Companies in the UK and Europe have suffered from declining liquidity in the past few years and executives are thinking about listing in the US rather than here because among other things, share liquidity and valuations for companies are higher there than they are on this side of the Atlantic. But I would say: not so fast. Trying to improve stock valuations by moving to a more liquid market may not be the best lever to pull. Instead, I suggest a different one.

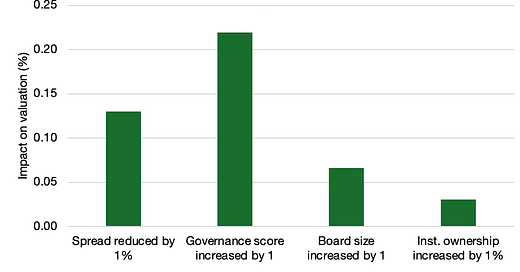

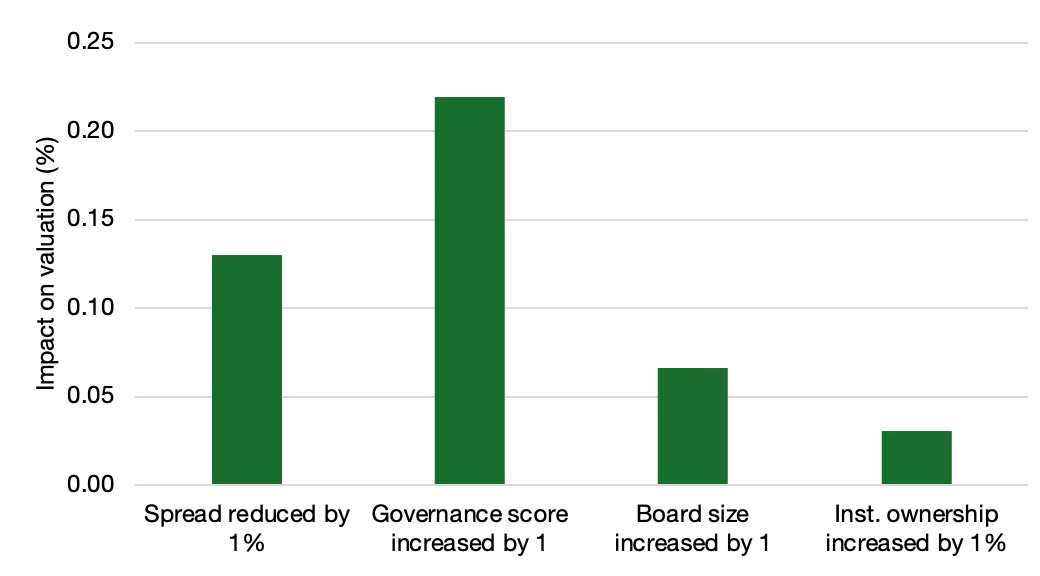

A recent paper analysed the impact of improving share liquidity on company valuations and compared it to the impact of improved corporate governance. To do this, the authors of the study analysed 428 studies from 55 papers. Based on these studies, the chart below shows the average impact of some key measures on stock valuations.

Impact of different measures on stock valuations

Source: Nguyen and Dao (2022)

Note that increasing the liquidity of shares to the extent that the bid-ask spread drops by 1% leads to a c. 0.13% increase in company valuation on average. Throughout the study, the authors use Tobin’s Q (market cap divided by total assets) as a measure of valuation, so if your preferred valuation measure is the P/E ratio, you would expect a larger increase in valuation from that.

This is a significant increase in valuation and much larger than the insignificant impact of a larger board or larger institutional ownership on the valuation of a company. In the study, the authors also checked whether it is detrimental for valuations if the CEO also is the chair of the board, and they found no effect. In other words, simple governance measures like splitting the CEO and chair position or increasing the size of the board are not going to help.

But what does help and helps more than an increase in liquidity is to improve corporate governance overall. Using corporate governance indices like the ISS Board Quality scores as a measuring stick, they found that improving these governance scores by one notch on average increases valuations by 0.22%.

Improving these governance scores requires a company to make serious changes in the oversight, which may mean more than just adding a few board members or other token measures. But unlike trying to increase liquidity, it is a measure that is entirely under the control of executives and their boards.

We, the investable community, have been slowly but surely improving the G for years if not decades now. Liquidity has decreased geometrically over time.

There will be outliers and they will flame and burn - but that's another story.

Liquidity, in the UK at least, has other drivers; writing more ESG drivel won't meaningfully impact that. FWIW I was involved as an investor in an IPO on the LSE in 2003. The Prospectus was 90 pages long. My last Annual Report was 243 pages long. The former was sold at 8x IPO price, the latter was taken private at a very significant premium to it's listed price, but still just about lifted it's head above water.

It's not causation, but liquidity and ESG aren't either

better governance makes a company's shares more investible. That's clear enough. But within the boundries of a short search, I couldn't find a clear ranking of European companies according to their ISS Board Quality scores.

Am I missing something? If not: is this a flaw, or feature of the European investing environment?