ESG investments and the current crisis

I have come across an article by Bloomberg that touts the outperformance of ESG funds in Europe and the United States as a proof of concept that ESG investments prove more resilient in crises. I think that ESG funds should be more resilient in a crisis, simply because ESG integration in the investment process forces the investor to consider risks that are not necessarily priced in the market.

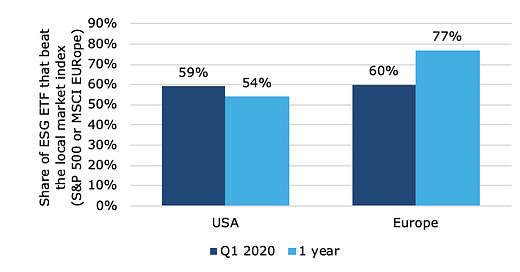

Share of ESG ETF beating the S&P 500 and the MSCI Europe in 2020

Source: Bloomberg.

But I think the Covid-19 pandemic is not a proof of concept at all.

First, I ESG investing is not designed to capture the impact of a global pandemic except in some niche sectors. In general, ESG criteria focus on environmental risks that are more linked to climate change, waste, and pollution, not to pandemics. The exception to the rule are ESG criteria for food companies ad retailers that may cover such topics as food hygiene and animal welfare. For these businesses, a food-borne illness like bovine TB or antibiotics resistant superbugs can have dramatic business consequences. Initiatives like the FAIRR initiative even provide dedicated information on these kinds of risks for all investors. But don’t expect for a moment that you could have prepared for the impact of a global pandemic with ESG risk analysis.

Instead, I think the outperformance of ESG funds in this crisis was mostly due to luck. Luck generated by the sector composition of ESG funds. By the very nature of their construction (even if they use a best in class approach), most ESG ETFs have a lower weight in energy companies than the regional market index. On the other hand, they tend to have a higher weight in consumer staples and IT stocks. I have compared the iShares MSCI Europe SRI UCITS ETF with the iShares Core MSCI Europe CITS ETF. Both are funds by BlackRock, both are rules-based, and both are highly liquid and have very low fees. In short, they are pretty similar in everything except the way they select stocks. The chart below shows their sector weights in comparison. The difference in IT and energy stand out and played clearly in favour of the ESG ETF this time. However, every crisis is different, and the next crisis may be more focused on IT.

MSCI Europe ESG ETF sector weights vs. MSCI Europe

Source: Blackrock iShares.

Hence, promoting ESG funds as superior to traditional funds based on the performance this year is to me playing with fire. It is likely to backfire and damage the reputation of an otherwise good product.