To all my friends who work at hedge funds: No, I am not talking about individual hedge funds or your specific fund. I am talking about the average hedge fund performance as it is so often reflected in the portfolios of wealth managers and private banks. This kind of diversified approach to hedge fund investing really isn’t worth the money…

We’ve reset our strategy to grow shareholder value

We are targeting to grow free cash flow* at more than 20% (CAGR 2024-2027) and deliver ROACE of more than 16% in 2027.

*Adjusted operating cash flow

I have recently been asked to present my views about hedge funds to a panel of fund selectors. This made me revisit a couple of analyses I did in the past and update them to a post-pandemic world. One motivation for that was to check whether hedge fund performance has improved now that we are no longer in a zero-interest-rate world that, according to some hedge fund managers, has reduced the opportunity set and performance during the 2010s.

This week, I want to focus on my favourite comparison. Hedge funds cannot keep up with stock markets because they maximise risk-adjusted returns, not raw returns. This is why I compare hedge funds to the good old 60/40 portfolio, which is invested in 60% global stocks (I use the MSCI World) and 40% US bonds (I use a US aggregate bond index comprising Treasuries and corporate bonds).

Unfortunately, due to past career changes, I can no longer access standard benchmarks like the HFR hedge fund indices. Thus, I must use the Bloomberg Hedge Fund Index, which I hope resembles the more commonly used hedge fund indices. The Bloomberg index covers more than 3,000 individual funds and their performance net of fees.

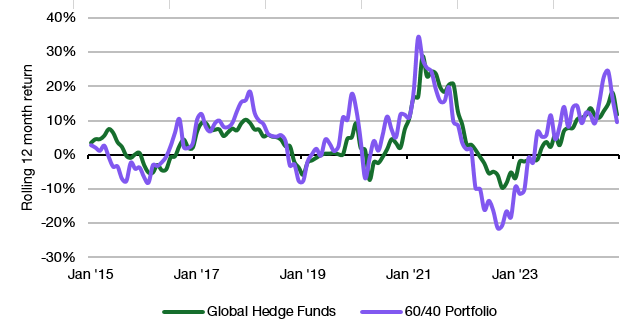

Disclaimers dealt with, here is the rolling 12-month return of this simple 60/40 portfolio vs. the Bloomberg Hedge Fund Index.

Rolling 12-month return of hedge funds and 60/40 portfolio

Source: Panmure Liberum, Bloomberg

Until the pandemic, the return of the 60/40 portfolio and hedge funds was very similar, with the 60/40 portfolio slightly outperforming hedge funds most of the time. Then, in 2022, when bond yields rose significantly and bonds experienced their worst drawdown in more than 40 years, the 60/40 portfolio significantly underperformed hedge funds. That’s when hedge funds did a good job of providing downside protection. Unfortunately, once that once-in-a-generation shock passed, hedge funds resumed their underperformance.

As of early 2025, it looks like hedge funds have not added value compared to a simple, low-cost 60/40 portfolio. Indeed, hedge funds look pretty average if we look at their cumulative performance over the last ten years. $100 invested in hedge funds at the start of 2014 would have grown to $161 at the beginning of 2025.

The same $100 invested in a 60/40 portfolio would have turned into $166 before costs. If I assume some 0.3% of annual expenses, then the 60/40 portfolio net of fees has the same return as the hedge funds. If fees are higher than that, the 60/40 portfolio will slightly lag the hedge funds.

A 60/40 portfolio returns similar to hedge funds

Source: Panmure Liberum, Bloomberg

By the way, you can also compare the performance of the 60/40 portfolio with different hedge fund strategies. I won’t go into the details here, but most strategies' results aren’t flattering. Macro hedge funds, on average, underperformed the 60/40 portfolio by 2.3% per year, while event-driven hedge funds were about the same as the 60/40 portfolio. Equity hedge strategies slightly outperformed (by 0.3% per year), reflecting the stock market's strong performance in recent years.

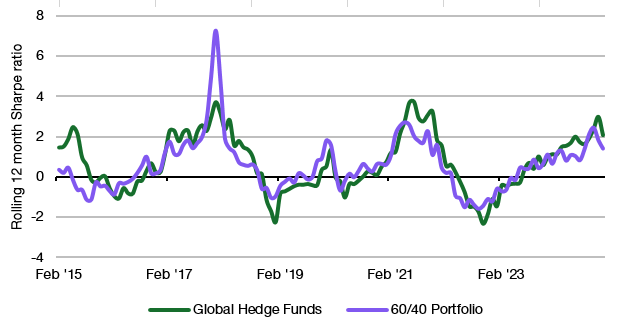

What I want to close on is a thought about risk-adjusted returns. Today's final chart shows the rolling 12-month Sharpe Ratio of the 60/40 portfolio vs. hedge funds. As you can see, it’s not only that the 60/40 portfolio tends to outperform slightly, but it does so on a risk-adjusted basis.

Rolling 12-month Sharpe Ratios

Source: Panmure Liberum, Bloomberg

Advocates of hedge funds may argue that I forgot about diversification benefits. After all, hedge funds have a low correlation to stocks and bonds, while the 60/40 portfolio is by definition highly correlated to these traditional asset classes. So, hedge funds should provide downside protection when stocks and bonds drop. This has proven to be the case in 2022, but a glance at the performance chart above tells you that most of the time there is no such thing as a diversification benefit for investment horizons of 12 months or longer.

In any case, next week, I will discuss a way to replicate hedge fund performance with a correlation to hedge funds of more than 0.8 and an annual outperformance before fees of more than 3%. You might want to read that.

Not a hedge fan here, but the issue I see with these "global hedge funds" comparisons, is that nobody really wants THAT performance, just like nobody wants the aggregate performance of all active long-only managers. What you want is either a HF pod or that one hf you believe is a star (you may not get star performance, but you can try)

Today it is feasible for American investors to hold the 60/40 stock/bond portfolio that Joachim describes for a total of 3 (yes, three, not 30) basis points. Add perhaps another 5 basis points p.a. for trading costs on rebalancing (and that is probably an overestimate) for a total of less than 10 basis points. Additionally, the "live" index funds might lag their indexes by a bit, but typically by a few bps per annum, not 20 bps. So, no need for the conservative 30 bp assumption about expenses on the 60/40 account.