Greed is good?

On Tuesday, I wrote about an experiment done by French and Russian researchers that showed that if short-termism becomes more common, then – at least in an artificial market – trends continue to last longer and momentum investing more profitable. One of the key concerns of momentum investing and trend following strategies is that they may lead to bubbles and crashes as longer trends create stocks that are severely mispriced relative to fundamentals. It turns out that the antidote to this risk may be greed.

In another setup of their market, the researchers programmed some of the bots trading stocks to have another psychological bias. Instead of making them more short-term oriented, they made them greedier, investing more money into stocks that are forecast to have higher returns. Note that this forecast doesn’t necessarily have to be based on past price momentum. It could be based on fundamental valuation, volatility or other factors. The only thing greedy investors have in common is that no matter the investment approach they use, they invest heavily in those stocks that are forecast to be more profitable and ignore the ones that are forecast to be less profitable. The result of a market with more and more greedy investors was a decline in crashes and stock market bubbles, not an increase as one may have expected.

Number of market crashes (drop > 20%) if greedy traders increase from 0% (P=0) to 100% (P=100)

Source: Lussange et al. (2019)

This kind of behaviour can be observed in markets with human investors as well. In an experiment, people were invited to participate in an artificial stock market and trade with other people. Unbeknownst to them, the participants were sorted into low greed and high greed groups and ten experiments were run in each group.

One fun side remark here is that it apparently is easy to find out who are the greedy people and who are not: Just ask them if they think they are greedy. If you calculate correlations between greedy behaviour in investments and everyday life with different questions, the questions “I always want more” and “Actually, I am kind of greedy” have the highest correlation with real-life behaviour.

In any case, the experimental markets with human investors showed that prices deviated more from the fundamental value in markets with less greedy investors than in markets with greedy investors. The maximum size of the price bubbles observed in these markets was also higher for markets full of less greedy investors than in markets with greedy investors.

Price bubbles and deviation from fundamentals with greedy and less greedy investors

Source: Hoyer et al. (2021)

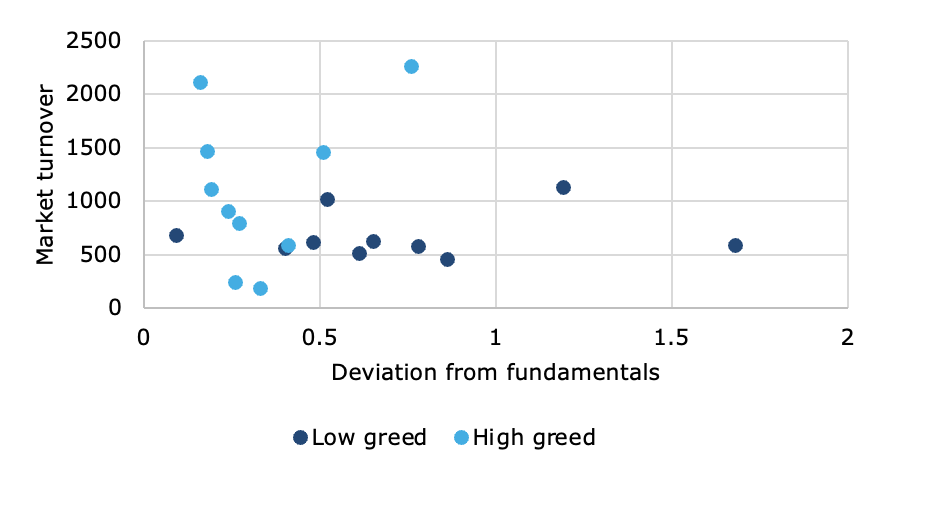

One key to understanding the higher efficiency in markets with greedier investors is to look at market turnover. There, we see that markets with higher turnover tend to have more efficient prices and smaller deviations from fundamentals.

Market turnover and deviation from fundamentals with greedy and less greedy investors

Source: Hoyer et al. (2021)

What is happening here is that if investors are really greedy, they don’t stick with investments for too long; If they see a better opportunity elsewhere, they sell what they own and buy something else. Because we have a mix of fundamental investors and trend followers in the market, this means that if a stock becomes too detached from fundamentals, the trend followers will continue to buy that stock, but the fundamental investors will aggressively bet against it. That will slowly reduce the returns of that stocks and eventually reverse the previous trend. At this point, fundamental investors still bet aggressively against the stock because it is still overvalued, but momentum investors are switching sides and now bet against that stock, too. The result is that the stock quickly moves back towards fundamental value thanks to the greed of investors who want to make as much money as they can.

Thus, there are circumstances when greed can be a force for good in investing. But remember that this experiment assumes that people with many different opinions are around who follow different strategies. And it assumes that there are different assets available. If you go into a market where there is only one asset or one type of asset and there are no substitutes (e.g. CDOs in the run-up to the financial crisis 2008) then you can be as greedy as you want to, you can only invest in one thing and that means you are forced to push the price of overvalued assets even higher. Similarly, if there is no difference in opinion (e.g. if all investors in a market are momentum investors because there is no fundamental value) then there will be no investors betting against trend followers and momentum investors and prices can deviate massively from whatever the fundamental value is and bubbles and crashes become more likely.

Greed can be good, but it depends on the circumstances.