Education influences fund management style

I have written in the past how our education influences our approach to problems and thus our success or failure in our careers. What you study at university, for example, shapes how you think of the world and how you approach it.

In asset management that can have interesting consequences since for a long time two schools of thought have been competing with each other for acceptance as the dominant market theory.

On the one hand, there are the proponents of modern portfolio theory and the efficient market hypothesis (EMH). Students who graduated from the University of Chicago, MIT, or the University of Pennsylvania have likely been inundated in their undergraduate courses with these theories since the academics who developed these theories taught at these schools and these schools were “early adopters” of them.

Students who went to NYU, UC Berkeley or Northwestern, on the other hand, were less likely to be taught too much about the EMH since these universities were “late adopters” of this world view and more prone towards research in the behavioural nature of markets.

Three researchers have recently looked at fund managers and compared their investment style as a function of where they went to school. In particular, they classified different US colleges and universities based on when academics at these schools first published research on the EMH. Assuming that academics teach their students the latest research in their fields, one might assume that students in early adopter schools in the 1960s and 1970s might have been exposed to the EMH while students at other schools weren’t, or to a lesser degree.

Some of these students then went on to become fund managers and interestingly, the research shows that students who have been exposed more to the EMH tend to manage their portfolios differently. Even if they manage an active fund portfolio, the fund managers who were more exposed to the EMH tended to be less active in their portfolios and have a tracking error and active share that is about 10% lower than the average fund manager. Furthermore, the fund managers who have been more exposed to the EMH also had c. 25% more stocks in their portfolios (which probably contributed to them having lower active share and tracking error).

Active fund managers who in their student days were more exposed to the EMH tended to be less active and hold a more diversified (read: more index-like) portfolio. On the other hand, they also had on average higher beta stocks in their portfolios. After all, while not part of the EMH, the CAPM teaches us that stocks with higher beta should have higher returns in the long run.

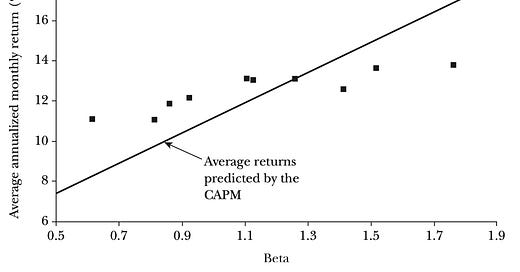

The emphasis is on the word “should”, because in 2004, the “inventor” of the EMH, Eugene Fama together with Ken French showed that stocks with higher beta do not have higher returns. In fact, the relationship between beta and stock returns observed in reality is that there is none.

The relationship between stock beta and stock returns and what the CAPM theory predicts

Source: Fama and French (2004).

The new research thus shows that students who were more exposed to the EMH became fund managers who were less active and more likely to be closet indexers. They did, however, take on more systematic market risk in the form of higher beta. And as a result, underperformed. The new research shows that the fund performance of managers who were more exposed to the EMH in their student days had a significantly lower alpha than managers who were not as much exposed. How much lower? On average 0.6% per year. Given that alpha is such a rare thing to find, that is a massive performance gap.