International spillovers: It’s mostly in your head

When I was much younger than today, and still enjoyed the benefits of youth like a concave belly, we used to say that when the US sneezes, the rest of the world catches a cold. Today, that still is true, but the same can be said about China – at least if you live in Europe or Asia.

The common explanation for the steeper declines in European asset prices when there was a crisis in the US was the international trade links between Western Europe and the United States. But in 2008, the housing market collapsed in countries like the United States, the UK, Ireland, while Germany or Switzerland had no housing crisis at all. Yet, German stock markets were down more than US stock markets.

In fact, a recent study showed that only about one-third of the spillover from US crises (and I presume Chinese crises) to other countries is explained by macroeconomic ties between countries. The other two-thirds are explained by financial market integration. Countries where institutions and households own a larger share of their wealth abroad and where their assets are held all over the world experience steeper declines in asset prices.

The driver of these steeper declines is quite straightforward. First, when the US economy hits a rough spot economically, US investors think about their investment portfolio. Psychologically, they will reduce their holdings in assets they are less familiar with and that thus appear to be riskier. This means they will keep their US stocks, but sell their foreign stocks. But also, they will tend to sell more of the stocks in countries that are heavily integrated with the US stock market, that is UK, Western Europe, and developed Asia. Why? Because it makes sense. First, these markets are typically the most liquid, so it is easy to sell these stocks at a moment’s notice. Second, because these markets are so integrated with the global markets and your home market, they offer less diversification benefits. Technically speaking, their correlation to the US market is so low that there are diversification benefits to be had, but these diversification benefits are so subtle that for most investors it simply appears as if the correlation between US and European stocks is about 1.0. When the US goes down, so do the UK and Europe. And as a result of this mental shortcut, US investors tend to sell UK and European stocks more than emerging market stocks, for example. And it is this psychological effect that creates a higher correlation and becomes a self-fulfilling prophecy. Because people think European stock markets are highly correlated in a US downturn, they act as if they were and sell these stocks first. And these actions in turn increase the correlation and turn perception into reality.

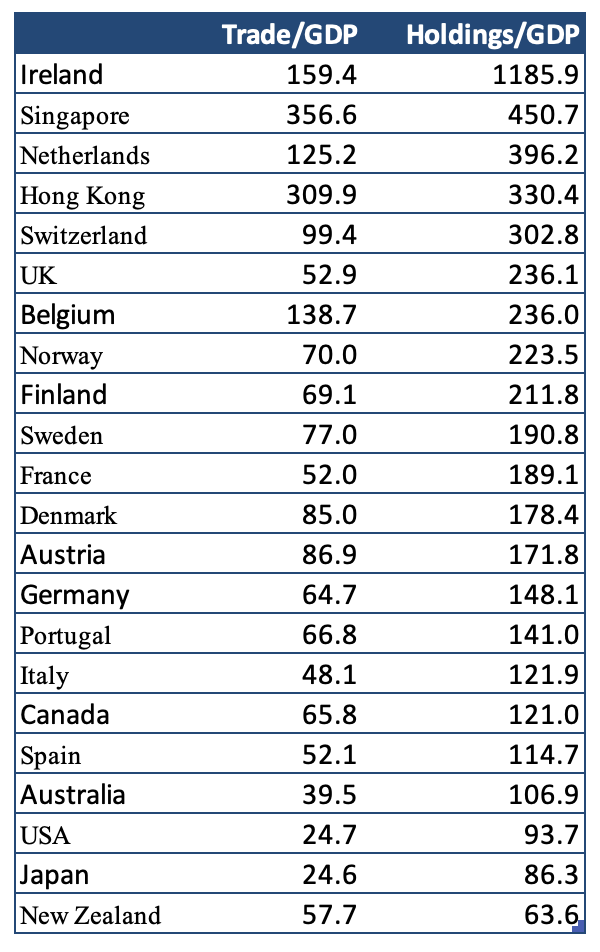

So the next time something happens on the economic front in the United States of China and somebody tells you that it is all going to be contained because it is a purely domestic problem, make sure you check the list below and look at the financial integration of different countries. The countries with higher financial integration will sell off more, whether that makes sense economically or not.

Financial and trade integration of different countries

Source: Londono (2021)