Systematic factors have multiplied like rabbits since the 1990s and many of these factors are redundant or not simply a result of data snooping. As Campbell Harvey and his colleagues have shown a long time ago, only three factors in the literature are statistically so significant that they are above suspicion. But that is a different question than asking how many and which factors we need to use to cover the entire factor zoo. How many factors can we get away with? This is what Alexander Swade wanted to know.

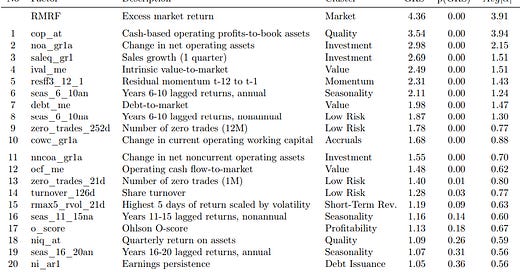

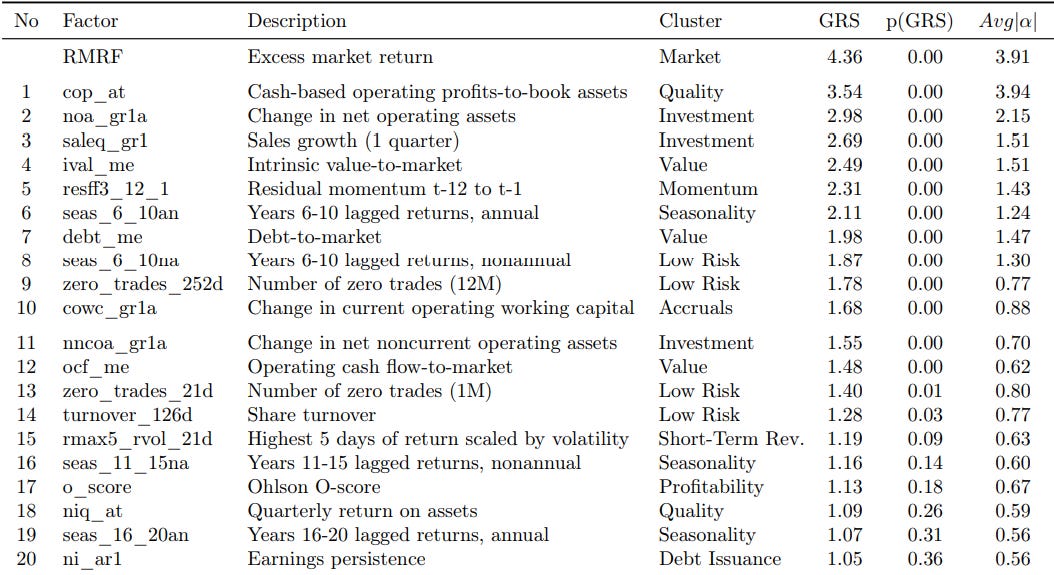

In this exercise, the team around Alexander Swade looked at a total of 153 equity factors as described by Theis Jensen, Bryan Kelly, and Lasse Pedersen. Obviously, I cannot go through all the factors, but let me show you a screenshot of the top 20. The crucial column is the one titled p(GRS) which shows the p-value of the statistical significance of the factor. In general, you want to include only factors with a p-value less than 0.05, which means that one needs about 15 factors to cover the factor zoo.

Top 20 factors needed to span the entire factor universe in the US

Source: Swade et al. (2023)

But what are these factors? You can look all of them up in the Jensen paper linked above, but let me stress the first five:

There is one value factor in there, which is the ratio of intrinsic value to market cap as defined in this paper. Essentially, that is the valuation of stocks as derived from a classic discounted cash flow model based on analyst expectations. It confirms that value is a crucial factor in understanding stock market returns.

There is the classic price momentum factor of share price returns from t-12 to t-1.

There is one quality factor in there, namely cash operating profits to book assets, a close relative of return on capital. This is interesting because, in the study on statistical significance, Harvey and his colleagues found that quality factors are not statistically significant enough, but when it comes to explaining equity returns, this factor plays a dominant role.

Finally, there are two investment-related factors in the top five, the quarterly sales growth of a company and the change in net operating assets. These are investment-related factors, but they are also closely related to the measures growth investors look at – and when I mean growth investors I mean real-life practitioners, not the imaginary growth investors academics write about.

Putting all this together, we end up with the knowledge that the factor zoo can be reduced to some 10 to 20 factors and that among the most important factors to consider are value, momentum, quality, and growth. And that is reassuring to me because it is what I do in my job all the time.