The US tech dominance is narrowing down to fewer and fewer stocks, namely those involved in building generative AI and the infrastructure needed to run it. And these stocks are trading at ever-increasing multiples. Don’t get me wrong, I am a fan of generative AI and think Amazon, Microsoft, and NVidia are great companies. But they better deliver on these lofty expectations or US tech dominance may falter and with it the outperformance of US stocks vs. Europe and the UK.

If you have ever read the analysis of NVidia by valuation guru Aswath Damodaran, you know that this stock prices in not just its leadership in the AI space over the coming decade, but also that NVidia will find another market with similar size as generative AI and dominate that market as well. That is quite ambitious, to say the least, but you have to give it to NVidia, over the last 12 months since Prof. Damodaran published that analysis the company has more than delivered. In fact, it has obliterated earnings estimates for each of the last four quarters and shows no signs of slowing down.

But going beyond NVidia as the posterchild of AI I want to take a look at AI stocks vs. non-AI stocks because there are some interesting things happening there.

Let’s start with the chart below which shows the median expected earnings growth of a basket of US AI stocks vs. non-AI stocks. For the AI basket, I simply looked at all the S&P 500 stocks that have more than 50% revenue exposure to AI according to Bloomberg Intelligence. The non-AI stocks are all the other stocks in the S&P 500 technology and communication services sectors. Also, I use median expected earnings growth and a rolling 12-month average to avoid any complications with small stocks that have huge earnings growth in a single quarter that may skew the entire statistic.

Expected earnings growth next 12 months for US AI and non-AI stocks

Source: Liberum, Datastream

As you can see, the AI stocks used to be the low growth stocks in the US tech space, but since the launch of chatGPT, growth expectations have overtaken the rest of the sector and now these are the stocks with the high growth expectations.

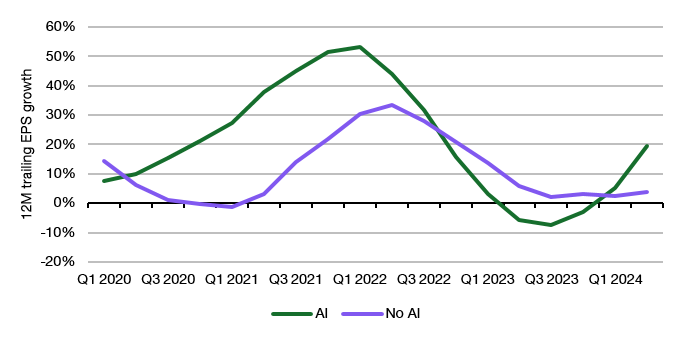

And here is the good news. So far, the AI stocks have delivered and managed to grow their earnings faster and faster (and faster than non-AI stocks in the US).

Realised earnings growth last 12 months for US AI and non-AI stocks

Source: Liberum, Datastream

Here is another way of looking at these two charts in one. I plot the difference in earnings growth between AI stocks and non-AI stocks in the US, both expected for the next 12 months and realised looking backward. As hopes for AI stocks grew more and more optimistic, the companies managed to deliver on these hopes twelve months later.

Difference in earnings growth between AI and non-AI stocks

Source: Liberum, Datastream

All is well then.

Ahem, if I may…

The situation looks rather different if I look at the actual difference between the realised earnings growth and the growth anticipated twelve months earlier. Since the start of 2023, AI companies have on average underperformed expected earnings growth by 26 percentage points and non-AI companies have missed expected earnings growth by 32 percentage points. Effectively, what companies did (or had to do?) was to guide for massive growth and then manage earnings expectations lower over the next 12 months so they could beat earnings expectations at the actual results day.

This is not something that happens in Europe. Since 2023, the median expected earnings growth for tech and communication companies in the Stoxx Europe was 10.3%, well below the average for US non-AI companies of 38%. But when I look at realised earnings growth then European tech and communication companies beat their US peers with a median earnings growth of 10.1% YoY vs. 5.1% for their US non-AI peers.

Here is a chart with the average ‘earnings miss’ relative to growth expectations a year earlier. In short, US tech companies overpromise and underdeliver while European tech companies do as they say.

Realised earnings growth vs. expected growth 12 months earlier

Source: Liberum, Datastream

In a rational market, stocks would get a ratings boost if expected earnings growth is higher in the future. But they should also de-rate and decline if these lofty expectations are revised down again. Instead, markets reward companies for making lofty promises and then do not punish them when expectations are lowered again. It’s as if the market is driven by unsophisticated investors who don’t go beyond the headlines on results day while the sophisticated investors who do the hard work of tracking the companies and their management day after day have less and less influence on the share price. It truly is an attention economy.

"Since 2023, the median expected earnings growth for tech and communication companies in the Stoxx Europe was 10.3%, well below the average for US non-AI companies of 38%. But when I look at realised earnings growth then European tech and communication companies beat their US peers with a median earnings growth of 10.1% YoY vs. 5.1% for their US non-AI peers."

So expected earnings growth in Europe was +10.3% and the reality was +10.1%, but in the US it was +38% and the reality was +5.1%? I think I would've read about that in the newspaper at some point ... especially about European tech earnings growing at 2x the US rate! Anyway:

1) Could there be a base effect issue here? For instance, European semiconductor companies tend to be more exposed to automotive/industrial markets, whilst US peers lean more toward computing/data processing, the latter of which tends to be more cyclical, and the timing of recovery more uncertain. "Well, we were modeling +38%, and although it turned out to be +5.1%, that was a timing issue; the absolute recovery is still in place, but the y-y percent changes are now against "tougher comp(arison)s". Investors say, "okay, not a problem ... (with apologies to Alfred Lord Tennyson) 'tis better to have loved and lost than never to have loved at all headline growth rate-wise, but we'll look through that and it will all come out in the wash." Thus no sell-off ... especially if it's stock of a company in a "FOMO" (fear of mission out) sector.

2) The pool of US tech names is much deeper, so I'd be interested in the "tech and communications" universes used; if the European universe has Siemens, Schneider Electric, and a dozen telecom operators, a tighter experctations-to-reality relationship would be expected.

3) Also, were the expected earnings forecasts set by management guidance or street analysts? I've noticed a cultural difference where European and Asian analysts tend to not deviate much from explicit company forecasts, whilst American analysts show a much wider spread ... especially as analysts with "buy" ratings tend to post higher-than-consensus estimates and "hold/sell" analysts lower-than-consensus to underscore their recommendations; somewhat ironically, this may also work in the opposite directions, as some" buy" analysts like "beats", so may "sandbag" their numbers, and some "sell" analysts "set the bar high" such that companies "miss", and unlike being on the wrong side of a stock rating-wise, there's no perceived penalty for failure for "innacurate" earnings estimates.

As always, love your work ... it remains amongst the most thought-provoking out there.

Interesting... If I were to guess, the same phenomenon is occurring for companies at the bottom of the expectations pile... i.e. even if results are better than low expectations, they are being ignored because the perception based on the headline result is poor in absolute terms.