I have written a couple of times about biodiversity issues in ESG investing. While I was sceptical, I was also hoping that as the area evolved, we would get better measurements of biodiversity risks (which we did) and a better grasp of their impact on share price returns. Alas, so far, the impact of biodiversity risks on share prices remains elusive. A new study with Chinese companies doesn’t help.

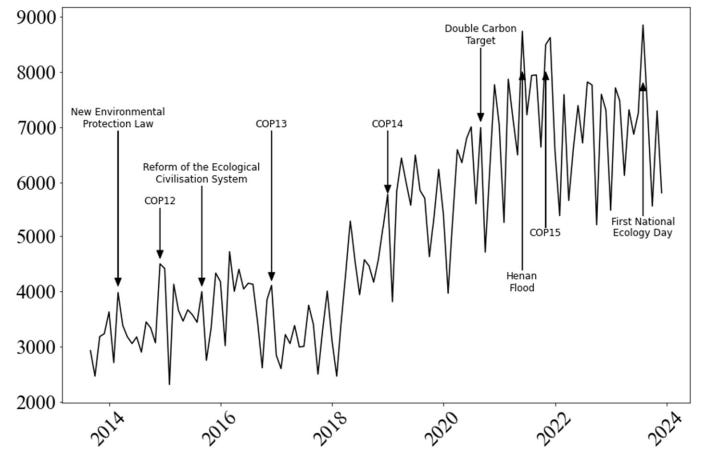

The research first constructed a measure of biodiversity risk awareness in China using news mentions of biodiversity issues and internet searches for related terms. This methodology follows the biodiversity risk indicator developed at Yale for the US. Clearly, awareness of biodiversity risks in China has grown.

Biodiversity attention index in China

Source: Chen et al. (2025)

Then, the researchers tried to trade Chinese stocks based on this index. They did the usual split into groups of stocks with different degrees of correlation to their biodiversity attention index. However, rather than the more common split into five buckets, they used three buckets of companies with high, medium or low correlation to the index.

Then they calculated the monthly alpha of these baskets after correcting for the usual set of Fama-French factors. The chart below shows the annualised alpha for their backtest from 2007 to 2023 before transaction costs.

Alpha of portfolios sorted by biodiversity risk

Source: Chen et al. (2025)

The point of the chart is that there is no point. The three portfolios have the same performance. OK, technically, the performance difference between the portfolios is statistically significant at the 10% level, but it is still only 0.1%. And that is before transaction costs, slippage, and all the other factors that reduce returns in real life. Not great.

No, (i) I don't think so, but what is the option? Consumers are already making the choices and they must learn to become better at it. Producers should produce what they think is good and push it on to consumers. I find it very strange though that investors should follow their own ideals. Capitalism is a success because it allocates resources to where they are most profitable, best used. Nothing else. Shareholder value maximation is, not short-term, but long-term efficient.

Under perfect working capitalism, consumers decide what should be produced and how. Investors should select the most profitable producers based on this demand from consumers. ESG investing is absurd.