The US equity market is expensive, there is hardly any disagreement about it. But how expensive is it, really? Advocates for US equities tend to argue that given the current low interest rates, valuations aren’t that expensive. Indeed, Sophia Hua from Wharton recently showed that valuation metrics that are adjusted for the long-term decline in interest rates are more accurate predictors of future equity returns. This is also why Robert Shiller has adjusted his cyclically adjusted PE-ratio (CAPE) for low interest rates to come up with the Excess CAPE yield. This Excess CAPE shows a US equity market roughly at fair values or slightly expensive.

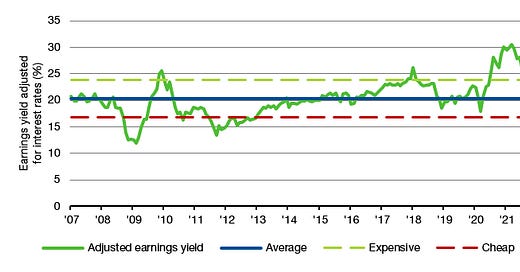

I have done my own, simplified version of these metrics and simply adjusted the PE-ratio of the S&P 500 with the trend in 10-year real yield to get the chart below. Compared to the average of the last 15 years the PE-ratio is on the border between fair and expensive valuations.

S&P 500 PE-ratio adjusted for interest rate trends

Source: Liberum, Datastream

So all clear for the S&P 500? Well, if you believe this methodology then you must really love European and UK stocks. Using the same methodology for the FTSE 350 and the Stoxx Europe indices provides an adjusted PE-ratio of 13.8 for Europe and 11.0 for the UK compared to the 24.7 for the S&P 500. This indicates that the UK equity market is some 55% cheaper than the US equity market and the European equity market is some 45% cheaper. Compare this to the typical 25% to 35% discount you get when using traditional valuation metrics and you see that European and UK markets are much, much cheaper than the US. If adjusting for the long-term decline in interest rates is really a better metric to predict future market returns as Sophia Hua and Robert Shiller claim, then I would definitely buy UK and European stocks right now, rather than US stocks.

PE-ratios adjusted for interest rate trends in the US, the UK and Europe

Source: Liberum, Datastream

my preferred simple explanation for US outperformance was the higher and faster US growth vs the EU. Is there any paper about this?

As far as I am concerned the US is also easier for people to understand vs French or German industrials (who all seem to mostly rely on US companies for cloud computing, and 100% of them rely on them for mobile app-stores).

Interesting angle of analysis but only really useful when done on a sector-neutral basis. Would that be feasible ? ;)