In January, fund manager Terry smith publicly slammed Unilever for focussing too much on its ESG credentials rather than its financial performance. As is often the case, such attacks come after years of underperformance and usually just when the tides are turning. With the bear market in 2022, defensive companies like Unilever came back in fashion and started to outperform the market.

However, Terry Smith may have been on to something when he criticized Unilever’s management for focussing too much on ESG. A group of Korean researchers looked at some 1,018 Korean companies and their valuations. The exciting thing about their research is not so much the basic result that has been found many times over: Companies with better ESG credentials have higher valuations.

What is really interesting in this sample of Korean companies is that the impact of ESG credentials on company valuations changes with profitability. When they split the companies into two groups of companies with above average profitability (they used Return on Assets, ROA) better ESG credentials lead to higher valuations. But when they looked at companies with below-average ROA, better ESG performance had no impact on valuations. That indicated that investors only pay attention to ESG criteria when they are assured that the company is profitable and in good health.

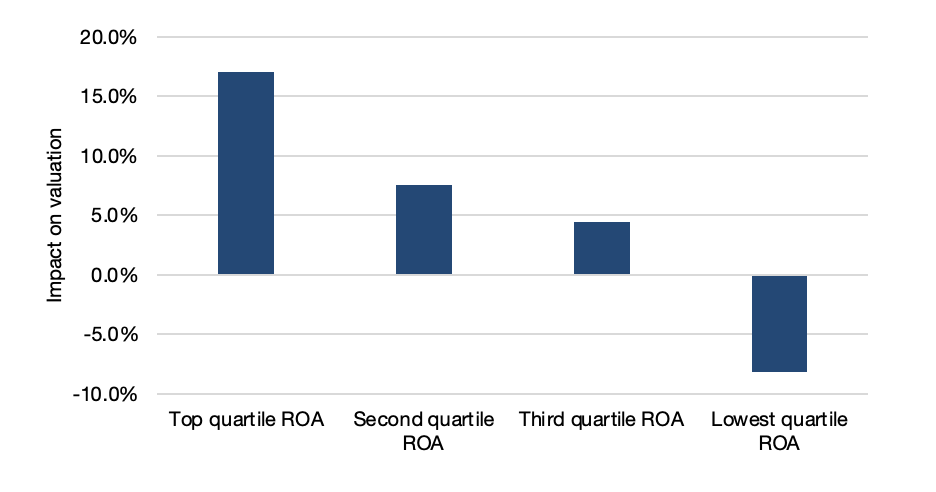

When the researchers split the companies into four groups from lowest profitability to highest profitability, they saw something even more interesting. The higher the profitability of the company, the bigger the impact of good ESG credentials on company valuations. But for the companies with the lowest profitability, better ESG credentials were detrimental to the company’s valuation.

Clearly, investors want companies to be profitable first and then demand good ESG performance. A company that focuses on ESG performance to the detriment of its financial performance will be punished by investors in the form of lower valuations. Good ESG performance is necessary for high ratings, but clearly not sufficient.

Improvement of valuation due to better ESG performance

Source: Cho et al. (2022)

Joachim, do you think this result could be influenced by large institutional investors having both a Quality bias and preference to demonstrate commitment to ESG?