Hedging hedge funds have higher (h)returns

Sorry, I couldn’t quite make that alliteration work all the way through my headline. Hedge funds are famously misnamed investment vehicles because they don’t hedge other assets like stocks in an investor portfolio. However, hedge fund managers tend to hedge some of their risks internally and this is a major source of alpha.

Yong Chen and Hanjiang Zhang measured what they call the ‘risk gap’ of 1,078 hedge funds between 1994 and 2018. The risk gap essentially measures the realised volatility of the hedge fund portfolio and compares it to the expected volatility based on the disclosed equity holdings of the fund. On average, some 78% of hedge funds have a negative risk gap, meaning their actual portfolio risk is less than what can be expected from their equity holdings.

Hedging comes at a cost so the worry is that is not done properly, these hedging activities by hedge fund managers could reduce returns. However, it turns out that managers are pretty good at hedging equity risks internally and the risk gap is a major source of performance.

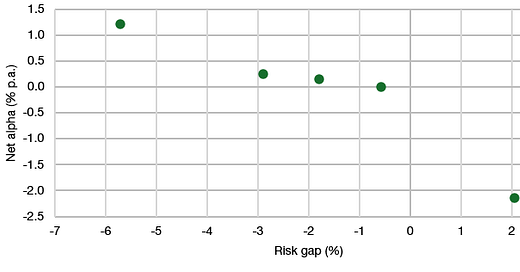

The chart below shows the average risk gap of the hedge funds analysed (split into five equal groups by size of risk gap) and the alpha generated relative to hedge funds with no risk gap. The more hedge funds reduce equity risk internally, the higher their alpha becomes. Meanwhile, hedge funds that use derivatives and other investments to increase risks fare very poorly and lose performance on these trades. Better to invest in hedge funds with a large negative risk gap. They tend to perform better on a risk-adjusted and absolute basis.

Risk gap and net alpha generated by hedge funds

Source: Chen and Zhang (2024)