If you are a small- and mid-cap investor, look away now. This article contains distressing information. In September, I wrote an article with probably the best explanation of how the rise of index funds distorts market dynamics and creates an outperformance of large caps vs. small caps. Now, Pouya Behmaram from McGill University in Montreal has gone one step further and tried to quantify the broader impact of the rise of index trackers.

He collected the holdings of both index trackers and active equity funds in the US that track the same US market indices. He then added the total level of stock holdings due to index constraints. For index trackers that is simply the entire portfolio. For active funds that is the entire portfolio minus the active share. As I said in my note in September, once a company has become very large, it is hard to ignore even for active investors. They must invest in these stocks to limit their risk of underperformance vs. a benchmark.

Using this combined approach, he then calculates the Indexing Inclusion Ratio (IXI) as a measure of passive ownership of a stock. Now, let’s look at stocks by market cap. The largest 20% of all stocks in the US account for roughly 85% to 90% of the total market capitalisation of the US stock market. This number has remained roughly constant over the last 20 years or so, but what has changed is that passive ownership among these stocks has increased from about 5% in 2000 to more than a quarter in 2020.

If you look at the other end of the market, the 20% smallest stocks by market cap, the picture looks very different. The indexing share has remained close to zero because there are hardly any small-cap index trackers around. And because small-cap stocks have persistently underperformed large-caps and mega-caps, the share of the total market cap covered by the smallest 20% of stocks has declined from close to 0.6% in 2003 to less than 0.2% in 2020.

Proportion of average investors’ AUM dedicated to 20% smallest stocks in the US

Source: Behmaram (2024)

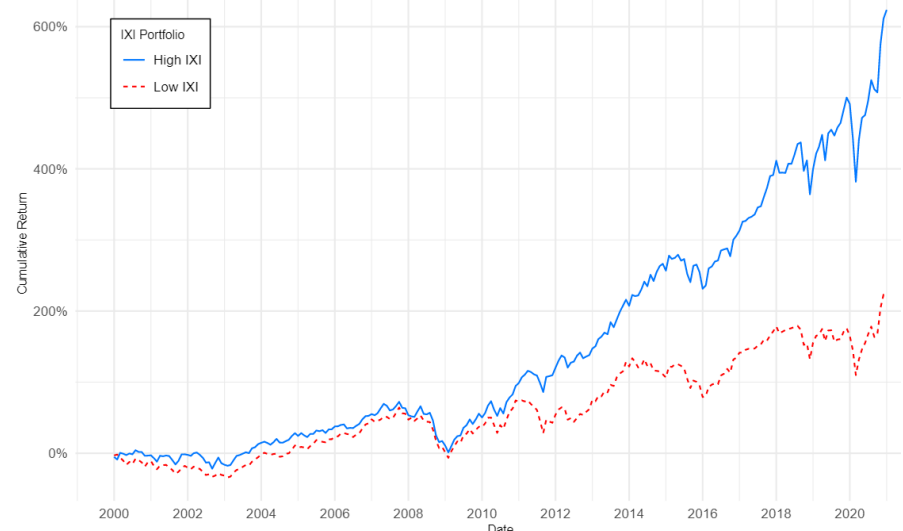

What role did the rise of index trackers have in this? To assess the quantitative impact of index tracking, Bahmaram calculated a portfolio of the 33% stocks with the highest index inclusion (IXI) and compared it to the 33% stocks with the lowest IXI. Over the 20-year sample period, high-IXI stocks outperformed low-IXI stocks by 325%! Adjusted for differences in stock characteristics like size, valuation, momentum, etc. the outperformance of the high-IXI portfolio is still some 4% per year on average.

Cumulative return of high-IXI vs. low-IXI portfolios

Source: Behmaram (2024)

How much of this performance is due to the flows into index funds and the need for active managers to hold at least some of these large cap funds that are heavily indexed?

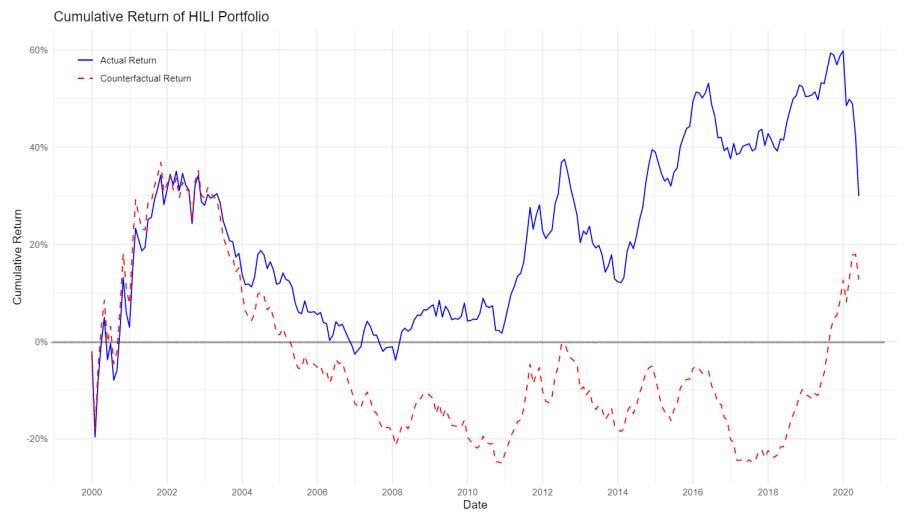

To test this, Behmaram constructed a counterfactual return that removed the effect of fund flows. The chart below shows that without these fund flows, the highly indexed stocks would for most of the time have underperformed the less indexed stocks. In other words, most, if not all the outperformance of megacaps stocks that are heavily indexed vs. lesser indexed small cap stocks is due to fund flows artificially pushing prices up.

High- vs. low-IXI portfolio performance and counterfactual without investment flows

Source: Behmaram (2024)

This means that once fund flows into index products stop or – even worse – investors start to sell index trackers in large quantities, these heavily indexed stocks will underperform by a lot and the entire flywheel goes into reverse. Unfortunately, though, as I have written here, we seem to be very far away from that point.

from a logical point of view, mid-caps should perform better in the long run. Ain't much potential for Apple or Nvidia to triple from this point.

The question would be, how much of the megacorp outperformance is due to flaws in antitrust? A lot of their growth comes from either buying out the competition, or shooting the competition in their tracks.

My point would be: more vigorous antitrust regulation should be beneficial to mid-caps. As in Europe.

I'd buy European mid-caps... if Europe was a high growth region.

(Or as my Dad's generation used to say, if we had some ham, we could make some ham and eggs, if we had some eggs.)

Taken to a logical - if extreme - conclusion assuming the flow to index funds continues unabated, we are in danger of losing sight altogether of the original goal of capital markets: to connect capital looking for a return to businesses needing capital to make a return. The index-driven shift to large and larger starves SMID caps of capital, in the listed markets at least....