The election of Donald Trump to the White House has ended the US government’s efforts to mitigate climate change. But how have US investors reacted in their portfolios? How did the political changes influence their investment decisions?

Marco Ceccarelli and his collaborators asked 1,200 Americans to participate in an incentivised survey both before the last election and after Trump was elected. This enabled them to check if the election outcome changed their attitudes towards green investments and their willingness to invest in ESG funds.

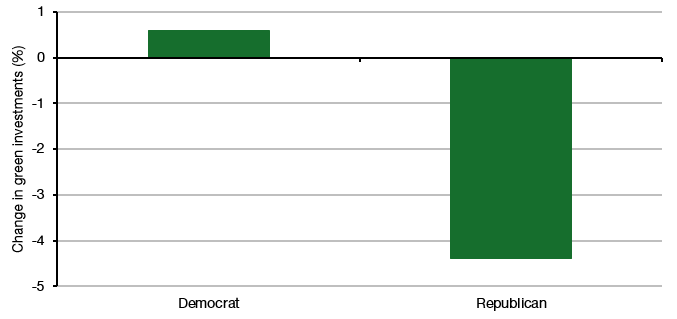

The first result I want to show from these surveys is the change in green investments by political party affiliation. The results shown below are adjusted for individual differences in expected risk and return of green funds or pre-existing investments in green funds. The result isn’t too surprising. Republicans significantly reduced their investments in green funds after the election, while volunteers who identified as Democrats, on average, slightly increased their investments.

Change in green investment after Trump’s re-election by party affiliation

Source: Ceccarelli et al. (2025)

The chart shows that the net effect on green funds was negative. On average, investments in green funds dropped by 2.9% after the election, but the median change was zero. The same number of people increased their investments in green funds as reduced them, but the people who reduced them did so to a greater extent. This can also be seen in ETF flows, where green ETFs suffered net outflows in the four months after the election.

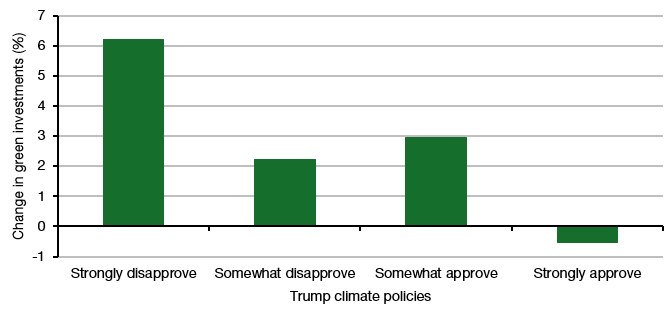

However, there is another way to slice the cake, carve the turkey, or crumble the cookie. Let's look at changes in green investment based on the participants’ attitude towards climate policy. We can see that the people who most fervently disagree with Trump’s ‘Drill baby, drill’ policy massively increased their green investments. Only people who are fully aligned with Trump’s climate policies are reducing their green investments.

Change in green investment after Trump’s re-election by climate policy stance

Source: Ceccarelli et al. (2025)

When asked why these people who disapprove of Trump’s climate policy increased their green investments after the election, the researchers found that it was not because they expected green investments to perform better. Rather, it was because they wanted to send a signal to themselves and their friends and acquaintances that they remain even more committed to green investment than before.

I support ESG investing as much as the next guy, but investing and politics don’t mix. Investing in green funds as a form of virtue signalling or to spite Trump is about the worst reason to invest, I can imagine.

I strongly disagree with wearing orange socks. Seeing such things offends every molecule of me, and I want to rip them off people's feet and destroy such garments by fire in front of the wearers' very eyes in order to teach them a lesson.

However I'm happy to hold shares of retailers who sell orange socks, textile companies who make them and petrochemical companies which produce the dye.

That's because I'm a sensible and level-headed fellow.

We should never invest in anything for emotional reasons and that’s coming from a climate investor.

The biggest curse word in climate investing is “need”. We need to do this for the planet. We need to do this because Trump won’t.

We don’t need to do anything that isn’t right for our shareholders.