It's not (going to be) easy being green

A week ago, the Technical Expert Group (TEG) of the European Commission published the guidelines for the EU Taxonomy on activities that qualify as sustainable economic activities. It’s a real page-turner with the main report being 67 pages long (the overview table of the covered activities is 8 pages alone) and the technical appendix with the detailed descriptions another 591 pages.

But you cannot overstate its impact on businesses and investors all over Europe. Even after the UK has left the EU, these regulations will be implemented there, because it is part of the package that the UK government has agreed to implement in local law to ease the path towards a potential free-trade agreement.

While these recommendations are non-binding, it is highly likely that he European Commission will put them into law by the end of this year almost unchanged. By mid-2021 the taxonomy will likely become part of the Non-Financial Reporting Directive, which means that by year-end 2021, investors from pension funds to mutual funds and all kinds of alternative investment funds will have to provide reporting on their exposure to sustainable economic activities in their portfolios (and thus automatically also on unsustainable economic activities). In a real stroke of regulatory genius, the EU has unfortunately decided that companies have to report their economic activities based on this new scheme as well – but only starting in fiscal year 2021. Hence, investment companies will have to report data about three to twelve months before it first becomes available through company disclosures…

But never mind these bumps in the road, the classification system will become the foundation for many other regulatory changes across the EU in coming years:

Companies with more than 500 employees will have to disclose their activities based on the performance in the economic activities defined by the EU. They can either do that in addition to the disclosure scheme they use in their financial reports today, or they can simply switch all of their reporting to the new classification scheme. Since the classification scheme of economic activities used by the EU is in some cases very different from conventional classification schemes, companies will likely have substantial costs in transforming their reporting structures and accounting tools. In many cases, it will just be easier and cheaper for businesses to change their entire reporting structure to match it to the EU classification scheme – which may confuse both analysts and investors.

Investment managers and asset owners will have to provide disclosure about the share of their portfolios that are sustainable according to EU regulations. This will significantly undermine the ability of asset managers to greenwash their products but also means that reporting capabilities have to be expanded, which will likely incur additional costs that have to be borne by the investor.

Currently under discussion are new regulatory requirements for banks and insurance companies. They may have to introduce a green supporting factor into their risk management models and incorporate climate risks into their risk management policies. This will penalise funding activities for unsustainable activities and projects that are harmful to the climate and may even lead to higher capital requirements for funds allocated to unsustainable economic activities.

The classification scheme will form the foundation on which the EU will define its green bond standard and its EU climate benchmarks. The TEG’s Handbook on Climate Benchmarks is another thriller and explains on 171 pages how climate change considerations need to be included in benchmarks for all kinds of asset classes (except rates and currency benchmarks). The EU climate benchmarks come in two shapes, but all climate benchmarks must ensure that companies included in the benchmarks work towards actively reducing their CO2 emissions and they cannot simply shift their sector exposure to low-CO2 sectors. The benchmarks have to be exposed to all sectors with some businesses excluded (e.g. companies producing controversial weapons or who are found to be in violation of global norms like the UN Global Compact Principles). It seems likely that these climate benchmarks will become the dominant way for investors and asset managers to assess their portfolios’ progress towards a lower carbon footprint and dedicated ESG funds will likely compare themselves against these benchmarks – if not by regulatory force then due to public pressure.

Meanwhile, green bonds may have a lower risk rating for banks and insurances in the future, thus making it easier for them to raise capital. At the very least the disclosure requirements for banks as well as asset owners ensure that green bonds and bonds of companies engaged in sustainable economic activities will have an easier time to raise capital and potentially a lower cost of capital than companies engaged in unsustainable activities.

Three steps to prove an activity is sustainable

For a company to show that revenues from its activities are sustainable it first has to split all its activities/revenues along the EU classification scheme. The problem is that while the EU classification system covers economic activities that are responsible for 93.1% of scope 1 emissions in the EU, not all activities have been fully evaluated and some haven’t been included in the evaluation at all, so far. For example, mining and quarrying activities are only considered with respect to their contribution to climate change as an input factor for manufacturing and other activities and other activities like retail or financial services so far have not been assessed as sustainable or unsustainable at all (mostly because the CO2 emissions from these activities are very small compared to energy, manufacturing or agriculture). Over time, the assessment of economic activities will be expanded and completed.

Once economic activities of a business are defined, the company then has to identify the activities that are classified by the taxonomy as contributing either to climate change mitigation or climate change adaptation. Currently, the EU has identified 70 activities that are eligible to provide a substantial contribution to climate change mitigation and a further 68 activities for adaptation.

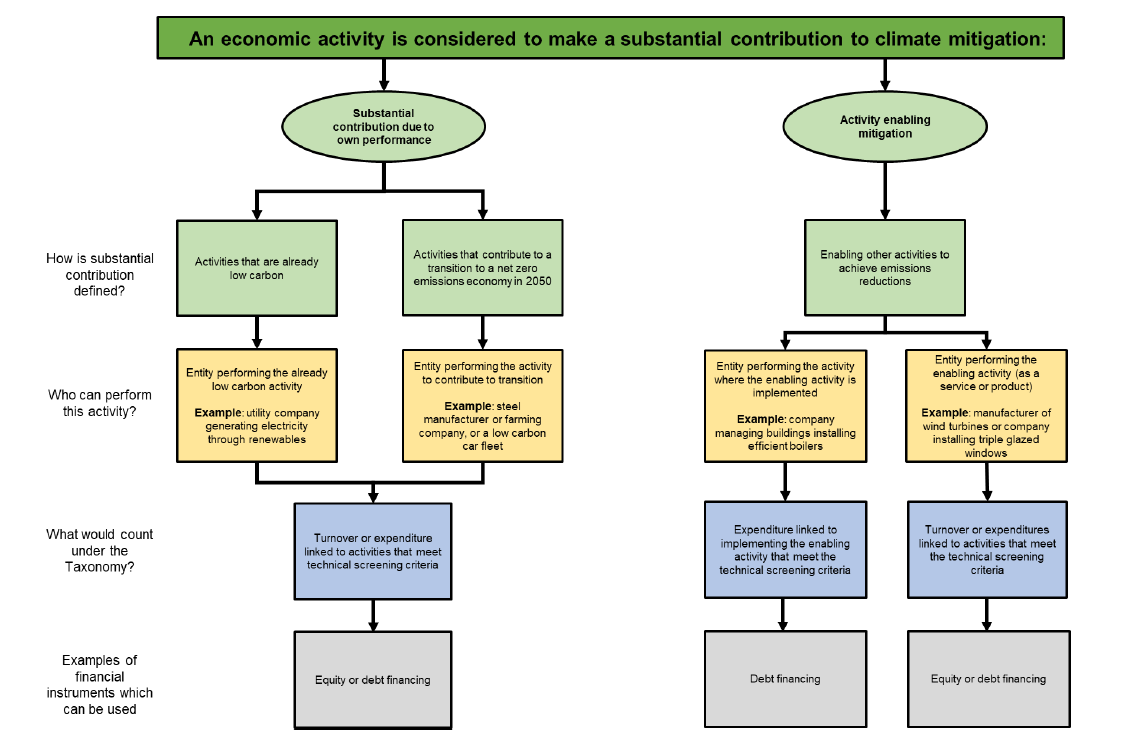

For those economic activities of a company that may contribute to climate change mitigation or adaptation, the company then has to prove how its activities make a substantial contribution to climate change mitigation or adaptation. The technical appendix of the taxonomy lists relatively detailed criteria to assess if an economic activity is making a substantial contribution, but essentially, all activities that already have a zero carbon footprint are already considered sustainable and all activities that help to reduce CO2 emissions (i.e. transition technologies) may be eligible as well. For example, the production of electric cars or hydrogen cars is considered an eligible economic activity, while the production of hybrid cars as a transition technology is only considered eligible and sustainable until 2025 after which it will no longer be considered eligible. The difficulty with some economic activities like mining becomes clear if one considers cobalt mining as an example. Cobalt is used to produce modern batteries used in electric and hybrid cars and as such, contributes to an eligible economic activity. However, the TEG did so far not have the time to assess if cobalt mining can be considered an eligible activity itself and if so under what circumstances. For now, these activities thus remain out of scope.

The chart below shows how an economic activity can be assessed for its contribution to climate change mitigation.

Assessment if an economic activity makes a substantial contribution to climate change mitigation

Source: Technical Expert Group.

The final step in assessing an economic activity as sustainable is to ensure that identified economic activities that make a substantial contribution to climate change mitigation or adaptation do no significant harm. Here the company has to demonstrate that the economic activity does not violate the minimum social safeguards like the UN Global Compact mentioned above and does no harm to any of the six environmental objectives of the EU:

Climate mitigation

Climate adaptation

Transition to a circular economy, waste prevention and recycling

Protection of healthy ecosystems

Pollution prevention and control

Sustainable use of water and marine resource

Showing that an activity does not do significant harm is arguably the most difficult step of the three because it relies mostly on qualitative assessments and is often impossible to quantify. It is also the step that has been most heavily criticized so far. For example, nuclear energy is considered not eligible as a sustainable economic activity because of the do no significant harm principle (radioactive waste is hard to get rid of and potentially harms ecosystems). This is probably the area where we will see the most changes going forward and where the TEG has the most work to do to clarify the criteria used to assess eligibility.

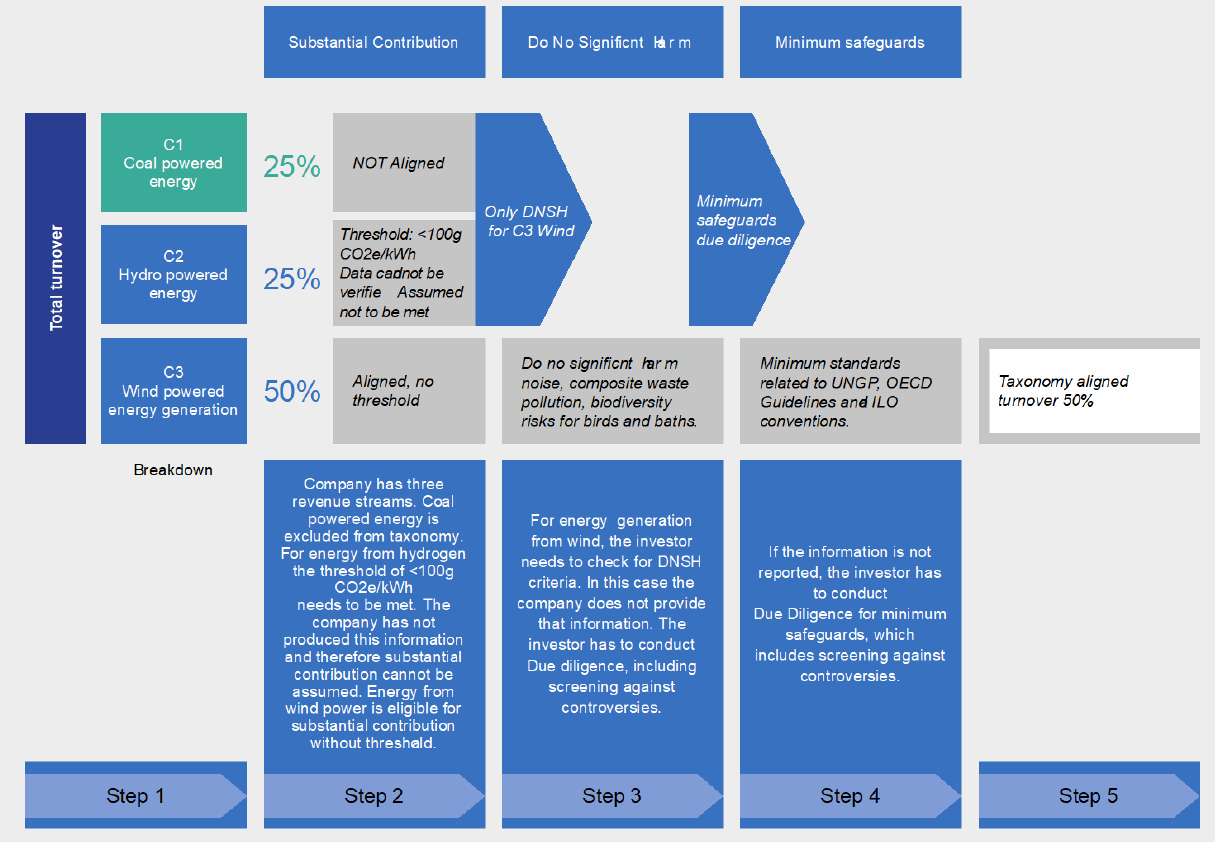

Only economic activities that pass all three steps are counted as sustainable economic activities. Investors who want to calculate their exposure to sustainable economic activities in their portfolios have to calculate the revenues generated by these activities in the companies in their portfolios. If the company does not provide the required disclosures, the investors have to do their own due diligence as shown in the flowchart below.

Steps required to assess economic activities

Source: Technical Expert Group

Summary: It’s not easy being green

As this brief overview has shown, the amount of work for corporations and investors to show how much of their portfolio is green is substantial. In many cases, data has to be gathered that so far isn’t available to company management or investors. On top, many grey areas still have to be fleshed out and the scope of economic activities will widen over time. Hence, the current regulations are only the start in a years-long transition of reporting and risk management standards.

Many investors still think that ESG investing is just a passing fad. What these regulations make clear is that at least for those companies operating in Europe or trying to attract capital from European investors, ESG is not just a fad, it is about to become a licence to operate. Companies and investors who do not comply with these regulations will increasingly be cut out of huge sources of capital – something they will hardly be able to sustain for long.

Given the complexities and uncertainties of this new regulatory environment, one may paraphrase the eminent philosopher Kermit the Frog: It’s not easy being green. But green we must be.