On 17 March 2020, I published one of my most read posts of all time. Back then, we were approaching the heights of the pandemic panic and I said that if you invert current market prices and back out how many years of no earnings growth companies would have to have in order to justify the market levels seen back then. It was easy to show with this calculation that markets were overly pessimistic back then. Little did I know that markets would bottom within a week and then rapidly rebound.

Today, every newspaper (especially here in the UK) is full of headlines on the energy crisis and how our energy prices are going through the roof fuelling inflation beyond our wildest dreams. So, once again it is a worthwhile exercise to back out what energy prices need to do in order to sustain current inflation rates.

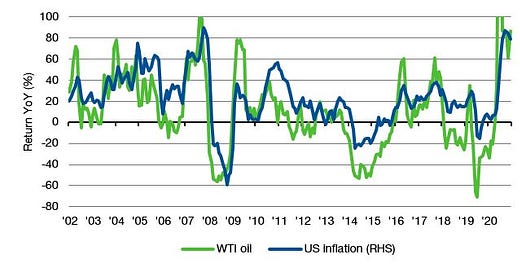

First, we have to realise that inflation rates are closely linked to the change in oil prices. The chart below shows the annual change in oil prices (WTI) and US inflation rates over the last two decades. The 86% increase year-on-year in oil prices drives the 5% inflation rate we currently see in the United States.

Change in oil prices and US inflation rates

Source: Bloomberg

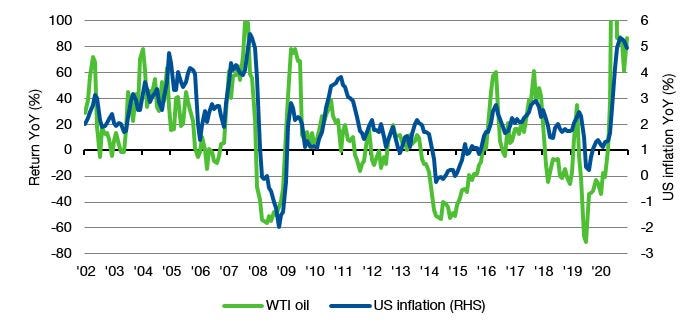

But remember that inflation is a change in prices. So in order to see a similar inflation rate one year from now, oil prices have to rise another 86% from current levels, which would bring them $140/bbl. in September next year – practically the highest they have ever been. Of course, I know that this is overly simplified. The risk is that higher oil prices spill over to higher wages and higher prices for other products, thus driving core inflation (inflation ex food and energy) higher. But as a first approximation, the question you should ask yourself is whether you think oil prices one year from now will be anywhere near $140/bbl.

If you think they will be about where they are today (c. $80/bbl.), then the chart above would indicate that inflation should be at 1% or a bit more in one year from now. And if you think that oil prices will be lower than today, inflation rates will be even lower than that. Feel free to add a one percentage point increase to core inflation from current levels and you will roughly end up at 2% inflation in the United States if oil prices stay where they are and below 2% if oil prices drop from current levels. That is how inflation works and that is why I am siding with central bankers in saying that current inflation is transitory and will decline in 2022.

Required oil price to sustain current inflation rates

Source: Bloomberg

You may argue differently, but be aware what the implicit assumption is for energy prices. You are effectively saying that we have to get used to oil prices above $100/bbl. for a long time. That is entirely possible but the only time we have seen that was in late 2007 before the financial crisis and from 2011 to 2013. Back then, the Chinese economy was growing at a rate of 8% to 10% per year. Today, it is growing at a rate of 6% per year and the government is actively trying to cool down growth and the use of commodities with it.

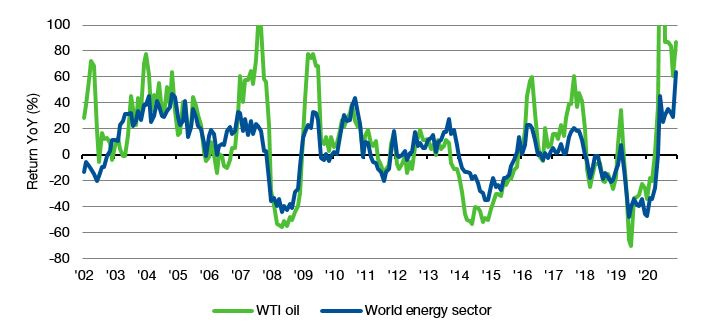

Finally, if you are an investor and tempted to invest in energy stocks, be aware that energy stock returns are also closely linked to oil prices. If oil prices one year from now are where they are today, energy stocks should have a return of roughly zero. If oil prices are lower, they should have a negative return.

Change in oil prices and energy stock returns

Source: Bloomberg

Opinions may differ and for good reasons, but my view is that oil prices that hover above current levels for a long time seem highly unlikely given that both US and Chinese growth is slowing down. And that means to me that inflation is going to decline in 2022 and that energy stocks likely to have very low returns over the next 12 months.

Your reasoning seems to base on the demand side of oil/energy market. However, the current spike of energy prices is caused by long-time under-investment of fossil fuel infrastructures. Let's assume what you project for the demand side is correct. Without picking up the investment, I think the most likely situation is that the energy prices stay high for an extended time. Of course, that should have us bring in the role of renewable energy supply...