I would venture a guess and say that almost all investors occasionally use simple heuristics to make investment decisions. I know, even professional investors do that. But many heuristics documented in the behavioural finance literature are just plain stupid, while others may work in practice. Time then for retail and institutional investors to compare their use of heuristics.

Hee-Seo Han, Xindi He and Daniel Weagley combed through 75 years of academic literature to identify 20 investment heuristics documented in top finance journals. For each of these, they checked how often retail investors and institutional investors used them based on real-life trading data from the Finnish stock exchange between 1995 and June 2009. Then they tried to estimate how often trades that looked based on a heuristic were just accidentally made as if they followed one. To remove these false positives, they simulated a stock market with trades in two different ways. If the real-life frequency of trades following a heuristic is higher than any of these simulations, we have a good indication that investors use these heuristics to make investment decisions.

Let’s start with retail investors. The chart below shows the 20 heuristics (I am not going through them one by one) and the frequency with which they were observed both in real life and in the control simulations.

Popularity of heuristics among retail investors

Source: Han et al. (2025)

Retail investors seem to be more likely than chance to use heuristics in 14 out of 20 cases. The biggest difference between real-life occurrences and theoretical prevalence is observed for peer influence (when people in the same neighbourhood or family invest in the same stock) and herding (investing in stocks with several signs of investor herding).

But they also use other heuristics more often than chance. For example, the good industry heuristic indicates investments in companies that were not previously in the portfolio but belong to an industry where the investor made a profit in the previous year. Or the contrarian heuristic, where investors buy the stocks that have lost the most value over the last four weeks (aka buy the dip). Or they invested in stocks because they paid an exceptionally high dividend.

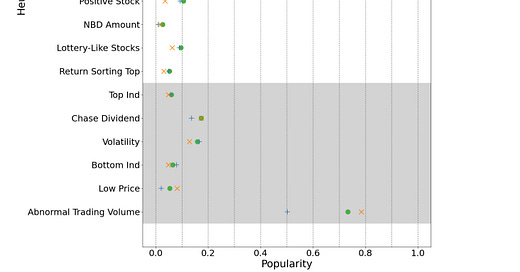

I could go on, but let’s contrast this with the heuristics institutional investors use.

Popularity of heuristics among institutional investors

Source: Han et al. (2025)

The professionals use only three out of 20 heuristics more often than chance, so they seem more analytical than the retail crowd. But the three heuristics they seem to use worry me. Peer influence and investor herding again show up on top, just like with retail investors. That isn’t a good sign, though it confirms what we know about institutional investors: They are moving in herds and groups because they are benchmarking their portfolios against their peers' portfolios. But I cannot, for my life, explain why the integer price heuristic shows up as more likely than chance. This is the heuristic where investors buy or sell because the share price is at a round number. Really? Professional investors?

In any case, the research also examined the performance of trades identified using these heuristics. They found that, on average, retail investors lose money when using a heuristic, while institutional investors profit when using heuristics. But then again, if you only use herding heuristics and represent the group with the largest pool of money in the market, your heuristic becomes a self-fulfilling prophecy.

I'm out on a shaky limb here, but from my experience, 75% of what differentiates professionals from retail is a) their ability to assuage clients from panicking. Thinking about selling everything because there is some po-dunk war starting? Call your investment manager, get a "professional opinion", and sleep better. Since there are only a handful of situations per generation where selling everything is really called for, this makes empirical sense (until it doesn't).

And secondly, the magic sauce is in sales. Perfecting the art of making the client feel they should be thankful one is working for them -- that's what the pros do.

But do pros generate consistently better returns based on harvesting the few real anomalies that really exist? I don't think so. So I agree with your article 100%, once again.

dont underestimate survivor bias as a reinforcing factor in professionals.

a recent, enjoyable 2025 podcast displays this :

b.ritholtz fires decades of strongly held heuristics vs data-driven dr.bernstein