Extreme consensus about climate risks to investments

When I talk about climate change and its impact on investments, I tend to observe more scepticism in the United States, Australia, and the Middle East than in Europe. There is obviously a pattern here in the acceptance of climate change and its impact on the planet and financial markets across different regions because, well, the United States, Australia, and the Middle East are three regions with an economy that depends heavily on the production and export of fossil fuels.

Yet, if you go and ask the leading finance professionals in academia, public and international organisations, and private organisations like think tanks the picture changes significantly. There is enormous consensus amongst the people who are at the cutting edge of research in climate finance. Johannes Ströbel and Jeffrey Wurgler from NYU asked 861 top finance professionals about their attitudes on climate change and how it impacts financial markets. Most notably, while 55% of respondents of this survey were academics, 36% were lead economists at private institutions, and 9% at public institutions like the World Bank or the IMF. And only about half of the respondents worked in climate finance, while the other half were outside observers of the field and had no personal research interest in the relationship between climate change and financial markets.

So, what do these experts on financial markets think about climate change? The responses are remarkably similar across regions and professions. Asked about the most important climate-related risk in the next 5 years, all of them came up with regulatory risks as the most important ones. No matter if you asked academics or private-sector economists, people in North America, Europe, or Asia, people who worked in climate finance or not, they all said regulatory changes like the introduction of a carbon tax are key risks for the next 5 years. Looking further ahead, there is also a consensus that over the next 30 years, physical climate change poses the biggest risk for markets and investments.

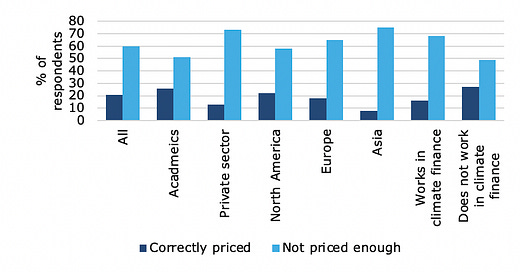

Furthermore, there is a clear consensus that these risks are currently not priced correctly in financial markets. While almost no one believes that climate risks are overpriced in stock markets at the moment (the share of respondents who believe this is generally less than 3% in each group), about three times as many experts think that climate risks are not priced enough rather than priced correctly. Also, by a margin of two to one, experts generally think that climate risks can be captured by investors in both good and bad economic times compared to good economic times only. In other words, there is a strong consensus that climate risks are underpriced at the moment, which means that active managers who can identify these risks and their impact on stocks can create additional performance, both in good and bad economic times.

Are climate risks priced correctly in stock markets?

Source: Ströbel and Wurgler (2021)