ESGT?

It’s not often that I go to the website of the World Economic Forum because, well, for me it’s a waste of time. The content of the WEF is usually some faddish trend in global management that is intellectually half-baked at best (can you tell why I am not the CEO of a major company?).

But through an ESG blog, I was made aware of a proposal that could make sense. In a blog post, Andrea Bonime-Blanc suggested that the concept of intangible risks covered by ESG may be incomplete. ESG is gaining traction in the investment world as the links between financial performance and environmental, social and governance risks become clearer.

But what about technology risks?

We live in a world of rapid technological advances where data is becoming – or already has become – the most valuable commodity on the planet. But with the rise of data, issues like data security and privacy are obvious drivers of corporate and investment risks. Yet, most companies underinvest in cybersecurity, and with their focus turned towards improving their ESG credentials there is a risk that technological risks are mounting in the background.

There are amusing incidences of technological solutions gone bad as was the case in 2016 when Nest shut down the Revolv smart switches and app, leaving some of its users literally in the dark as they suddenly were unable to turn on the lights in their homes. But in the world of artificial intelligence and the Internet of Things, the risks that technology not only leads to loss of sensitive data but to product malfunctions that endangers the health of users is mounting. And the experience with product recalls in the food and pharmaceutical industries tells us that these are indeed material risks for a company and its investors.

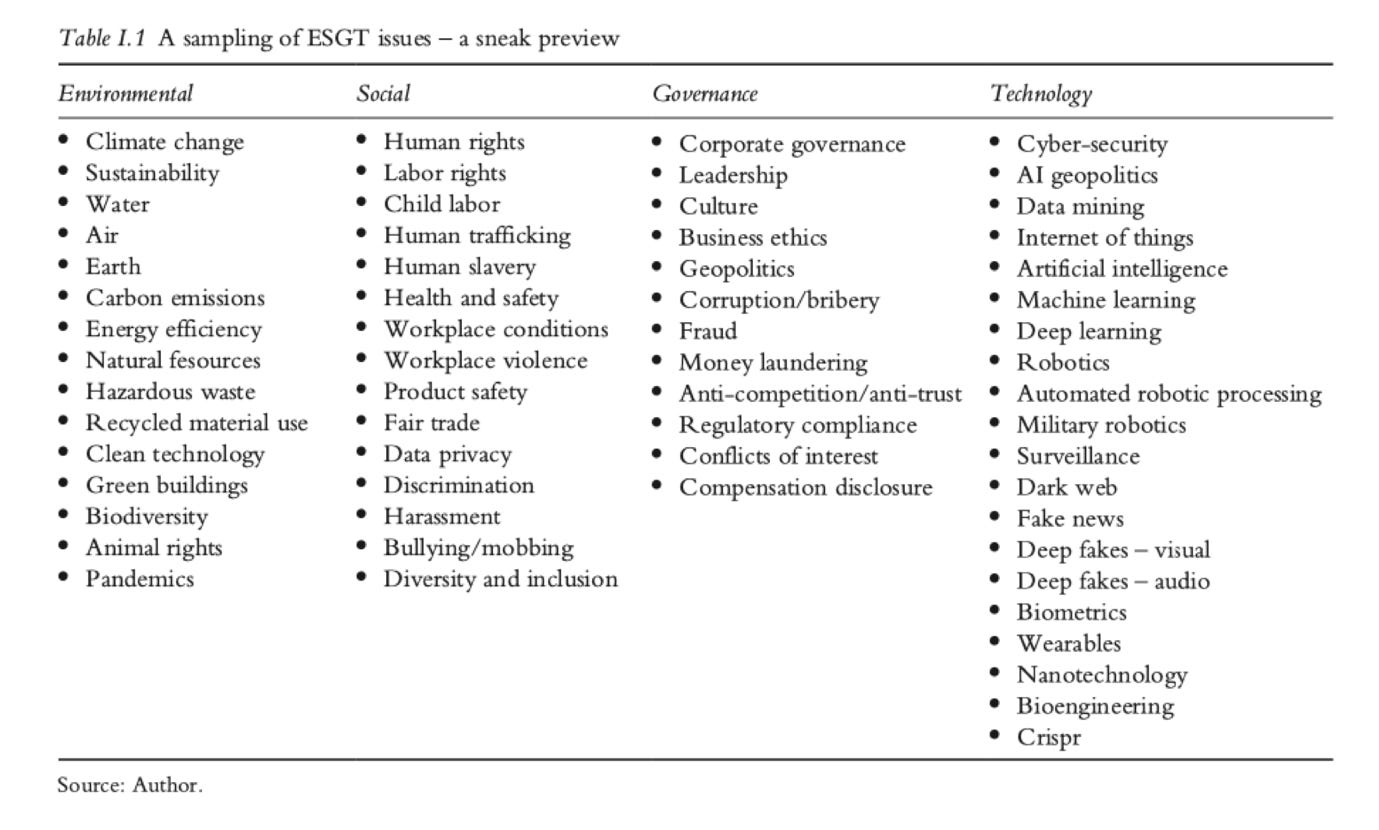

So, even though Andrea Bonime-Blanc calls herself “a global ESG and cyber strategist” (a title that makes me highly suspicious) she might be onto something. Technology risks come in many different forms as the table below shows, none of which can be fit neatly into either E, S, and G. But corporate leaders, just like investors shouldn’t just do what other people do. That is just lazy and leads to people taking ESG ratings at face value, for example. Instead, investors and corporations need to do something different in order to get an edge over their competitors. And a focus on technology risks and their interaction with other ESG risks and financial risks may just be such an avenue.