As we enter 2022, the key question on every investors mind is no longer the pandemic, but rather, when and by how much the Federal Reserve or the Bank of England will hike interest rates. Inflation runs high and the pressure on these two central banks to do something, anything, about it is increasing.

But the problem is that interest rates are extremely low and going into the pandemic, everybody argued that loosening monetary policy rates is not able to stimulate economic growth much. So, how effective is monetary policy at very low interest rates?

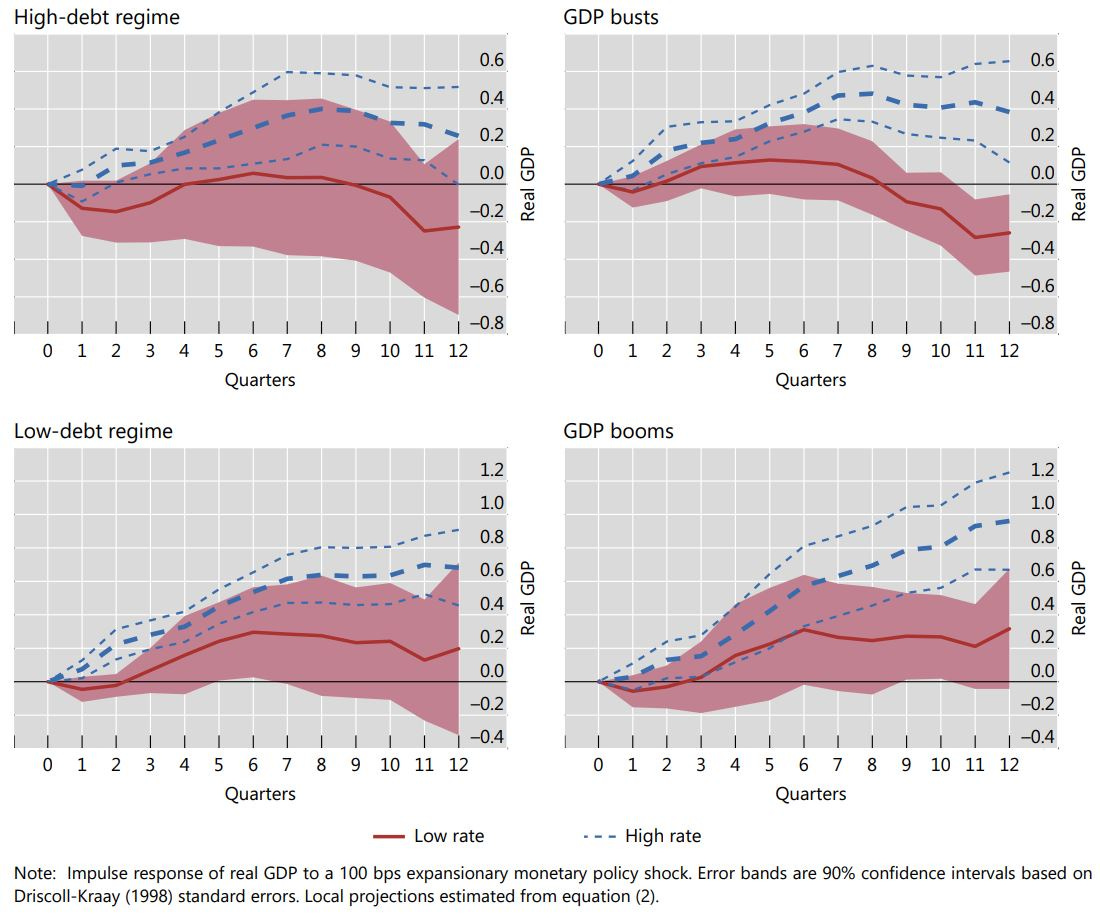

The Bank for International Settlements recently published a research paper that has some rather strong results. Using data from 18 industrialised countries worldwide since 1985 they found that at very low interest rate levels, interest rate cuts largely lose their ability to stimulate growth. The chart below shows the reduced impact on real GDP growth over 12 quarters (3 years) after a simulated 100bps cut in interest rates. Across all four cases, the boost to GDP growth is much smaller in a low interest rate environment (roughly the world we have been in since 2010).

Impact of 100bps rate cut on real GDP in different economic environments

Source: BIS

But compare the two charts in the left column and you will find that in an economy with high debt loads, monetary policy becomes even less effective, with the stimulus from a 100bps rate cut declining in an economy that has high debt levels vs. and economy with low debt levels. Meanwhile, in a booming economy with strong GDP growth the impact of monetary policy is stronger than in a GDP bust environment.

Now, I am making a leap of faith here, but looking at the equations in the paper, the impact of monetary policy they estimate is symmetrical with respect to interest rate hikes and cuts. That is, in their analysis a 100bps rate hike should have the same impact on economic growth, just with the opposite sign. This may be wrong in practice because it could be that the effectiveness of monetary policy may be higher for rate hikes than for rate cuts, so keep that caveat in mind. But if the estimates in that BIS paper are taken at face value, then interest rate hikes by the Fed or the Bank of England should slow down GDP growth less than in the past simply because we are in an environment of low interest rates – and will stay thee even if these central banks hike interest rates a couple of times. Furthermore, while we are in an environment of strong growth, we are also in an environment of high debt. Overall, this study indicates that hiking interest rates should lead to less of a growth slowdown than many people expect. Most importantly, while equity markets may react negatively to interest rate hikes by central banks, the fact that growth isn’t slowing down should keep equity markets out of a bear market and the current bull market running throughout 2022. I for one, hope so.

Consider: what if the central bank is not a leader but a follower by necessity. While not ignoring the impact of a large actor in the markets, when we look at short term government security rates, say 3-month treasuries, the Fed Funds rate follows changes, not leads. This of course is not sufficient, in and of itself as correlations are not causation, but what makes more sense, a $4 trillion bank reserve balance driving a $75 billion domestic debt market, or the other way around.