It’s the second Fed Day of the year. While I am normally critical of the Fed and its actions, I think it is appropriate in this good news week to pause for a minute and reflect on how good a job the Fed has done over the latest inflation cycle. So far (sorry, I couldn’t resist).

In December, I wrote that the Fed is probably responsible for only half the decline in inflation since the 2023 peak. But that means the Fed successfully managed to reduce inflation without causing a recession. And that is the first time they have ever done so successfully.

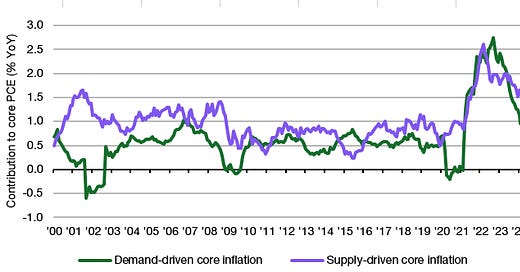

To give you an update, here is a chart of demand-driven and supply-driven inflation in the core PCE. Remember that he Fed can only manage demand driven inflation by changing interest rates. It is powerless in the face of supply-driven inflation like the gas shock from the Russian invasion of Ukraine and the supply chain disruptions in 2022. All the Fed can do in the face of a supply-driven inflation shock is let the fire burn itself out and prevent any spill over into demand-driven inflation.

Similarly, if Trump imposses tariffs on US imports, this acts like a supply shock and increases inflation. But if the Fed increases interest rates to fight this supply-driven inflation, it cools domestic demand, thus creating a recession.

Contribution to core PCE from supply and demand shocks

Source: San Francisco Fed

The chart shows how the Fed successfully managed to tame demand-driven core inflation while preventing a recession. As far as I know that is the first time in its history the Fed has successfully done that.

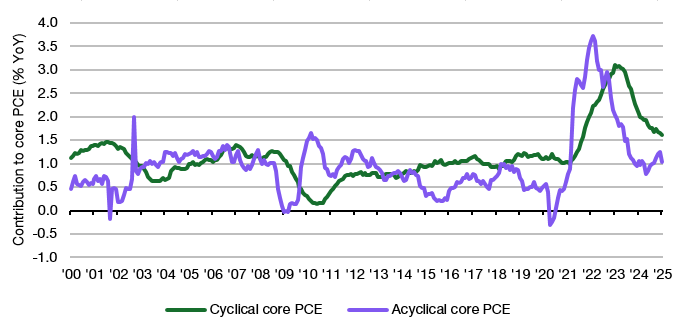

Of course, this is not the end of the story. You can also split core inflation into cyclical components like clothing and shoes, purchased meals and beverages, travel, etc. and acyclical components that don’t react as strongly to the business cycle.

If you do that you can see that the cyclical component of core inflation in the US is not back to typical levels, yet, but well on its way to get there in 2025. The problem is the acyclical component which has started to increase again (and tariffs would increased the acyclical component even further). If the Fed isn’t vigilant, this increase in acyclical inflation might lead to a resurgence in inflation in 2025. For now, things remain under control, though.

Contribution to core PCE from cyclical and acyclical components

Source: San Francisco Fed

Good read . Thanks for sharing