In equity markets, companies get rewarded for growing their revenues and earnings faster than their competitors. But fast growth is easy to achieve for a year or two if the conditions are right. The true long-term compounders manage to grow at exceptionally fast rates for years if not decades. These ‘fast compounders’ are exceedingly rare.

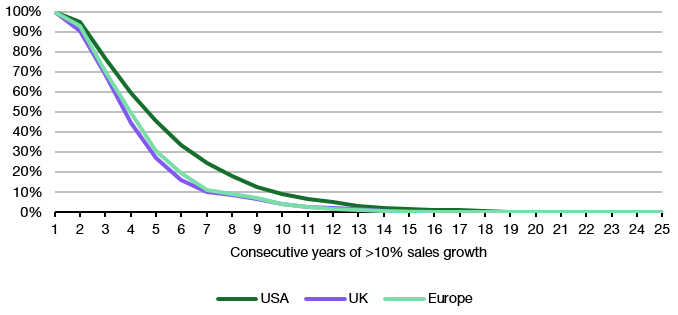

To see what I mean look at the chart below. I have gone back to 1990 and checked how many companies in the US (S&P 1500 of the 1,500 largest companies in the US), the UK (FTSE All-Share) and Europe (Stoxx Europe 600) managed to grow their revenues by at least 10% in consecutive years.

Number of companies with consecutive >10% sales growth

Source: Panmure Liberum, Bloomberg

Practically all companies managed to grow their sales by more than 10% at least once in this 34-year period. Repeating this feat two years in a row is still extremely common. 1,420 of the 1,500 stocks in the S&P 1500 in the US managed to do that at least once. Similarly, 555 stocks in the Stoxx Europe 600 and 498 of the 561 companies in the FTSE All-Share did so as well.

But what about growing revenues by more than 10% for ten years in a row? Mind you this is an extraordinary feat because growing more than 10% for ten years in a row means that revenues have grown by at least 150% in a decade.

These fast compounders are quite rare. Among the 1,500 largest companies in the US, I found 137 (9.1% of the total) that managed that feat. In the UK, only 22 stocks (4.0%) and in Europe 24 stocks (4.0%) managed to do that.

The chart above also shows the two companies in each region with the longest streak of fast compounding. That’s Amazon in the US (24 years before the streak broke in 2022) and Netflix (23 years before it broke in 2022). In the UK, it is professional services and outsourcing company Capita (20 years from 1990 to 2009) and online retailer ASOS (17 years from 2005 to 2022). In Europe, it was another tech company that takes the top spot with Swedish accounting software company Fortnox (16 years since its IPO in 2007 and still unbroken). But I was surprised to see a good old-fashioned industrial company take silver in flow control company Aalberts.

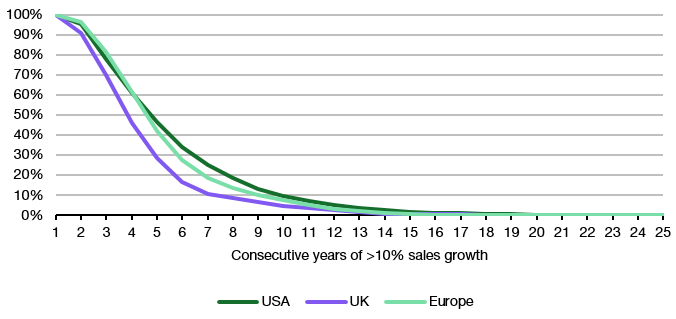

The pure number of companies that manage to grow revenues at extraordinary pace for a sustained period is a bit misleading though, since I compare indices with different numbers of constituents. So, let’s look at the same chart expressed in terms of share of companies from the original cohort. As you can see there is a big ga between the US and Europe/UK insofar as US businesses are able to sustain very high revenue growth for much longer. After ten years about twice as many companies in the US have become fast compounders than in Europe or the UK.

Share of companies with consecutive >10% sales growth

Source: Panmure Liberum, Bloomberg

In defence of European and UK businesses my initial reaction was that this is still a somewhat unfair comparison. After all, if a country has faster nominal GDP growth, it should also have more companies with higher nominal sales growth. And Europe has lower nominal GDP growth than the US.

So, let’s look at sales growth in excess of nominal GDP growth. I have calculated the share of companies in each index that manage to grow revenues by more than 5% above nominal GDP growth for consecutive years. As the chart below shows, that lifts the European market a little bit, but nowhere near the US benchmark.

Share of companies with consecutive >5% excess sales growth above GDP

Source: Panmure Liberum, Bloomberg

In short, European markets have a growth problem, at least compared to the US. And as long as that growth problem persists, I think a valuation discount of European stocks to the US is warranted. But is the current valuation discount of more than 30% for the UK and more than 20% for the European market vs. the S&P 500 warranted? That is an entirely different question.

PS: I discussed this with a colleague, and he asked me which companies are the ones with the longest streak of 10% revenue growth or more that is going today. So here are the top three spots with the longest unbroken streak of more than 10% revenue growth.

Looking at some of the companies on the list -- gaming software or delivery services -- one suspects they had a lucky streak, and further growth isn't too likely. As an investor, I'd preferably look for dividend aristocrats, i.e. companies that have continuously raised divvies for decades. (Until of course JK, in his considerable capacity to debunk myths, tells us the aristocrat phenomenon is just some hooey).

Very interesting. Do these growth rates reflect organic growth ? Otherwise the analysis might get distorted because of M&A (if material impact).