Higher bank capital requirements work

Since the financial crisis of 2008, banks in most countries have had to hold higher minimum capital buffers to prevent them from taking excessive risks and causing another financial meltdown.

Most countries by now have implemented the capital buffer regulations in Basel III, though the US was always a laggard and the Trump administration has been a staunch opponent of forcing banks to hold more capital. They and other opponents of higher capital requirements argue that this makes banks more risk averse and less able to fund projects that create jobs and economic growth.

A team from the Federal Reserve Banks of Richmond and New York and the IMF looked at how changing bank capital requirements influenced GDP growth. They didn’t need to look at the share prices of banks and the outcomes for investors because it is crystal clear that banks that have to hold more capital are less profitable and thus make less money for their shareholders. Investors are disadvantaged by regulation that requires banks to hold more capital.

But these regulations were designed to keep us all safe and prevent major economic disasters. And it seems that from that perspective, the regulation has worked.

The chart below shows the average real GDP growth in the US in the one to five years after bank capital requirements were increased. The median outcome is indicated with a big dot whole the 95% range of outcomes is indicated with the whiskers.

The key thing to realise is that the median outcome for GDP growth is unchanged when capital requirements are increased. But the range of possible outcomes declines significantly with negative growth (i.e. recessions) becoming much less likely over time as do high growth outcomes). Rising capital requirements temper excessive risk taking by banks but do not reduce GDP growth.

Range of GDP growth after capital increases for banks

Source: Boyarchenko et al. (2024)

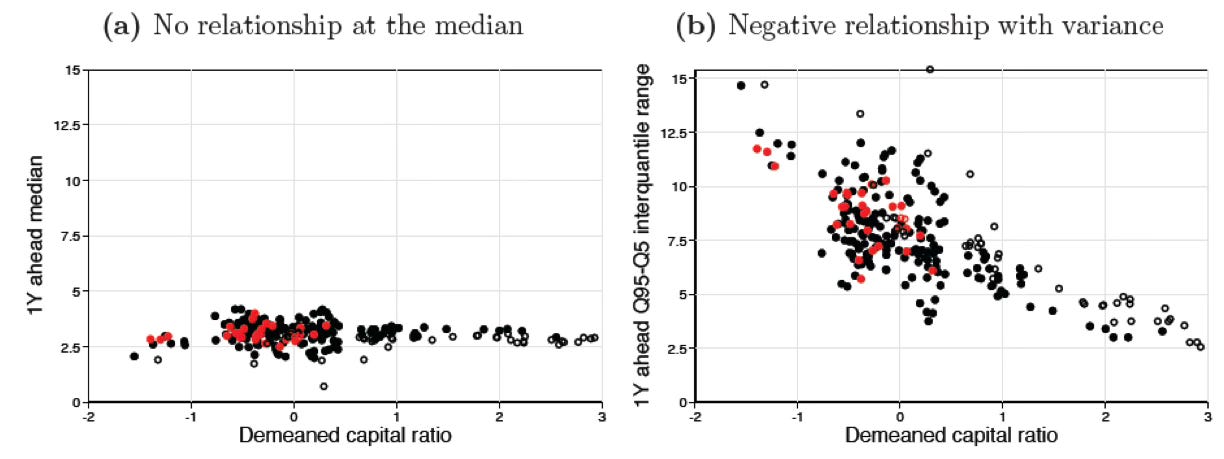

This can also be seen when we look at the individual events when capital requirements were changed. The charts below show that median GDP growth (left chart) remains unchanged no matter how high or low capital requirements were set. However, the range of outcomes (right chart) declines significantly when capital ratios are increased.

For once, I think we need to give credit where it is due. While most regulation tends to fail, forcing banks to hold more capital and lend less aggressively is a regulation that does its job rather well.

Range of GDP growth for different levels of bank capital requirements

Source: Boyarchenko et al. (2024)