Enjoy the good economic data

It has been a great few months for the US economy with one positive surprise after another. The Citi Economic Surprise Index (ESI) for the United States is now at the highest level since January 2018. Just two months ago, it was close to zero, indicating no positive surprises at all. In an international context, the economic data out of the United States has certainly been good and only been surpassed by the economic surprises coming out of China (despite the outbreak of the Coronavirus) and Sweden.

Citi Economic Surprise Index

Source: Bloomberg. WD = World, EM = Emerging Markets, US = USA, EU = Eurozone, SE = Sweden, CH = China, JP = Japan, AU = Australia.

But investors should not get carried away by all this good economic data in the United States. There is virtually no link between economic surprises and future economic performance. The chart below shows the relationship between the level of the ESI in the United States and real GDP growth over the subsequent three months. The correlation between the two is a mere 0.18.

Economic Surprise Index and future economic growth

Source: Bloomberg.

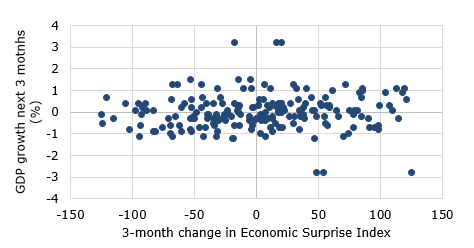

A similar picture emerges when one looks at the correlation between the change in the ESI and future GDP growth. Again, a correlation barely above zero.

Change in Economic Surprise Index and future economic growth

Source: Bloomberg.

Finally, here is a table with the correlation between the ESI and future and past changes in some economic data as well as stock market returns. Again, no correlation whatsoever.

Correlation between ESI, economic data and stock market returns

Source: Bloomberg.

This should come as no surprise since economic surprises not only depend on the actual economic data, but also on the expectations of economists. And on average, their expectations tend to be close to the actual data. Whenever there is a positive surprise, it is immediately incorporated both in stock markets (indicated by the small positive correlation between the ESI and past 3-month stock market returns) and reflected in the revised forecasts of economists, so that future economic data, just doesn’t surprise anymore unless it gets even better than this revised forecast. Hence, while it is great hat the US economy is doing well, we shouldn’t take this as a signal that the economy is going to accelerate in 2020.