Some time ago, I wrote about the research of Jules van Binsbergen who showed that you can replicate the performance of the S&P 500 with a series of Treasury strips that pay the amount of the expected dividend at maturity. In essence, you replace uncertain future dividends with the certain payback of zero-coupon Treasuries and end up with less risk and the same or even higher return. And with lower volatility to boot. This research creates all kinds of problems from a theoretical standpoint because it purports to show that equity markets do not compensate investors for the risk of future dividend cuts or increases. And more importantly, it shows that stock market returns are essentially compensation for changing interest rates and not for any other risks. All that seems to matter for aggregate stock markets is where interest rates and inflation are going.

Back then I said we need to understand this result better, but while I have no answer except that as an investor, I am using expected changes in interest rates and inflation as the main, though not the only driver of my market outlook for the coming years, we now have results from three different international markets that show the same lack of equity market outperformance over a series of government bond designed to replicate expected dividend payouts.

In a follow-up paper van Binsbergen tested his methodology for the FTSE All-Share, the EuroStoxx, and the Nikkei 225 and came to the same conclusion as for the S&P 500. You can replicate the performance of the stock market at lower volatility with a series of government bonds. So, the problem of the lack of compensation for risk in equity markets seems more widespread than just the US market.

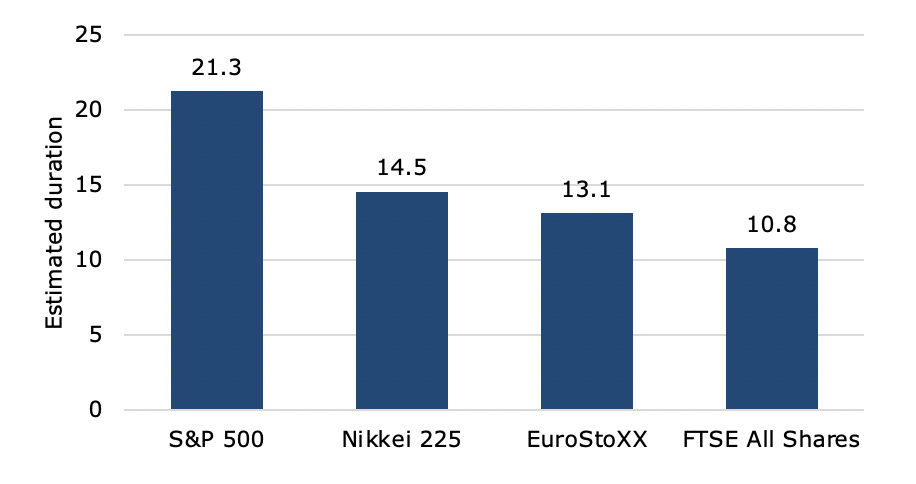

But also, van Binsbergen’s analysis allows us to calculate the sensitivity of different stock markets to local interest rates, i.e. the duration of the local stock market. The chart below shows the different durations of the stock markets. Markets with longer duration like the S&P 500 should do better in a world of declining and low interest rates. Markets with shorter duration like the FTSE and the EuroStoxx should do better in an environment of rising interest rates. This is simply a reflection of the dividend cash flows in different markets and the interest rate sensitivity of the stocks in the different markets.

Estimated duration of different stock markets

Source: van Binsbergen (2021)

As for this year, there seems almost universal agreement amongst investors that this will be a year of rising interest rates. And that means that as an equity investor, you might want to shorten the duration of your equity portfolio to reduce the negative impact of rising rates on the portfolio. The simplest way to do that is to sell US stocks and buy UK stocks.

Van Binsbergen, like Koijen, is unafraid to tackle the core assumptions that many of us have held since our university days. This is another good example - - thanks for bringing it to our attention, Joachim!

Loved the beginning but was a bit surprised by the ending.

Should advice have been:

Construct a bond portfolio to replicate FTSE?