The current episode of insecurity and panic about banks was triggered by the collapse of SVB Bank which was incompetent enough not to hedge its Treasury portfolio and was forced to sell these Treasuries at a loss once many deposit holders demanded access to their money. Had SVB done what every normal bank does, namely use swaps to swap the income from the Treasuries into the income from variable rate bonds, the swaps would have compensated the bank for the losses and SVB would never have gone under. This was a major risk management SNAFU by SVB Bank, and one has to wonder if there was a way to identify the weakness in SVB beforehand or the deception the banks pulled on investors…

As it turns out, there may be just such a tool in the form of Deception and Truth Analysis (D.A.T.A.). Before I continue, though, full disclosure. While I have no commercial ties with D.A.T.A., Jason Voss, who founded it is a friend of mine and I have known him for years and rate him highly. So, when I write about this tool, I may be biased by my experience of him as a high quality portfolio manager and someone who worked on lie detection for years.

The basic idea behind D.A.T.A. is to use natural language processing techniques on regulatory filings and earnings calls to identify sections where management may be deceptive or even lie in order to identify accounting shenanigans long before they become a problem. To do this, every section in earnings calls transcripts and quarterly and annual reports filed with the SEC (so far, the tool only has US listed stocks in its database) is analysed and ranked from -100% (maximum deceptiveness) to +100% (maximum truthfulness). Values below -10% tend to be warning signs that something may be amiss in the reports of a company (rough guidance, I know Jason would disagree with me on this rule of thumb).

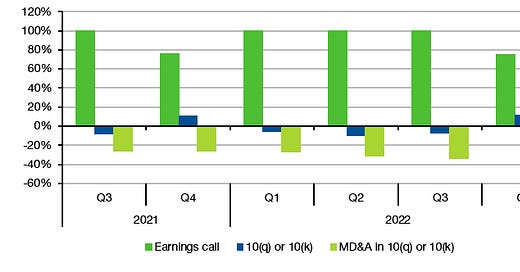

The chart below shows the D.A.T.A. scores for SVB Bank’s last six quarterly results and earnings calls based on an analysis on the D.A.T.A. webpage. Note that the management was not deceptive at all at earnings calls because during these events, management can effectively steer the conversation into directions that are more preferred by them. Meanwhile, in the regulatory 10(q) and 10(k) filings a company has to address a much broader range of topics and can’t easily wiggle out of a corner. You can see that when looking at the quarterly reports of SVB Bank, management was already a bit deceptive with scores around zero to slightly negative. But when looking at the management discussion and analysis sections in the regulatory filings, deceptiveness scores got really low. Management essentially erected a lot of smoke screens in their discussion and these smoke screens became thicker (the deceptiveness scores became more negative) over time.

Deceptiveness scores for SVB Bank’s last six quarterly results

Source: Deception and Truth Analysis

The fun thing about the D.A.T.A. tool is not just that it was able to identify deceptive tactics by corporate management well before it became an issue for investors. The tool also directed investors to the discussion of the impact of rising rates on the bank’s balance sheet and its deposits as key elements where management used particularly deceptive statements. As I said, if only we had a tool that could have warned us. It seems there is one, but most investors have not heard about it, yet.

What an excellent tool! I just wonder how long it will take those trying the deception to use AI to write the reports in such a way as to disguise their lies. It is about time that those company boards, accountants and auditors faced some sanction for what they do. Every time these things happen it seems they get off scot free, so there is no deterrent.

On a slightly related note I took a small punt on UBS yesterday as they have just received a massive windfall gain which must be reflected in some gains once the sector calms down. Hoping I haven't caught a falling knife.......

Jason Voss related to Christopher Voss (https://en.wikipedia.org/wiki/Christopher_Voss) - is uncovering deception the family interest?