the last decade or so, we have witnessed the proliferation of a new investment style: the copycat investor. The basic idea is always the same. Look at the quarterly reports of prominent investment gurus and their holdings at the end of each quarter. Then simply invest in the same stocks they hold.

There are obvious problems with that copycat investment style since holdings are disclosed only with a substantial time lag, and you don’t know which stocks an investor has bought and then sold again within each quarter. One can only see the holdings per each quarter end. But if the investment guru is a long-term investor and holds mostly stocks and very little in terms of derivatives or private assets, the copycat strategy might just work.

In the United States, where these copycat strategies have been put into action via ETFs we can by now look at a relatively long track record that – crucially – includes the bear market of 2020. To the best of my knowledge there are three such ETFs out there, all of which exclusively invest in US stocks and should thus be compared to the S&P 500: The Global X Guru Index ETF (GURU) has $74m in AUM and tracks the positions of thousands of hedge fund managers, The AlphaClone Alternative Alpha ETF (ALFA) has $32m in AUM and tracks the holdings of c.500 hedge funds, and the Goldman Sachs Hedge Industry VIP ETF (GVIP) has $220m in AUM and tracks the 50 stocks held most frequently by hedge fund managers.

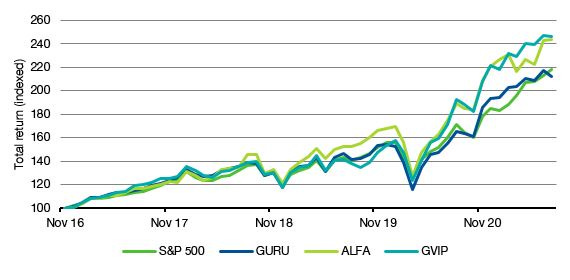

Going back to the launch date of the GVIP ETF in 2016, we can see that two of these ETFs have materially outperformed the S&P 500. While GURU has underperformed the S&P 500 by 0.5% p.a. in terms of total returns, ALFA and GVIP have beaten the S&P 500 by 2.% p.a. and 2.6% p.a., respectively.

Performance of copycat ETF since 2016

Source: Bloomberg

Not bad, but that outperformance comes at the price of higher volatility and higher drawdowns during a crisis. The maximum drawdown of the S&P 500 came in March 2020 during the height of the pandemic panic. Back then, the index fell by 19.6%, while GVIP dropped 21.4% and ALFA 25.1%. As the chart above indicates, that meant that the copycat ETFs either lost all the outperformance they created from 2016 to 2020 in one month (as in the case of ALFA) or underperformed the S&P 500 after previously matching its performance (GURU and GVIP). It was only in the recovery since April last year that the copycat funds started to outperform.

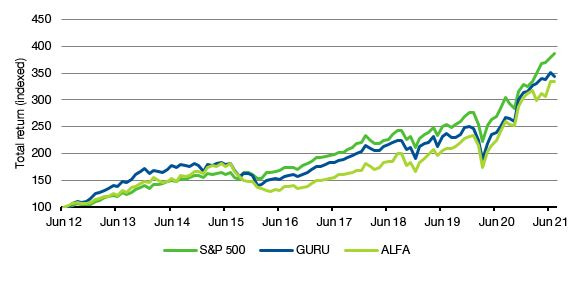

And while the GVIP ETF only exists since 2016, we can use the GURU and ALFA ETFs to go back even longer to mid-2012 when these two funds were launched. With almost 10 years of performance to look at, it seems hard to conclude that these copycat funds add a lot of value. Both GURU and ALFA have underperformed by 1.3%p.a. and 1.6%p.a., respectively and had much higher volatility. Note in the chart that the copycat funds tended to do well in the upswing from 2012 to 2015 and then lost all of that outperformance and more in the 2015-2016 correction. It seems very much like these copycat funds are essentially fair weather investments, that don’t perform over an entire cycle. It seems copying from other investors misses one key ingredient for outperformance that I will talk about tomorrow: creativity.

Performance of copycat ETF since 2012

Source: Bloomberg

Really good read. Looking forward to tomorrow’s reading