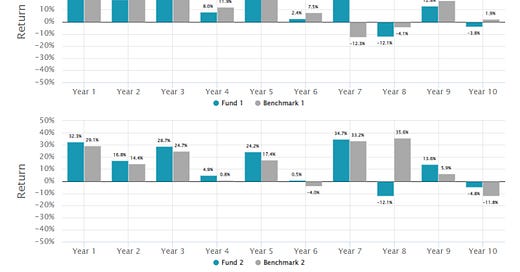

Take a look at the two funds shown in the chart below with their annual performance vs. their respective benchmarks. Which one of these funds would you rather invest in? If you had $10,000 to invest, how much would you allocate to fund 1 and fund 2?

Two funds and their performance vs. benchmark

Source: Ungeheuer and Weber (2023)

If you are anything like the participants in studies by Michael Ungeheuer and Martin Weber, you are 2.7 times more likely to buy fund 2 than fund 1 and would allocate on average some 60% of your capital to fund 2.

What’s the difference between fund 1 and fund 2 that makes fund 2 so much more attractive? I can tell you it isn’t the return because the two funds are designed to have exactly the same return. The key difference between fund 1 and fund 2 is that fund 1 is a frequent underperformer that sometimes has a large outperformance, while fund 2 is a frequent outperformer but sometimes suffers large underperformance.

It is this frequent outperformance of fund 2 that makes people believe that fund 2 is the better investment and more optimistic about its future returns. By the way, the tests were originally performed with retail investors, but in later rounds, the researchers also asked financial professionals at large asset management firms and there was no difference in the selection bias to retail investors. The bias towards fund 2 didn’t even disappear when fund 2 had a total return 2% below that of fund 1 and when the alpha vs. the benchmark was 1% below that of fund 1.

Also, didn’t I write yesterday about outcome bias and how coaches of sports teams and investors are more likely to change their line-up after a narrow loss than after a narrow win? If you prefer fund 2 over fund 1 in the chart above, you are displaying the same bias. Fund 2 is one where the frequent outperformance of the fund lulls you into a false sense of safety that may eventually end in a large loss. Meanwhile, fund 1 is constantly struggling, tempting you to tinker with your portfolio line-up and make changes, possibly just before fund 1 has a banner year of strong outperformance. Probably not the best way to make money by selecting funds…

And one final thought. To me, the return profile reminds me of the typical return profile of value investors. Years of small underperformance but then a banner year when they shoot the lights out. Meanwhile, momentum and growth investors tend to have a return profile that resembles more that of fund 2, years of small outperformance and then potentially years where they lose a lot of it in one go. Which one is easier to sell to clients and which one is easier for investors to stick with in the long run? The answer is in this post.

I would add that if you don't understand the strategy, one can have the idea that fund 2 shows persistence while fund 1 could be a random shot.

I find your notes very incisive. Would you perhaps have some thoughts on option selling?